Motorola 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

losses on the assets, liabilities and future transactions being hedged. If the hedged transactions were included in the

sensitivity analysis, the hypothetical change in fair value would be immaterial. The foreign exchange financial

instruments are held for purposes other than trading.

The Company recorded income of $0.6 million and $1.5 million for the years ended December 31, 2006 and

2005, respectively, representing the ineffective portions of changes in the fair value of fair value hedge positions.

The ineffective portion of changes in the fair value of foreign currency fair value hedge positions in 2007 was de

minimis. These amounts are included in Other within Other income (expense) in the Company’s consolidated

statements of operations. The above amounts include the change in the fair value of derivative contracts related to

the changes in the difference between the spot price and the forward price. These amounts are excluded from the

measure of effectiveness. Expense (income) related to fair value hedges that were discontinued for the years ended

December 31, 2007, 2006 and 2005 are included in the amounts noted above.

The Company recorded income of $1 million, $13 million and $1 million for the years ended December 31,

2007, 2006 and 2005, respectively, representing the ineffective portions of changes in the fair value of cash flow

hedge positions. These amounts are included in Other within Other income (expense) in the Company’s

consolidated statements of operations. The above amounts include the change in the fair value of derivative

contracts related to the changes in the difference between the spot price and the forward price. These amounts are

excluded from the measure of effectiveness. Expense (income) related to cash flow hedges that were discontinued

for the years ended December 31, 2007, 2006 and 2005 are included in the amounts noted above.

During the years ended December 31, 2007, 2006 and 2005, on a pre-tax basis, income (expense) of

$(16) million, $(98) million and $21 million, respectively, was reclassified from equity to earnings in the

Company’s consolidated statements of operations.

At December 31, 2007, the maximum term of derivative instruments that hedge forecasted transactions was

one year. However, the weighted average duration of the Company’s derivative instruments that hedge forecasted

transactions was five months.

Interest Rate Risk

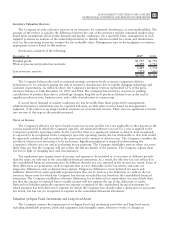

At December 31, 2007, the Company’s short-term debt consisted primarily of $134 million of short-term

foreign debt, priced at short-term interest rates. The Company has $4.2 billion of long-term debt, including the

current portion of long-term debt, which is primarily priced at long-term, fixed interest rates.

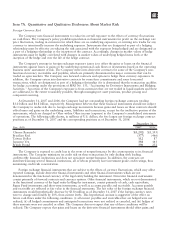

In order to manage the mix of fixed and floating rates in its debt portfolio, the Company has entered into

interest rate swaps to change the characteristics of interest rate payments from fixed-rate payments to short-term

LIBOR-based variable rate payments. The following table displays these outstanding interest rate swaps at

December 31, 2007:

Date Executed

Notional Amount

Hedged

(in millions) Underlying Debt

Instrument

October 2007 $ 400 5.375% notes due 2012

October 2007 400 6.0% notes due 2017

September 2003 457 7.625% debentures due 2010

September 2003 600 8.0% notes due 2011

May 2003 114 6.5% notes due 2008

May 2003 84 5.8% debentures due 2008

May 2003 69 7.625% debentures due 2010

$2,124

The weighted average short-term LIBOR-based variable rate payments on each of the above interest rate

swaps was 6.60% for the three months ended December 31, 2007. The fair value of the above interest rate swaps

at December 31, 2007 and December 31, 2006, was $36 million and $(47) million, respectively. The fair value of

the above interest rate swaps would hypothetically decrease by $38 million (i.e., would decrease from $36 million

to $(2) million) if LIBOR were to change unfavorably by 10% from current levels. Except as noted below, the

Company had no outstanding commodity derivatives, currency swaps or options relating to debt instruments at

December 31, 2007 or December 31, 2006.

72