NVIDIA 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

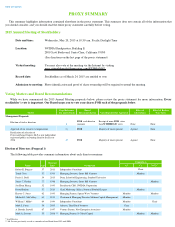

Corporate Governance Highlights

Our Board is committed to strong corporate governance, which is used to promote the long-

term interest of NVIDIA and our stockholders.

Regular stockholder outreach is important to us. We seek a collaborative approach to issues of importance to our stockholders that affect our

business and also to ensure that they see our governance and executive pay practices as well-

structured. In Fiscal 2015, our management reached

out to 10 of our largest stockholders as of June 30, 2014 to gain valuable insights into the corporate governance and executive compensation

issues they most care about.

In the last four years, the Board has appointed four new directors: Robert K. Burgess, Dawn Hudson, and most recently, Michael G.

McCaffery, an asset-

management executive and investment banker, and Persis S. Drell, a physicist and dean of the Stanford School of

Engineering. Mr. McCaffery brings to the Board deep business, financial and public market knowledge, as well as extensive executive

management and corporate governance experience. As an accomplished researcher and educator, Ms. Drell brings to the Board expert leadership

in guiding innovation in science and technology.

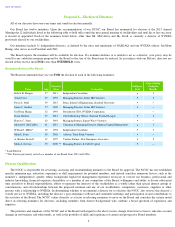

In Fiscal 2015, we also amended our director and NEO stock ownership guidelines as follows:

Approval of Executive Compensation for Fiscal 2015 (Proposal 2)

We are asking our stockholders to cast a non-binding vote, commonly referred to as “say on pay”,

to approve our NEO compensation. The

Board believes that our compensation policies and practices are effective in achieving our goals of attracting, retaining and motivating our

executive officers, rewarding financial and operating performance and aligning our executives’

interests with those of our stockholders to create

long-term value. The Board has adopted a policy of providing for annual say on pay votes.

Executive Compensation Highlights

At our 2014 Annual Meeting, nearly 98% of the votes cast on our say-on-

pay proposal were in support of the compensation paid to our

executive officers for Fiscal 2014. Consistent with its strong commitment to engagement, communication and transparency, the CC continues to

regularly review our executive compensation program to ensure alignment between the interests of our executive officers and stockholders. The

only changes made to our executive compensation program since our stockholders overwhelmingly supported our Fiscal 2014 program were the

following, each intended to further align pay with performance:

3

•

Non

-employee directors are required to hold a number of shares of the Company's common stock with a value equal to six times the

annual cash retainer for Board service. Each such director has until the later of (i) the end of fiscal year 2016 or (ii) within five years of

Board appointment, to reach this threshold.

• The CEO is required to hold a number of shares of the Company's common stock with a value equal to six times his annual base salary.

Mr. Huang holds stock with a value equal to 487 times his annual base salary, based on our closing price as of March 24, 2015.

• All other NEOs are required to hold a number of shares of the Company's common stock with a value equal to his or her annual base

salary. All of our NEOs hold stock with a value exceeding his or her respective annual base salary, based on our closing price as of

March 24, 2015.

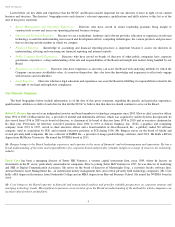

• We granted 100% of our CEO’

s equity compensation in the form of PSUs

•

We introduced PSUs for all of our other NEOs

• We revised our Variable Cash Plan so that 100% of our NEOs’ variable cash opportunity is tied to NVIDIA’

s financial operating

performance

•

We increased emphasis on equity compensation as a percentage of total target pay