KeyBank 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KeyCorp

2015 Annual Report

Focused Forward

Table of contents

-

Page 1

KeyCorp 2015 Annual Report Focused Forward -

Page 2

1 Letter to Shareholders 2 Five-year Financial Highlights 6 Corporate Governance 8 Investor Connection 9 2015 Form 10-K -

Page 3

..., executing against our strategic priorities, and making investments that will improve our returns and create long-term value for you, our shareholders. We saw strong levels of retail and corporate client growth, record results in a number of our fee-based businesses, and improved productivity... -

Page 4

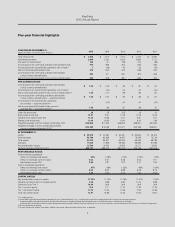

... dividends paid Book value at year end Tangible book value at year end Market price at year end Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000)(c) AT DECEMBER 31, Loans Earning assets Total assets Deposits Key shareholders... -

Page 5

... consumer credit card business, with card sales up 13% in 2015. We completed the addition of a technology vertical in our Corporate Bank with the successful integration of Pacific Crest Securities. This new vertical enables us to further capitalize on our targeted offering for middle market clients... -

Page 6

...Record year with fees up 12% from 2014 Commercial payments: Purchase and prepaid cards produced record revenue Strategic investments contributed to record results in a number of our fee-based businesses u Credit card: Consumer card sales and revenue reached record level $ Key Investment Services... -

Page 7

...Hartford, and New Haven. The hard work and dedicated efforts of our team in 2015 led branch sales productivity to an all-time high. Corporate Responsibility Our purpose at KeyBank is to help our clients and communities thrive. By leveraging lending, investments, and philanthropy, offering fair and... -

Page 8

... Materion Corporation KeyCorp Leadership Team Beth E. Mooney Chairman and Chief Executive Officer Robert A. DeAngelis Program Management and Marketing Executive Paul N. Harris Secretary and General Counsel Amy G. Brady Chief Information Officer Dennis A. Devine Co-President Key Community Bank... -

Page 9

...our communities, Key team members volunteer at the Cleveland Christian Children's Home during the company's 25th annual Neighbors Make The Difference® Day. At KeyBank, we are proud to foster a diverse and inclusive environment where employees feel they do work that matters and results are rewarded... -

Page 10

...management's quarterly earnings discussions. Annual meeting of shareholders Thursday, May 19, 2016 • 8:30 a.m. One Cleveland Center 1375 East 9th Street • Cleveland, OH 44114 Common shares: KeyCorp common shares are listed on the New York Stock Exchange under the symbol KEY. Anticipated dividend... -

Page 11

... 31, 2015 Commission file number: 1-11302 Exact name of Registrant as specified in its charter: Ohio State or other jurisdiction of incorporation or organization: 34-6542451 IRS Employer Identification Number: 127 Public Square, Cleveland, Ohio Address of Principal Executive Offices: 44114-1306... -

Page 12

-

Page 13

... events; / increasing capital and liquidity standards under applicable regulatory rules; / unanticipated changes in our liquidity position, including but not limited to, changes in our access to or the cost of funding, our ability to enter the financial markets and to secure alternative funding... -

Page 14

... dispositions of assets or businesses; / our ability to complete the acquisition of First Niagara and to realize the anticipated benefits of the merger; and / our ability to develop and effectively use the quantitative models we rely upon in our business planning. Any forward-looking statements made... -

Page 15

...and Analysis of Financial Condition and Results of Operations ...Quantitative and Qualitative Disclosures About Market Risk ...Financial Statements and Supplementary Data ...Management's Annual Report on Internal Control over Financial Reporting ...Reports of Independent Registered Public Accounting... -

Page 16

... we provide investment management services to clients that include large corporate and public retirement plans, foundations and endowments, high-net-worth individuals, and multi-employer trust funds established for providing pension or other benefits to employees. We provide other financial services... -

Page 17

...segments: Key Community Bank and Key Corporate Bank. Key Community Bank serves individuals and small to mid-sized businesses by offering a variety of deposit, investment, lending, credit card, and personalized wealth management products and business advisory services. These products and services are... -

Page 18

... from Continuing Operations Short-Term Borrowings Page(s) 36 46 48 58 67 68 69 70 92 94 95 96 96 207 Our executive offices are located at 127 Public Square, Cleveland, Ohio 44114-1306, and our telephone number is (216) 689-3000. Our website is www.key.com, and the investor relations section of our... -

Page 19

... related financial services is highly competitive. Key competes with other providers of financial services, such as BHCs, commercial banks, savings associations, credit unions, mortgage banking companies, finance companies, mutual funds, insurance companies, investment management firms, investment... -

Page 20

... Consumer Segment executive with responsibility for developing client strategies and programs for Key's Community Bank Consumer and Small Business segments. He became an executive officer of KeyCorp in March 2013. Christopher M. Gorman (55) - Mr. Gorman has been the President of Key Corporate Bank... -

Page 21

...for non-member state banks and savings associations; 3) the Federal Reserve for member state banks; 4) the CFPB for consumer financial products or services; 5) the SEC and FINRA for securities broker/dealer activities; 6) the SEC, CFTC, and NFA for swaps and other derivatives; and 7) state insurance... -

Page 22

... particular condition, risk profile, or growth plans. As presented in Note 22 ("Shareholders' Equity"), at December 31, 2014, Key and KeyBank (consolidated) had regulatory capital in excess of all applicable minimum risk-based capital (including all adjustments for market risk) and leverage ratio... -

Page 23

... using organization-specific internal risk measures and management processes for calculating risk-based capital requirements as well as follow certain methodologies to calculate their total risk-weighted assets. Since neither KeyCorp nor KeyBank has at least $250 billion in total consolidated assets... -

Page 24

... to FDIC-insured depository institutions (like KeyBank) and not to BHCs (like KeyCorp). Moreover, since the regulatory capital categories under these regulations serve a limited supervisory function, investors should not use them as a representation of the overall financial condition or prospects... -

