Motorola 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the Mobile Devices segment and decreased in the Enterprise Mobility Solutions and Home and Networks

Mobility segments. The Company participates in very competitive industries with constant changes in technology

and, accordingly, the Company continues to believe that a strong commitment to R&D is required to drive long-

term growth.

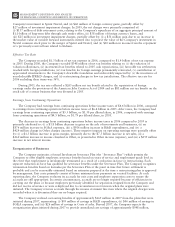

Other Charges (Income)

The Company recorded net charges of $984 million in Other charges (income) in 2007, compared to net

charges of $25 million in 2006. The net charges in 2007 include: (i) $369 million of charges relating to the

amortization of intangibles, (ii) $290 million of net reorganization of business charges, (iii) $140 million of charges

for legal settlements and related insurance matters, (iv) $96 million of acquisition-related in-process research and

development charges (“IPR&D”) relating to 2007 acquisitions, and (v) $89 million for asset impairment charges.

The net charges in 2006 included: (i) $172 million of net reorganization of business charges, (ii) $100 million of

charges relating to the amortization of intangibles, (iii) an $88 million charitable contribution to the Motorola

Foundation of appreciated equity holdings in a third party, (iv) $50 million of legal reserves, and (v) $33 million of

acquisition-related IPR&D charges relating to 2006 acquisitions, partially offset by $418 million of income for

payments relating to the Telsim collection settlement. The net reorganization of business charges are discussed in

further detail in the “Reorganization of Businesses” section.

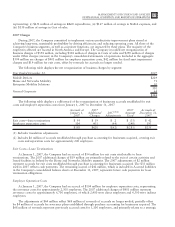

Net Interest Income

Net interest income was $91 million in 2007, compared to net interest income of $326 million in 2006. Net

interest income in 2007 included interest income of $456 million, partially offset by interest expense of

$365 million. Net interest income in 2006 included interest income of $661 million, partially offset by interest

expense of $335 million. The decrease in net interest income was primarily attributed to lower interest income due

to the decrease in average cash, cash equivalents and Sigma Fund balances during 2007 compared to 2006,

partially offset by higher interest rates.

Gains on Sales of Investments and Businesses

Gains on sales of investments and businesses were $50 million in 2007, compared to gains of $41 million in

2006. In 2007, the net gain primarily reflects a gain of $34 million from the sale of the Company’s embedded

communications computing business. In 2006, the net gain primarily reflected a gain of $141 million on the sale of

the Company’s remaining shares in Telus Corporation, partially offset by a loss of $126 million on the sale of the

Company’s remaining shares in Sprint Nextel Corporation (“Sprint Nextel”).

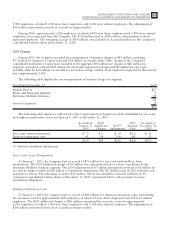

Other

Income classified as Other, as presented in Other income (expense), was $22 million in 2007, compared to net

income of $151 million in 2006. The net income in 2007 was primarily comprised of $97 million of foreign

currency gains, partially offset by $62 million of investment impairment charges. The net income in 2006 was

primarily comprised of: (i) a $99 million net gain due to an increase in market value of a zero-cost collar derivative

entered into to protect the value of the Company’s investment in Sprint Nextel, and (ii) $60 million of foreign

currency gains, partially offset by $27 million of investment impairment charges.

Effective Tax Rate

The Company recorded $285 million of net tax benefits in 2007, compared to $1.3 billion in net tax expense

in 2006. The Company’s net tax benefit for 2007 was favorably impacted by an increase in tax credits compared

to 2006. The Company’s net tax benefit was also favorably impacted by: (i) the settlement of tax positions, (ii) tax

incentives received, and (iii) reversal of deferred tax valuation allowances, and unfavorably impacted by: (i)

adjustments to deferred taxes in non-U.S. locations due to enacted tax rate changes, (ii) an increase in

unrecognized tax benefits, and (iii) a non-deductible IPR&D charge. The Company’s effective tax rate for

continuing operations, excluding the items described above and the tax impact of restructuring charges and asset

impairments, was 26%.

The Company’s net tax expense of $1.3 billion in 2006 was favorably impacted by $348 million of net tax

benefits relating to: (i) the reduction of valuation allowances, (ii) incremental tax benefits related to 2005 cash

43

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS