Motorola 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

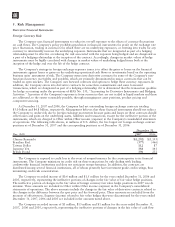

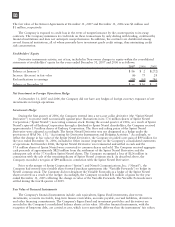

Commercial Paper and Other Short-Term Debt

December 31 2007 2006

Notes to banks $ 134 $71

Commercial paper —300

134 371

Add: current portion 198 1,340

Fair value adjustment —(18)

Notes payable and current portion of long-term debt $ 332 $1,693

Weighted average interest rates on short-term borrowings throughout the year

Commercial paper 5.3% 5.1%

Other short-term debt 4.6% 5.8%

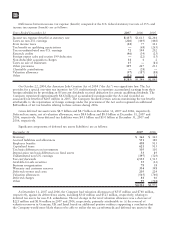

In November 2007, the Company repaid, at maturity, the entire $1.2 billion aggregate principal amount

outstanding of its 4.608% Notes due November 16, 2007.

In November 2007, the Company issued an aggregate face principal amount of: (i) $400 million of

5.375% Senior Notes due November 15, 2012, (ii) $400 million of 6.00% Senior Notes due November 15, 2017,

and (iii) $600 million of 6.625% Senior Notes due November 15, 2037.

In January 2007, the Company repaid, at maturity, the entire $118 million aggregate principal amount

outstanding of its 7.6% Notes due January 1, 2007.

In September 2005, the Company repurchased an aggregate principal amount of $1.0 billion of its outstanding

long-term debt for an aggregate purchase price of $1.1 billion through cash tender offers. Included in the

$1.0 billion of long-term debt repurchased were repurchases of a principal amount of: (i) $86 million of the

$200 million of 6.50% Notes due 2008 outstanding, (ii) $241 million of the $325 million of 5.80% Notes due

2008 outstanding, and (iii) $673 million of the $1.2 billion of 7.625% Notes due 2010 outstanding. In addition,

the Company terminated a notional amount of $1.0 billion of fixed-to-floating interest rate swaps associated with

the debt repurchased, resulting in an expense of approximately $22 million. The aggregate charge for the

repurchase of the debt and the termination of the associated interest rate swaps, as presented in Other income

(expense) in the Company’s consolidated statements of operations, was $137 million.

In September 2005, the Company retired approximately $1 million of the $398 million of 6.5% Debentures

due 2025 (the “2025 Debentures”) in connection with the holders of the debentures right to put their debentures

back to the Company. The residual put options expired unexercised and the remaining $397 million of 2025

Debentures were reclassified to long-term debt.

Aggregate requirements for long-term debt maturities during the next five years are as follows:

2008—$198 million; 2009—$4 million; 2010—$534 million; 2011—$607 million; 2012—$409 million.

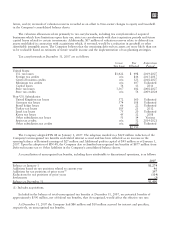

In December 2006, the Company signed a new five-year revolving domestic credit facility (“5-Year Credit

Facility”) for $2.0 billion, replacing the $1.0 billion facility due to expire in May 2007. At December 31, 2007,

the commitment fee assessed against the daily average amounts unused was 8.0 basis points. Important terms of

the 5-Year Credit Facility include a covenant relating to the ratio of total debt to EBITDA. The Company was in

compliance with the terms of the 5-year Credit Facility at December 31, 2007.

The Company’s current corporate credit ratings are “BBB” on rating watch negative by Fitch, “Baa1” with a

review for possible downgrade by Moody’s, and “BBB” on credit watch negative by S&P. The Company has never

borrowed under its domestic revolving credit facilities. The Company also has $2.3 billion of uncommitted

non-U.S. credit facilities with interest rates on borrowings varying from country to country depending upon local

market conditions. At December 31, 2007, the Company’s total domestic and non-U.S. credit facilities totaled

$4.3 billion, of which $314 million was considered utilized.

91