Page 25

..., the Federal Reserve identifies its core capital planning expectations regarding governance, risk management, internal controls, capital policy, capital positions, incorporating stressful conditions and events, and estimating impact on capital positions for large and noncomplex firms building upon... -

Page 26

... consolidated earnings, losses, and capital over a nine-quarter planning horizon, taking into account their current condition, risks, exposures, strategies, and activities. While KeyBank must only conduct an annual stress test, KeyCorp must conduct both an annual and a mid-cycle stress test. KeyCorp... -

Page 27

... and liabilities of KeyCorp's insured depository institution subsidiaries, such as KeyBank, including obligations under senior or subordinated debt issued to public investors. Receivership of certain SIFIs The Dodd-Frank Act created a new resolution regime, as an alternative to bankruptcy, known... -

Page 28

... each year. For 2015, these resolution plans, the third required from KeyCorp and KeyBank, were submitted on December 1, 2015. Annually, in January, the Federal Reserve and FDIC make available on their websites the public sections of resolution plans for the companies, including KeyCorp and KeyBank... -

Page 29

... financial laws. Any new regulatory requirements promulgated by the CFPB or modifications in the interpretations of existing regulations could require changes to Key's consumer-facing businesses. The Dodd-Frank Act also gives the CFPB broad data collecting powers for fair lending for both small... -

Page 30

... the Federal Reserve's previously finalized rules on capital planning and stress tests, (ii) liquidity requirements relating to cash flow projections, a contingency funding plan, liquidity risk limits, monitoring liquidity risks (with respect to collateral, legal entities, currencies, business lines... -

Page 31

..., such as unemployment and real estate values, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may indicate the need for an increase in the ALLL. Bank regulatory agencies periodically review our ALLL and... -

Page 32

... costs and affect our lending practices, capital structure, investment practices, dividend policy, ability to repurchase our common shares, and growth, among other things. We face increased regulation of our industry as a result of current and future initiatives intended to provide financial market... -

Page 33

... to increase mobile payments and other internet-based product offerings and expand our internal usage of web-based products and applications. In the event of a failure, interruption or breach of our information systems, we may be unable to avoid impact to our customers. Other U.S. financial service... -

Page 34

... increased in recent years with regard to many firms in the financial services industry due to legal changes to the consumer protection laws provided for by the Dodd-Frank Act and the creation of the CFPB. There have also been a number of highly publicized legal claims against financial institutions... -

Page 35

... tend to have a higher cost of funds than that of traditional core deposits. Further, the Federal Reserve requires bank holding companies to obtain approval before making a "capital distribution," such as paying or increasing dividends, implementing common stock repurchase programs, or redeeming or... -

Page 36

... arrangements, using relationships developed with a variety of fixed income investors, and further managing loan growth and investment opportunities. These alternative means of funding may result in an increase to the overall cost of funds and may not be available under stressed conditions, which... -

Page 37

... States or internationally: / A loss of confidence in the financial services industry and the equity markets by investors, placing pressure on the price of Key's common shares or decreasing the credit or liquidity available to Key; / A decrease in consumer and business confidence levels generally... -

Page 38

... routinely execute transactions with such counterparties, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional clients. Financial services institutions are interrelated as a result of trading, clearing, counterparty or other relationships... -

Page 39

... other types of financial institutions, including, without limitation, savings associations, credit unions, mortgage banking companies, finance companies, mutual funds, insurance companies, investment management firms, investment banking firms, broker-dealers and other local, regional, national, and... -

Page 40

... "disintermediation," could result in the loss of fee income, as well as the loss of customer deposits and related income generated from those deposits. The increasing pressure from our competitors, both bank and nonbank, to keep pace and adopt new technologies and products and services requires us... -

Page 41

... the registration statement filed in connection with the transaction, and approval of the KeyCorp common shares and the new KeyCorp preferred stock to be issued to First Niagara common and preferred stockholders, as applicable, for listing on the NYSE. The conditions to the closing of the merger may... -

Page 42

... estimating probable loan losses, measuring the fair value of financial instruments when reliable market prices are unavailable, estimating the effects of changing interest rates and other market measures on our financial condition and results of operations, managing risk, and for capital planning... -

Page 43

...PROPERTIES The headquarters of KeyCorp and KeyBank are located in Key Tower at 127 Public Square, Cleveland, Ohio 44114-1306. At December 31, 2015, Key leased approximately 477,781 square feet of the complex, encompassing the first 12 floors and the 54th through 56th floors of the 57-story Key Tower... -

Page 44

... on Cash, Dividends and Lending Activities"), and Note 22 ("Shareholders' Equity") ...KeyCorp common share price performance (2011-2015) graph ...71 36, 71, 100 14, 88, 136, 216 72 From time to time, KeyCorp or its principal subsidiary, KeyBank, may seek to retire, repurchase, or exchange... -

Page 45

ITEM 6. SELECTED FINANCIAL DATA The information included under the caption "Selected Financial Data" in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page 36 is incorporated herein by reference. 33 -

Page 46

... expense Income taxes Line of Business Results Key Community Bank summary of operations Key Corporate Bank summary of operations Other Segments Financial Condition Loans and loans held for sale Securities Other investments Deposits and other sources of funds Capital Off-Balance Sheet Arrangements... -

Page 47

... strategy. These exit loan portfolios are included in Other Segments. We engage in capital markets activities primarily through business conducted by our Key Corporate Bank segment. These activities encompass a variety of products and services. Among other things, we trade securities as a dealer... -

Page 48

...value at year end Market price at year end Dividend payout ratio Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) (c) AT DECEMBER 31. Loans Earning assets Total assets Deposits Long-term debt Key common shareholders' equity... -

