NVIDIA 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

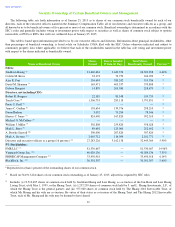

Director Compensation

In reviewing the type and form of compensation to be paid to our non-

employee directors for the year starting on the date of our 2014

Annual Meeting, the CC consulted with Exequity and reviewed peer data from the executive peer group approved by the CC for Fiscal 2014.

The CC subsequently recommended, and the Board approved, effective on the date of our 2014 Annual Meeting, a mix of cash and equity

awards for our non-

employee directors with an approximate annual value of $300,000. This value approximates the average total annual

compensation, both cash and equity, paid by technology peer companies of similar size and market capitalization to their non-

employee

directors. We refer to this as the 2014 Program. We do not pay any additional retainers or fees for serving as a chairperson or member of Board

committees or for attending any Board or committee meetings. Discussion of Mr. McCaffery’s and Ms. Drell’

s respective compensation is not

included, as they were appointed to the Board in March 2015.

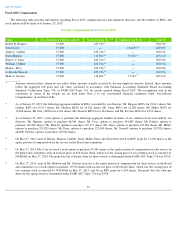

Cash Compensation

Under the 2014 Program, the cash portion of the annual retainer, representing $75,000 on an annualized basis, was paid quarterly over the

course of twelve months beginning on May 23, 2014, the date of our 2014 Annual Meeting.

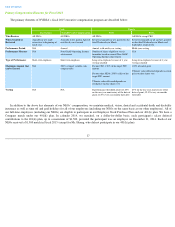

Equity Compensation

Under the 2014 Program, each non-

employee director elected in advance of the 2014 Annual Meeting the form of equity award he or she

would receive on the first trading day following the date of our 2014 Annual Meeting. Non-

employee directors were allowed to elect RSUs,

stock options or a 50/50 combination of each. The aggregate value of the equity award was $225,000. The number of shares subject to each RSU

equaled the value of the annual retainer allocated to the RSU divided by the average closing market price over the 60 calendar days ending two

business days before the 2014 Annual Meeting, or the RSU Shares. The number of shares subject to each stock option grant equaled 3.2 times

the number of RSU Shares that would correspond to the annual retainer value, rounded down to the nearest whole share.

In order to correlate the vesting of the equity awards to the non-employee directors’

service on the Board and its committees over the

following year, RSUs vested as to 50% on November 19, 2014 (the third Wednesday in November 2014) and will vest as to the remaining 50%

on May 20, 2015 (the third Wednesday in May 2015) and stock options granted under the 2014 Program vested quarterly commencing on the

day of our 2014 Annual Meeting.

The options granted to our Board members above have a term of ten years. If a non-employee director’

s service as a director terminates due

to death, the option and RSU grants will immediately fully vest and the option grants will become exercisable. Non-

employee directors do not

receive dividend equivalents on unvested RSUs.

Non-

employee directors choosing RSUs as all or part of their equity compensation could elect to defer settlement of all such RSUs upon

vesting, to be issued on the earliest of (a) the date of the non-employee director’s “separation from service” (

as defined under Treasury

Regulation Section 1.409A-

1(h)), unless a six month delay would be required under such Section, (b) the date of a change in control of NVIDIA

that also would constitute a “change in control event” (as defined under Treasury Regulation Section 1.409A-

3(i)(5)), and (c) the third

Wednesday in March of the year elected by the non-

employee director, which year must be no earlier than 2016. Messrs. Gaither, Jones and

Miller elected to defer settlement of the RSUs granted during Fiscal 2015.

Other Compensation/Benefits

Our non-

employee directors are also reimbursed for expenses incurred in attending Board and committee meetings, as well as in attending

continuing educational programs pursuant to our Corporate Governance Policies. Directors who are also employees do not receive any fees or

equity compensation for service on the Board.

We do not offer change-in-control benefits to our directors, except for the change-in-

control vesting acceleration provisions in our equity

plans that are applicable to all holders of stock awards under such plans in the event that an acquiring company does not assume or substitute for

such outstanding stock awards.

19