Motorola 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

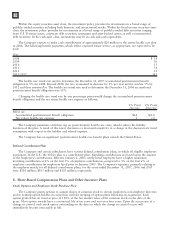

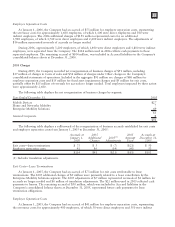

$4.5 billion sold in 2005 (including $4.2 billion of short-term receivables). As of December 31, 2007, there were

$978 million of receivables outstanding under these programs for which the Company retained servicing

obligations (including $587 million of short-term receivables), compared to $1.1 billion outstanding at

December 31, 2006 (including $789 million of short-term receivables) and $1.0 billion outstanding at

December 31, 2005 (including $838 million of short-term receivables).

Under certain receivables programs, the value of the receivables sold is covered by credit insurance obtained

from independent insurance companies, less deductibles or self-insurance requirements under the policies (with the

Company retaining credit exposure for the remaining portion). The Company’s total credit exposure to outstanding

short-term receivables that have been sold was $23 million at December 31, 2007 as compared to $19 million at

December 31, 2006. Reserves of $1 and $4 million was recorded for potential losses on sold receivables at both

December 31, 2007 and December 31, 2006, respectively.

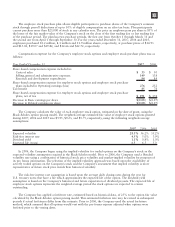

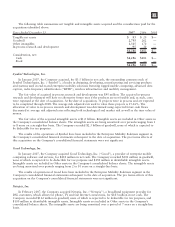

Certain purchasers of the Company’s infrastructure equipment continue to request that suppliers provide

financing in connection with equipment purchases. These requests may include all or a portion of the purchase

price of the equipment. Periodically, the Company makes commitments to provide financing to purchasers in

connection with the sale of equipment. However, the Company’s obligation to provide financing is often

conditioned on the issuance of a letter of credit in favor of the Company by a reputable bank to support the

purchaser’s credit or a pre-existing commitment from a reputable bank to purchase the receivable from the

Company. The Company had outstanding commitments to extend long-term credit to third parties totaling

$610 million at December 31, 2007, compared to $398 million at December 31, 2006. Of these amounts,

$454 million was supported by letters of credit or by bank commitments to purchase receivables at December 31,

2007, compared to $262 million at December 31, 2006.

In addition to providing direct financing to certain equipment customers, the Company also assists customers

in obtaining financing directly from banks and other sources to fund equipment purchases. The Company had

committed to provide financial guarantees relating to customer financing totaling $42 million and $122 million at

December 31, 2007 and December 31, 2006, respectively (including $23 million and $19 million at December 31,

2007 and 2006, respectively, relating to the sale of short-term receivables). Customer financing guarantees

outstanding were $3 million and $47 million at December 31, 2007 and 2006, respectively (including $0 million

and $2 million at December 31, 2007 and 2006, respectively, relating to the sale of short-term receivables).

10. Commitments and Contingencies

Leases

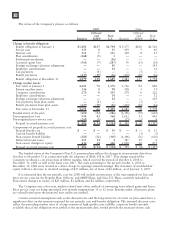

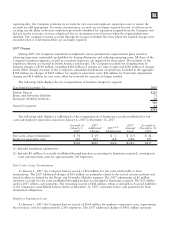

The Company owns most of its major facilities and leases certain office, factory and warehouse space, land,

and information technology and other equipment under principally non-cancelable operating leases. Rental

expense, net of sublease income, for the years ended December 31, 2007, 2006 and 2005 was $231 million,

$241 million and $250 million, respectively. At December 31, 2007, future minimum lease obligations, net of

minimum sublease rentals, for the next five years and beyond are as follows: 2008—$355 million; 2009—$268

million; 2010—$253 million; 2011—$169 million; 2012—$162 million; beyond—$212 million.

Legal

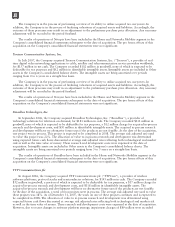

Iridium Program: The Company has been named as one of several defendants in putative class action

securities lawsuits arising out of alleged misrepresentations or omissions regarding the Iridium satellite

communications business which, on March 15, 2001, were consolidated in the federal district court in the District

of Columbia under Freeland v. Iridium World Communications, Inc., et al., originally filed on April 22, 1999.

Plaintiffs’ motion for class certification was granted on January 9, 2006 and the trial is scheduled to begin on

May 22, 2008.

The Company was sued by the Official Committee of the Unsecured Creditors of Iridium (the “Committee”)

in the United States Bankruptcy Court for the Southern District of New York (the “Iridium Bankruptcy Court”) on

July 19, 2001. In re Iridium Operating LLC, et al. v. Motorola asserts claims for breach of contract, warranty and

fiduciary duty and fraudulent transfer and preferences, and seeks in excess of $4 billion in damages. On

September 20, 2007, following a trial on the solvency and capital adequacy portion of the Committee’s fraudulent

transfer and preference claims, the Iridium Bankruptcy Court granted judgment for Motorola on all those claims.

The remaining claims for breach of contract, warranty, fiduciary duty and equitable subordination remain pending.

109