Page 49

...to maintain the existing policy of reinvesting principal payments to help accommodate financial conditions throughout the year. In addition, the FOMC kept the federal funds target rate near zero until December 2015, lifting the target rate by 25 basis points, citing an improving labor market and the... -

Page 50

... and year ended December 31, 2015. Figure 2. Evaluation of Our Long-Term Financial Goals KEY Business Model Balance sheet efficiency Moderate risk profile High quality, diverse revenue streams Positive operating leverage Financial Returns Key Metrics (a) Loan-to-deposit ratio (b) Net loan charge... -

Page 51

... benefited from increases in several of our core fee-based businesses: investment banking and debt placement fees, which had record high fees in 2015 due to stronger financial advisory fees and loan syndications, trust and investment services income, corporate services income, and cards and payments... -

Page 52

...fund investments for institutional customers. In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank. In February 2013, we decided to sell Victory to a private equity fund. As a result... -

Page 53

... and payments income due to higher merchant services, purchase card, and ATM debit card fees driven by increased volume. Other income also increased $10 million. These increases were partially offset by declines of $27 million in net gains from principal investing and $23 million in operating lease... -

Page 54

Our capital management remains focused on creating value. During 2015, our full-year dividend per common share increased 16% from the prior year, and we repurchased $460 million of common shares. Figure 4 presents certain non-GAAP financial measures related to "tangible common equity," "return on ... -

Page 55

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 56

... on cash flow hedges, net of deferred taxes Amounts in AOCI attributed to pension and postretirement benefit costs, net of deferred taxes Total Common Equity Tier 1 capital Net risk-weighted assets (regulatory) Common Equity Tier 1 ratio (non-GAAP) Tier 1 common equity at period end Key shareholders... -

Page 57

... volume and value of net free funds, such as noninterest-bearing deposits and equity capital; the use of derivative instruments to manage interest rate risk; interest rate fluctuations and competitive conditions within the marketplace; and asset quality. To make it easier to compare results among... -

Page 58

...2015 increase in average earning assets was average loan growth of $2.9 billion driven by commercial, financial and agricultural loans, which increased $3.3 billion and was broad-based across our commercial lines of business. In addition, our average securities available for sale portfolio increased... -

Page 59

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 60

... Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans Loans held for sale Securities available for sale (b), (e) Held-to-maturity securities (b) Trading account assets Short-term investments Other... -

Page 61

...(e) Yield is calculated on the basis of amortized cost. (f) Rate calculation excludes basis adjustments related to fair value hedges. (g) A portion of long-term debt and the related interest expense is allocated to discontinued liabilities as a result of applying our matched funds transfer pricing... -

Page 62

... available for sale Held-to-maturity securities Trading account assets Short-term investments Other investments Total interest income (TE) INTEREST EXPENSE NOW and money market deposit accounts Savings deposits Certificates of deposit ($100,000 or more) Other time deposits Deposits in foreign office... -

Page 63

..., dollars in millions Trust and investment services income Investment banking and debt placement fees Service charges on deposit accounts Operating lease income and other leasing gains Corporate services income Cards and payments income Corporate-owned life insurance income Consumer mortgage income... -

Page 64

...nonyield loan fees and dealer trading and derivatives income. Corporate services income increased $6 million, or 3.5%, in 2014 compared to 2013 driven by higher non-yield loan fees. Cards and payments income Cards and payments income, which consists of debit card, consumer and commercial credit card... -

Page 65

... Net occupancy Computer processing Business services and professional fees Equipment Operating lease expense Marketing FDIC assessment Intangible asset amortization OREO expense, net Other expense Total noninterest expense Average full-time equivalent employees (a) Change 2015 vs. 2014 $ 2015... -

Page 66

... 2015, compared to 25.6% for 2014, and 23.7% for 2013. Our federal tax (benefit) expense differs from the amount that would be calculated using the federal statutory tax rate, primarily because we generate income from investments in tax-advantaged assets, such as corporate-owned life insurance, earn... -

Page 67

... deferred tax assets for certain state net operating loss and state credit carryforwards. Line of Business Results This section summarizes the financial performance and related strategic developments of our two major business segments (operating segments): Key Community Bank and Key Corporate Bank... -

Page 68

... income taxes (TE) Allocated income taxes (benefit) and TE adjustments Net income (loss) attributable to Key AVERAGE BALANCES Loans and leases Total assets Deposits Assets under management at year end 2015 $ 1,486 789 2,275 70 1,798 407 151 256 $ 2014 1,446 769 2,215 59 1,771 385 143 242 $ 2013... -

Page 69

... with increases in loans, derivatives fees, and foreign exchange fees. Other noninterest income increased $25 million mostly driven by gains related to the disposition of certain investments held by the Real Estate Capital line of business and higher trading income. The provision for credit losses... -

Page 70

... KEY CORPORATE BANK DATA Year ended December 31, dollars in millions NONINTEREST INCOME Trust and investment services income Investment banking and debt placement fees Operating lease income and other leasing gains Corporate services income Service charges on deposit accounts Cards and payments... -

Page 71

... Other Segments consist of Corporate Treasury, our Principal Investing unit, and various exit portfolios. Other Segments generated net income attributable to Key of $124 million for 2015, compared to $158 million for both 2014 and 2013. Taxable-equivalent net interest income decreased $33 million... -

Page 72

...(a) Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans CONSUMER Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards... -

Page 73

...total loans. These loans are originated by both Key Corporate Bank and Key Community Bank and consist of fixed and variable rate loans to our large, middle market and small business clients. These loans increased $3.3 billion, or 11.6%, from one year ago. Figure 16 provides our commercial, financial... -

Page 74

... estate lending business is conducted through two primary sources: our 12-state banking franchise, and KeyBank Real Estate Capital, a national line of business that cultivates relationships with owners of commercial real estate located both within and beyond the branch system. This line of business... -

Page 75

... to $16 million at December 31, 2015, as a result of continued improvement in asset quality and market conditions. This category of loans declined by $2 million during 2014. Since December 31, 2014, our nonowner-occupied commercial real estate portfolio has increased by approximately $84 million, or... -

