NVIDIA 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

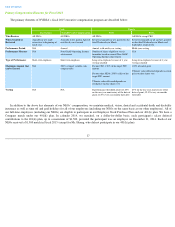

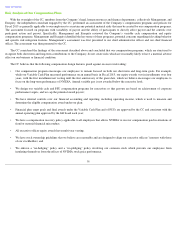

Colette M. Kress - Executive Vice President and Chief Financial Officer

__________

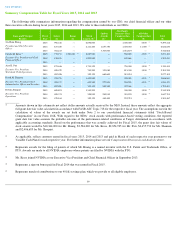

Ajay K. Puri - Executive Vice President, Worldwide Field Operations

__________

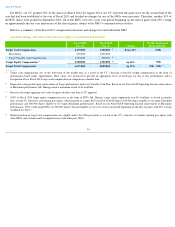

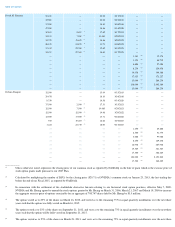

Fiscal 2014

Pay ($) Fiscal 2015

Pay ($) Change Market Position of Fiscal

2015 Pay

Target Cash Compensation

(1)

1,050,000

1,050,000

(2)

no change

50th

(3)

Base Salary

500,000

775,000

Target Variable Cash Compensation

550,000

275,000

(4)

Target Equity Compensation

(5)

—

(6)

2,097,430

(7)

—

65th

Target Total Compensation

—

3,147,340

—

65th

(8)

(1)

Ms. Kress began employment in the second half of Fiscal 2014; therefore, Fiscal 2014 target cash compensation has been annualized to present a more

accurate comparison of year over year change and excludes a sign-

on bonus of $1.5 million paid in Fiscal 2014; Fiscal 2015 target cash compensation

excludes an anniversary bonus of $1.0 million paid in Fiscal 2015 pursuant to Ms. Kress’

offer letter (which must be repaid upon a resignation or

termination under certain circumstances). The CC determined that these special bonuses were necessary to attract Ms. Kress, in consideration of her

compensation opportunity at her prior employer.

(2)

Target variable cash compensation reduction by 50% (similar to Mr. Puri and Ms. Shoquist) and a base salary increase were determined by the CC to be

appropriate because they resulted in overall target cash compensation at the median of the market data.

(3)

Market position of target cash compensation was lower than that of the other NEOs in part due to internal pay equity for cash compensation.

(4)

Represents cash payable upon achievement of Target performance under our Variable Cash Plan. Based on our Non-

GAAP Operating Income achievement

at Maximum performance, Ms. Kress earned a maximum award of $550,000.

(5)

Based on the target aggregate fair value of equity awards at the time of CC approval.

(6)

Excludes new hire equity grant as it will not present an accurate comparison of year over year change.

(7)

Target equity opportunity was $2.1 million (129,500 shares), set based on market data, overall CC objectives and internal pay equity. 40% of target shares

(or 52,000 shares) were allocated to RSUs and 60% of target shares (or 77,500 shares) were allocated to PSUs (where 19,375 shares were eligible to vest

upon Threshold performance and 155,000 shares were eligible to vest upon Maximum performance). Based on our Non-

GAAP Operating Income

achievement at Maximum performance, 200% of the target PSUs (or 155,000 shares) became eligible to vest over a four year period beginning on the date

of grant (with 25% vesting on March 18, 2015).

(8)

Market position of target total compensation was lower than that of Mr. Shannon and Ms. Shoquist, but was determined by the CC to be appropriate based

on the subjective determination of the CC.

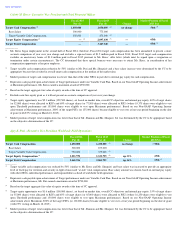

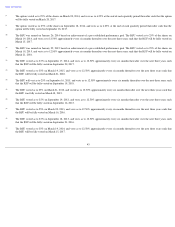

Fiscal 2014

Pay ($) Fiscal 2015

Pay ($) Change Market Position of Fiscal

2015 Pay

Target Cash Compensation

1,250,000

1,250,000

(1)

no change

> 90th

Base Salary

500,000

875,000

Target Variable Cash Compensation

750,000

375,000

(2)

Target Equity Compensation

(3)

1,211,936

1,611,725

(4)

up 33%

65th

Target Total Compensation

2,461,936

2,861,725

up 16%

65th

(5)

(1)

Target variable cash compensation was reduced by 50% (similar to Ms. Kress and Ms. Shoquist) and base salary was increased to provide an appropriate

level of fixed pay for retention and security in light of increased “at-risk”

total compensation. Base salary amount was chosen based on internal pay equity

with other NEOs, individual performance and responsibilities as head of worldwide field operations.

(2)

Represents cash payable upon achievement of Target performance under our Variable Cash Plan. Based on our Non-

GAAP Operating Income achievement

at Maximum performance, Mr. Puri earned a maximum award of $750,000.

(3)

Based on the target aggregate fair value of equity awards at the time of CC approval.

(4)

Target equity opportunity was $1.6 million (100,000 shares), set based on market data, overall CC objectives and internal pay equity. 35% of target shares

(or 35,000 shares) were allocated to RSUs and 65% of target shares (or 65,000 shares) were allocated to PSUs (where 16,250 shares were eligible to vest

upon Threshold performance and 130,000 shares were eligible to vest upon Maximum performance). Based on our Non-

GAAP Operating Income

achievement above Maximum, 200% of the target PSUs (or 130,000 shares) became eligible to vest over a four year period beginning on the date of grant

(with 25% vesting on March 18, 2015).

(5)

Market position of target total compensation was lower than that of Mr. Shannon and Ms. Shoquist, but was determined by the CC to be appropriate based

on the subjective determination of the CC.