Lifetime Fitness 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Lifetime Fitness annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Our Growth Strategy

Our growth strategy is driven by three primary elements:

Build and acquire new centers.

We intend to expand our base of centers, primarily through new center development as well as opportunistic

acquisition. Our new center expansion will focus on strategic locations which we believe will generate higher

average dues and higher in-center revenue per membership. These locations typically represent our Life Time

Athletic centers, which include our Onyx and Diamond membership plans. In 2013, we opened three large format

centers that we designed and constructed, two of which are Life Time Athletic centers. We expect to open six centers

in 2014, five of which are Life Time Athletic centers. One of these centers opened in February and the others are

currently under construction. A rollforward of our center growth is as follows:

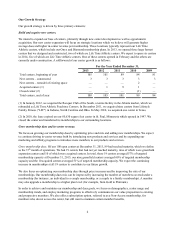

For the Year Ended December 31,

2013 2012 2011 2010 2009

Total centers, beginning of year 105 101 89 84 81

New centers – constructed 3 3 3 3 3

New centers – remodel of existing space — — — 2 —

Acquired centers (1) — 1 9 1 —

Closed center (2) — — — (1) —

Total centers, end of year 108 105 101 89 84

(1) In January 2012, we acquired the Racquet Club of the South, a tennis facility in the Atlanta market, which we

rebranded as Life Time Athletic Peachtree Corners. In December 2011, we acquired nine centers from Lifestyle

Family Fitness ("LFF") in Indiana, North Carolina and Ohio. In May 2010, we acquired one center in Texas.

(2) In 2010, the lease expired on our 85,630 square foot center in St. Paul, Minnesota which opened in 1997. We

closed the center and transferred its memberships to our surrounding locations.

Grow membership dues and in-center revenue.

We focus on growing our membership dues by optimizing price and mix and adding new memberships. We expect

to continue driving in-center revenue both by introducing new products and services and by expanding our

marketing and affinity programs to introduce more members to our products and services.

Grow membership dues. Of our 108 open centers at December 31, 2013, 89 had reached maturity, which we define

as the 37th month of operations. We had 19 centers that had not yet reached maturity, nine of which were greenfield

expansion centers and 10 of which were acquired centers. In total, these 19 centers averaged 57% of targeted

membership capacity at December 31, 2013; our nine greenfield centers averaged 60% of targeted membership

capacity and the 10 acquired centers averaged 51% of targeted membership capacity. We expect the continuing

increase in memberships at all 19 centers to contribute to our future growth.

We also focus on optimizing our membership dues through price increases and by improving the mix of our

memberships. Our membership dues mix can be improved by increasing the number of members covered under a

membership (for instance, an individual to a couple membership, or a couple to a family membership). A member

may also upgrade a membership to a higher plan level (for example, from Gold to Platinum).

In order to achieve and maintain our membership and dues goals, we focus on demographics, center usage and

membership trends, and employ marketing programs to effectively communicate our value proposition to existing

and prospective members. We also offer a subscription option, referred to as a Non-Access membership, for

members who do not access the center, but still want to maintain certain member benefits.