Page 76

... past year. If loan terms are extended at less than normal market rates for similar lending arrangements, our Asset Recovery Group is consulted to help determine if any concession granted would result in designation as a TDR. Transfer to our Asset Recovery Group is considered for any commercial loan... -

Page 77

... balance sheets, income statements, tax returns, and real estate schedules. While the specific steps of each guarantor analysis may vary, the high-level objectives include determining the overall financial conditions of the guarantor entities, including size, quality, and nature of asset base; net... -

Page 78

... from Key Community Bank within our 12-state footprint. The remainder of the portfolio, which has been in an exit mode since the fourth quarter of 2007, was originated from the Consumer Finance line of business and is now included in Other Segments. Home equity loans in Key Community Bank decreased... -

Page 79

... review our assumptions quarterly. For additional information related to the valuation of loans held for sale, see Note 6 ("Fair Value Measurements"). Loan sales As shown in Figure 20, during 2015, we sold $6.0 billion of commercial real estate loans, $415 million of commercial lease financing loans... -

Page 80

... of alternative funding sources; the level of credit risk; capital requirements; and market conditions and pricing. Figure 20 summarizes our loan sales for 2015 and 2014. Figure 20. Loans Sold (Including Loans Held for Sale) Commercial Real Estate $ 1,570 1,246 2,210 1,010 6,036 Commercial Lease... -

Page 81

... government-sponsored enterprises or GNMA, and are traded in liquid secondary markets. These securities are recorded on the balance sheet at fair value for the available-for-sale portfolio and at cost for the held-to-maturity portfolio. For more information about these securities, see Note 6 ("Fair... -

Page 82

... sheet positioning. In addition, the size and composition of our securities available-for-sale portfolio could vary with our needs for liquidity and the extent to which we are required (or elect) to hold these assets as collateral to secure public funds and trust deposits. Although we generally use... -

Page 83

...calculated based on amortized cost. Such yields have been adjusted to a taxable-equivalent basis using the statutory federal income tax rate of 35%. (b) Excludes $5 million of securities at December 31, 2015, that have no stated yield. Other investments Principal investments - investments in equity... -

Page 84

...the funds we used to support loans and other earning assets, compared to $67.3 billion and 86% during 2014. NOW and money market deposit accounts increased $2.0 billion, and noninterest-bearing deposits increased $1.9 billion, reflecting continued growth in the commercial mortgage servicing business... -

Page 85

...dividend payments of $1.9375 per share on our Series A Preferred Stock during each quarter of 2015 for a total of $23 million. Common shares outstanding Our common shares are traded on the New York Stock Exchange under the symbol KEY with 27,058 holders of record at December 31, 2015. Our book value... -

Page 86

... 1 of this report under the heading "Capital planning and stress testing," we are required to annually submit a capital plan to the Federal Reserve setting forth planned capital actions, including any share repurchases our Board of Directors and management intend to make during the year (subject to... -

Page 87

..., the calculation of which is prescribed in federal banking regulations. The Federal Reserve's assessment of capital adequacy previously focused on a component of Tier 1 risk-based capital, known as Tier 1 common equity, and its review of the consolidated capitalization of SIFIs, including KeyCorp... -

Page 88

... on lending-related commitments (b) Net unrealized gains on available-for-sale preferred stock classified as an equity security Less: Deductions Total Tier 2 capital Total risk-based capital RISK-WEIGHTED ASSETS Risk-weighted assets on balance sheet Risk-weighted off-balance sheet exposure Market... -

Page 89

... other comprehensive income (a) Other assets (b) Total Tier 1 capital TIER 2 CAPITAL Allowance for losses on loans and liability for losses on lending-related commitments (c) Net unrealized gains on equity securities available for sale Qualifying long-term debt Total Tier 2 capital Total risk... -

Page 90

... principal investments) are carried at fair value. Commitments to extend credit or funding Loan commitments provide for financing on predetermined terms as long as the client continues to meet specified criteria. These commitments generally carry variable rates of interest and have fixed expiration... -

Page 91

... of $100,000 or more Other time deposits Federal funds purchased and securities sold under repurchase agreements Bank notes and other short-term borrowings Long-term debt Noncancelable operating leases Liability for unrecognized tax benefits Purchase obligations: Banking and financial data services... -

Page 92

... be contingently liable to make payments to the guaranteed party based on changes in a specified interest rate, foreign exchange rate or other variable (including the occurrence or nonoccurrence of a specified event). These variables, known as underlyings, may be related to an asset or liability, or... -

Page 93

... to changes in economic value due to varying market conditions, primarily changes in interest rates. Trading market risk Key incurs market risk as a result of trading, investing, and client facilitation activities, principally within our investment banking and capital markets businesses. Key has... -

Page 94

... to appropriate management. VaR and stressed VaR results are also provided to our regulators and utilized in regulatory capital calculations. We use a historical VaR model to measure the potential adverse effect of changes in interest rates, foreign exchange rates, equity prices, and credit spreads... -

Page 95

...VaR numbers exceeded their VaR limits or stress VaR limits. Figure 32. VaR for Significant Portfolios of Covered Positions 2015 Three months ended December 31, in millions High Low Mean December 31, High 2014 Three months ended December 31, Low Mean December 31, Trading account assets: Fixed income... -

Page 96

... Board-approved policy limits. Interest rate risk positions are influenced by a number of factors including the balance sheet positioning that arises out of consumer preferences for loan and deposit products, economic conditions, the competitive environment within our markets, changes in market... -

Page 97

..., 2015, our simulated exposure to changes in interest rates was moderately asset sensitive, and net interest income would benefit over time from either an increase in short-term or intermediate-term interest rates. Tolerance levels for risk management require the development of remediation plans to... -

Page 98

... base simulation results presented in Figure 34. Net interest income is highly dependent on the timing, magnitude, frequency, and path of interest rate increases and the associated assumptions for deposit repricing relationships, lending spreads, and the balance behavior of transaction accounts. The... -

Page 99

...recognizes that adverse market conditions or other events that could negatively affect the availability or cost of liquidity will affect the access of all affiliates to sufficient wholesale funding. The management of consolidated liquidity risk is centralized within Corporate Treasury. Oversight and... -

Page 100

... the targeted merger completion date. Our credit ratings at December 31, 2015, are shown in Figure 36. We believe these credit ratings, under normal conditions in the capital markets, will enable KeyCorp or KeyBank to issue fixed income securities to investors. Figure 36. Credit Ratings Short-Term... -

Page 101

...part of the plan, we maintain on-balance sheet liquid reserves referred to as our liquid asset portfolio, which consists of high quality liquid assets. During a problem period, that reserve could be used as a source of funding to provide time to develop and execute a longer-term strategy. The liquid... -

Page 102

... to manage through an adverse liquidity event by providing sufficient time to develop and execute a longer-term solution. From time to time, KeyCorp or KeyBank may seek to retire, repurchase, or exchange outstanding debt, capital securities, preferred shares, or common shares through cash purchase... -

Page 103

.... Our credit risk management team uses risk models to evaluate consumer loans. These models, known as scorecards, forecast the probability of serious delinquency and default for an applicant. The scorecards are embedded in the application processing system, which allows for real-time scoring and... -

Page 104

... such as changes in economic conditions, lending policies including underwriting standards, and the level of credit risk associated with specific industries and markets. In the third quarter of 2015, we enhanced the approach used to determine the commercial reserve factors used in estimating the... -

Page 105

... of the individual impairment for commercial loans and TDRs by comparing the recorded investment of the loan with the estimated present value of its future cash flows, the fair value of its underlying collateral, or the loan's observable market price. Secured consumer loan TDRs that are discharged... -

Page 106

... Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer... -

Page 107

... Commercial lease financing Total commercial loans Home equity - Key Community Bank Home equity - Other Credit cards Marine Other Total consumer loans Total net loan charge-offs Net loan charge-offs to average loans Net loan charge-offs from discontinued operations - education lending business... -

Page 108

...commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total recoveries Net loans charged off Provision (credit) for loan... -

Page 109

... commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total nonperforming loans (c) Nonperforming loans held for sale... -

Page 110

...- homebuilder Marine and RV floor plan Commercial lease financing (a) Total commercial loans Home equity - Other Marine RV and other consumer Total consumer loans Total exit loans in loan portfolio Discontinued operations - education lending business (not included in exit loans above) $ $ $ 12-31-15... -

Page 111

... and 2014. Figure 44. Summary of Changes in Other Real Estate Owned, Net of Allowance, from Continuing Operations 2015 Quarters in millions Balance at beginning of period Properties acquired - nonperforming loans Valuation adjustments Properties sold Balance at end of period $ 2015 18 20 (6) (18) 14... -

Page 112

... results of operations. Recent high-profile cyberattacks have targeted retailers and other businesses for the purpose of acquiring the confidential information (including personal, financial, and credit card information) of customers, some of whom are customers of ours. We may incur expenses related... -

Page 113

... lower trust and investment services income reflecting market variability. These decreases were partially offset by a $12 million increase in other income and growth in some of our other core fee-based businesses, including $4 million of higher cards and payments income due to higher credit card and... -

Page 114

... hedge fund investments for institutional customers. In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank. In February 2013, we decided to sell Victory to a private equity fund. 100 -

Page 115

... for period-to-period comparisons. (e) Represents period-end consolidated total loans and loans held for sale (excluding education loans in securitizations trusts for periods prior to September 30, 2014) divided by period-end consolidated total deposits (excluding deposits in foreign office). 101 -

Page 116

... on cash flow hedges, net of deferred taxes Amounts in AOCI attributed to pension and postretirement benefit costs, net of deferred taxes Total Common Equity Tier 1 capital Net risk-weighted assets (regulatory) Common Equity Tier 1 ratio (non-GAAP) Tier 1 common equity at period end Key shareholders... -

Page 117

...-end purchased credit card receivables. (b) Net of capital surplus. (c) Includes net unrealized gains or losses on securities available for sale (except for net unrealized losses on marketable equity securities), net gains or losses on cash flow hedges, and amounts resulting from the application of... -

Page 118

... the business segment and commercial portfolio reserves was not significant. Our accounting policy related to the allowance is disclosed in Note 1 under the heading "Allowance for Loan and Lease Losses." Valuation methodologies We follow the applicable accounting guidance for fair value measurements... -

Page 119

... are our two major business segments: Key Community Bank and Key Corporate Bank. Fair values are estimated using comparable external market data (market approach) and discounted cash flow modeling that incorporates an appropriate risk premium and earnings forecast information (income approach). We... -

Page 120

... accounting policies related to derivatives reflect the current accounting guidance, which provides that all derivatives should be recognized as either assets or liabilities on the balance sheet at fair value, after taking into account the effects of master netting agreements. Accounting for changes... -

Page 121

... in which they occur. For further information on our accounting for income taxes, see Note 12 ("Income Taxes"). During 2015, we did not significantly alter the manner in which we applied our critical accounting policies or developed related assumptions and estimates except for the ALLL enhanced... -

Page 122

... - 1 17 18 Short- and LongTerm Commercial Total (a) Foreign Exchange and Derivatives with Collateral (b) Net Exposure $ $ $ (a) Represents our outstanding leases. (b) Represents contracts to hedge our balance sheet asset and liability needs, and to accommodate our clients' trading and/or hedging... -

Page 123

Our credit risk exposure is largely concentrated in developed countries with emerging market exposure essentially limited to commercial facilities; these exposures are actively monitored by management. We do not have at-risk exposures in the rest of the world. ITEM 7A. QUANTITATIVE AND QUALITATIVE ... -

Page 124

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 125

... Accounting Policies Note 2. Earnings Per Common Share Note 3. Restrictions on Cash, Dividends and Lending Activities Note 4. Loans and Loans Held for Sale Note 5. Asset Quality Note 6. Fair Value Measurements Note 7. Securities Note 8. Derivatives and Hedging Activities Note 9. Mortgage Servicing... -

Page 126

... reporting as of December 31, 2015. Our independent registered public accounting firm has issued an attestation report, dated February 24, 2016, on our internal control over financial reporting, which is included in this annual report. Beth E. Mooney Chairman, Chief Executive Officer and President... -

Page 127

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of KeyCorp as of December 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, changes in equity, and cash flows for each of the three... -

Page 128

... Registered Public Accounting Firm The Board of Directors and Shareholders of KeyCorp We have audited the accompanying consolidated balance sheets of KeyCorp as of December 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, changes in equity, and cash flows... -

Page 129

Consolidated Balance Sheets December 31, in millions, except per share data ASSETS Cash and due from banks Short-term investments Trading account assets Securities available for sale Held-to-maturity securities (fair value: $4,848 and $4,974) Other investments Loans, net of unearned income of $646 ... -

Page 130

... in millions, except per share amounts INTEREST INCOME Loans Loans held for sale Securities available for sale Held-to-maturity securities Trading account assets Short-term investments Other investments Total interest income INTEREST EXPENSE Deposits Federal funds purchased and securities sold under... -

Page 131

... sale, net of income taxes of ($32), $35, and ($173) Net unrealized gains (losses) on derivative financial instruments, net of income taxes of $17, $2, and ($17) Foreign currency translation adjustments, net of income taxes of ($14), ($8), and ($3) Net pension and postretirement benefit costs, net... -

Page 132

... for sale, net of income taxes of ($173) Net unrealized gains (losses) on derivative financial instruments, net of income taxes of ($17) Foreign currency translation adjustments, net of income taxes of ($3) Net pension and postretirement benefit costs, net of income taxes of $63 Cash dividends... -

Page 133

...on LIHTC guaranteed funds Depreciation, amortization and accretion expense, net Increase in cash surrender value of corporate-owned life insurance Stock-based compensation expense FDIC reimbursement (payments), net of FDIC expense Deferred income taxes (benefit) Proceeds from sales of loans held for... -

Page 134

.... KCDC: Key Community Development Corporation. KEF: Key Equipment Finance. KREEC: Key Real Estate Equity Capital, Inc. LCR: Liquidity coverage ratio. LIBOR: London Interbank Offered Rate. LIHTC: Low-income housing tax credit. Moody's: Moody's Investor Services, Inc. MRM: Market Risk Management group... -

Page 135

...provide deposit, lending, cash management, and investment services to individuals and small and medium-sized businesses through our subsidiary, KeyBank. We also provide a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private... -

Page 136

.... Relationships with a number of equipment vendors give the asset management team insight into the life cycle of the leased equipment, pending product upgrades and competing products. In accordance with applicable accounting guidance for leases, residual values are reviewed at least annually to... -

Page 137

... down to net realizable value when payment is 180 days past due. Credit card loans and similar unsecured products continue to accrue interest until the account is charged off at 180 days past due. Commercial and consumer loans may be returned to accrual status if we are reasonably assured that... -

Page 138

... of the individual impairment for commercial loans and TDRs by comparing the recorded investment of the loan with the estimated present value of its future cash flows, the fair value of its underlying collateral, or the loan's observable market price. Secured consumer loan balances of TDRs that are... -

Page 139

... both historical trends and current market conditions quarterly, or more often if deemed necessary. Fair Value Measurements We follow the applicable accounting guidance for fair value measurements and disclosures for all applicable financial and nonfinancial assets and liabilities. This guidance... -

Page 140

... changes in interest rates, prepayment risk, liquidity needs, or other factors. Securities available for sale are reported at fair value. Unrealized gains and losses (net of income taxes) deemed temporary are recorded in equity as a component of AOCI on the balance sheet. Unrealized losses on equity... -

Page 141

... transactions are recorded in interest income; fees paid are recorded in interest expense. Derivatives In accordance with applicable accounting guidance, all derivatives are recognized as either assets or liabilities on the balance sheet at fair value. The net increase or decrease in derivatives is... -

Page 142

... assets) is available to determine the fair value of servicing assets, fair value is determined by calculating the present value of future cash flows associated with servicing the loans. This calculation is based on a number of assumptions, including the market cost of servicing, the discount rate... -

Page 143

... testing is to determine the fair value of each reporting unit. This amount is estimated using comparable external market data (market approach) and discounted cash flow modeling that incorporates an appropriate risk premium and earnings forecast information (income approach). The amount of capital... -

Page 144

...loan losses. Fair value of these loans is determined using market participant assumptions in estimating the amount and timing of both principal and interest cash flows expected to be collected, as adjusted for an estimate of future credit losses and prepayments, and then a market-based discount rate... -

Page 145

... systems applications that support corporate and administrative operations. Software development costs, such as those related to program coding, testing, configuration, and installation, are capitalized and included in "accrued income and other assets" on the balance sheet. The resulting asset, net... -

Page 146

... programs. We estimate the fair value of options granted using the Black-Scholes option-pricing model, as further described in Note 15 ("Stock-Based Compensation"). Marketing Costs We expense all marketing-related costs, including advertising costs, as incurred. Accounting Guidance Adopted in 2015... -

Page 147

... used to estimate the fair value of financial instruments measured at amortized cost and changes the presentation of financial assets and financial liabilities on the balance sheet or in the footnotes. If an entity has elected the fair value option to measure liabilities, the new accounting... -

Page 148

... should consolidate certain types of legal entities. The new guidance amends the current accounting guidance to address limited partnerships and similar legal entities, certain investment funds, fees paid to a decision maker or service provider, and the impact of fee arrangements and related parties... -

Page 149

... accounting guidance can be implemented using either a retrospective method or a cumulative-effect approach. In August 2015, the FASB issued an update that defers the effective date of the revenue recognition guidance by one year. This new guidance will be effective for interim and annual reporting... -

Page 150

...fund investments for institutional customers. In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank. In February 2013, we decided to sell Victory to a private equity fund. As a result... -

Page 151

... billion in short-term investments, which can be used to pay dividends to shareholders, service debt, and finance corporate operations. As indicated in the "Supervision and Regulation" section of Item 1 of this report under the heading "Bank transactions with affiliates," federal law and regulation... -

Page 152

... commercial real estate loans Commercial lease financing (b) Total commercial loans Residential - Prime Loans: Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Total residential - prime loans Consumer other - Key Community Bank Credit cards Consumer... -

Page 153

...net Loan sales Loan draws (payments), net Balance at end of period $ 2015 734 7,108 62 (7,229) (36) 639 $ 2014 611 5,681 (3) (5,289) (266) 734 $ $ Commercial lease financing receivables primarily are direct financing leases, but also include leveraged leases. The composition of the net investment... -

Page 154

...carrying value of all PCI loans was $20 million and $13 million, respectively, compared to $24 million and $16 million, respectively, at December 31, 2013. Changes in the accretable yield during 2015 included accretion and net reclassifications of less than $1 million, resulting in an ending balance... -

Page 155

... commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans with an allowance recorded Total Recorded Investment... -

Page 156

... commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans with an allowance recorded Total Recorded Investment... -

Page 157

... commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans with an allowance recorded Total Recorded Investment... -

Page 158

... Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total prior-year accruing TDRs Total TDRs Number of Loans... -

Page 159

... Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total prior-year accruing TDRs Total TDRs Number of Loans... -

Page 160

... Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total prior-year accruing TDRs Total TDRs Number of Loans... -

Page 161

due. During the year ended December 31, 2015, there were two commercial loan TDRs with a combined recorded investment of $1 million and 269 consumer loan TDRs with a combined recorded investment of $12 million that experienced payment defaults after modifications resulting in TDR status during 2014.... -

Page 162

... Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer... -

Page 163

...assigned at the time of origination, verified by credit risk management, and periodically re-evaluated thereafter. This risk rating methodology blends our judgment with quantitative modeling. Commercial loans generally are assigned two internal risk ratings. The first rating reflects the probability... -

Page 164

...is 180 days past due. Consumer loans generally are charged off when payments are 120 days past due. Home equity and residential mortgage loans generally are charged down to net realizable value when payment is 180 days past due. Credit card loans, and similar unsecured products, are charged off when... -

Page 165

... and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine... -

Page 166

... and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine... -

Page 167

... Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer... -

Page 168

... Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer... -

Page 169

... third-party pricing services. Both of these approaches rely on market-based parameters, when available, such as interest rate yield curves, option volatilities, and credit spreads, or unobservable inputs. Unobservable inputs may be based on our judgment, assumptions, and estimates related to credit... -

Page 170

...reported trades, issuer spreads, benchmark securities, bids, offers, and reference data obtained from market research publications. Inputs used by the third-party pricing service in valuing CMOs and other mortgage-backed securities also include new issue data, monthly payment information, whole loan... -

Page 171

...indirect investments are valued using a methodology that allows the use of statements from the investment manager to calculate net asset value per share. A primary input used in estimating fair value is the most recent value of the capital accounts as reported by the general partners of the funds in... -

Page 172

... based on current market conditions and the current financial status of each company. A valuation analysis is performed to value each investment. The valuation analysis is reviewed by the Principal Investing Entities Deal Team Member, and reviewed and approved by the Chief Administrative Officer of... -

Page 173

... are priced monthly by our MRM group using a credit valuation adjustment methodology. Swap details with the customer and our related participation percentage, if applicable, are obtained from our derivatives accounting system, which is the system of record. Applicable customer rating information is... -

Page 174

... to trading management, derivative traders and marketers, derivatives middle office, and corporate accounting personnel. On a quarterly basis, MRM prepares the credit valuation adjustment calculation, which includes a detailed reserve comparison with the previous quarter, an analysis for change in... -

Page 175

...account securities Commercial loans Total trading account assets Securities available for sale: States and political subdivisions Collateralized mortgage obligations Other mortgage-backed securities Other securities Total securities available for sale Other investments: Principal investments: Direct... -

Page 176

...account securities Commercial loans Total trading account assets Securities available for sale: States and political subdivisions Collateralized mortgage obligations Other mortgage-backed securities Other securities Total securities available for sale Other investments: Principal investments: Direct... -

Page 177

... available for sale Other securities Other investments Principal investments Direct Indirect Equity and mezzanine investments Direct Indirect Other Derivative instruments (a) Interest rate Commodity Credit Gains Beginning (Losses) of Period Included Balance in Earnings Purchases Transfers... -

Page 178

... quarterly basis based on current borrower developments, market conditions, and collateral values. The following two internal methods are used to value impaired loans: / Cash flow analysis considers internally developed inputs, such as discount rates, default rates, costs of foreclosure, and changes... -

Page 179

...3 assets. Direct financing leases and operating lease assets held for sale. Our KEF Accounting and Capital Markets groups are responsible for the valuation policies and procedures related to these assets. The Managing Director of the KEF Capital Markets group reports to the President of the KEF line... -

Page 180

... the fourth quarter of 2015. Fair value of our reporting units is determined using both an income approach (discounted cash flow method) and a market approach (using publicly traded company and recent transactions data), which are weighted equally. Inputs used include market-available data, such as... -

Page 181

... investments - direct: Debt instruments Equity instruments of private companies Nonrecurring Impaired loans (a) Goodwill - 1,060 Fair value of underlying collateral Discounted cash flow and market data Discount Earnings multiple of peers Equity multiple of peers Control premium Weighted-average cost... -

Page 182

... 31, 2015 Fair Value in millions ASSETS Cash and short-term investments (a) Trading account assets (b) Securities available for sale (b) Held-to-maturity securities (c) Other investments (b) Loans, net of allowance (d) Loans held for sale (b) Derivative assets (b) LIABILITIES Deposits with no stated... -

Page 183

... related to liquidity. During 2014 and 2015, the fair values of our loan portfolios generally remained stable, primarily due to increasing liquidity in the loan markets. If we were to use different assumptions, the fair values shown in the preceding table could change. Also, because the applicable... -

Page 184

...value of securities on the balance sheet as of the dates indicated. Accordingly, the amount of these gains and losses may change in the future as market conditions change. For more information about our securities available for sale and held-to-maturity securities and the related accounting policies... -

Page 185

... 31, 2014 Impairment recognized in earnings Balance at December 31, 2015 $ $ 4 - 4 Realized gains and losses related to securities available for sale were as follows: Year ended December 31 in millions 2015 2014(a) 2013(b) Realized gains Realized losses Net securities gains (losses) (a) Realized... -

Page 186

... terms; and / foreign exchange risk is the risk that an exchange rate will adversely affect the fair value of a financial instrument. Derivative assets and liabilities are recorded at fair value on the balance sheet, after taking into account the effects of bilateral collateral and master netting... -

Page 187

... fixed-rate debt. We also use these swaps to manage the interest rate risk associated with anticipated sales of certain commercial real estate loans. The swaps protect against the possible short-term decline in the value of the loans that could result from changes in interest rates between the time... -

Page 188

... 31, 2015 Fair Value in millions Derivatives designated as hedging instruments: Interest rate Foreign exchange Total Derivatives not designated as hedging instruments: Interest rate Foreign exchange Commodity Credit Total Netting adjustments (a) Net derivatives in the balance sheet Other collateral... -

Page 189

... exposure to changes in the carrying value of our investments as a result of changes in the related foreign exchange rates. Instruments designated as net investment hedges are recorded at fair value and included in "derivative assets" or "derivative liabilities" on the balance sheet. Initially, the... -

Page 190

...rate Interest rate Interest rate Net Investment Hedges Foreign exchange contracts Total 50 Interest income - Loans (8) Interest expense - Long-term debt (1) Investment banking and debt placement fees 27 $ 68 Other Income $ - 63 Other income - - The after-tax change in AOCI resulting from cash... -

Page 191

...for the years ended December 31, 2015, December 31, 2014, and December 31, 2013, and where they are recorded on the income statement. 2015 Year ended December 31, in millions NET GAINS (LOSSES) Interest rate Foreign exchange Commodity Credit Total net gains (losses) Corporate Services Income $ 28 36... -

Page 192

... rate Foreign exchange Commodity Credit Derivative assets before collateral Less: Related collateral Total derivative assets $ $ 2015 628 66 298 4 996 377 619 $ $ 2014 607 41 478 1 1,127 518 609 We enter into derivative transactions with two primary groups: broker-dealers and banks, and clients... -

Page 193

... 31, 2014. The fair value of credit derivatives presented below does not take into account the effects of bilateral collateral or master netting agreements. December 31, in millions Purchased 2015 Sold Net Purchased 2014 Sold Net Single-name credit default swaps Traded credit default swap indices... -

Page 194

... information about the credit ratings for KeyBank and KeyCorp, see the discussion under the heading "Factors affecting liquidity" in the section entitled "Liquidity risk management" in Item 7 of this report. 2015 December 31, in millions KeyBank's long-term senior unsecured credit ratings One rating... -

Page 195

... 51 (98) 323 417 $ $ The fair value of mortgage servicing assets is determined by calculating the present value of future cash flows associated with servicing the loans. This calculation uses a number of assumptions that are based on current market conditions. The range and weighted-average of the... -

Page 196

... of net assets acquired in a business combination exceeds their fair value. Other intangible assets are primarily the net present value of future economic benefits to be derived from the purchase of credit card receivable assets and core deposits. Additional information pertaining to our accounting... -

Page 197

...the Key Corporate Bank unit. Approximately $72 million of the goodwill was allocated to KBCM in the second quarter of 2015, when Pacific Crest Securities was fully merged into KBCM. During the third quarter of 2015, goodwill increased $3 million to account for a tax item associated with the business... -

Page 198

... trust assets and liabilities from our balance sheet. Further information regarding these education loan securitization trusts is provided in Note 13 ("Acquisitions and Discontinued Operations") under the heading "Education lending." LIHTC investments. Through KCDC, we have made investments directly... -

Page 199

... Income taxes included in the income statement are summarized below. We file a consolidated federal income tax return. Year ended December 31, in millions Currently payable: Federal State Total currently payable Deferred: Federal State Total deferred Total income tax (benefit) expense (a) $ $ 2015... -

Page 200

... investments Foreign tax adjustments Reduced tax rate on lease financing income Tax-exempt interest income Corporate-owned life insurance income Interest refund (net of federal tax benefit) State income tax, net of federal tax benefit Tax credits Other Total income tax expense (benefit) $ 2015... -

Page 201

...of a share of KeyCorp common stock and (ii) $2.30 in cash. The exchange ratio of KeyCorp stock for First Niagara stock is fixed and will not adjust based on changes in KeyCorp's share trading price. First Niagara equity awards outstanding immediately prior to the effective time of the merger will be... -

Page 202

... 2015, First Niagara, headquartered in Buffalo, New York, had approximately 390 branches with $40 billion of total assets and $29 billion of deposits. Pacific Crest Securities. On September 3, 2014, we acquired Pacific Crest Securities, a leading technologyfocused investment bank and capital markets... -

Page 203

...our education lending business included on the balance sheet are as follows. There were no discontinued liabilities for the periods presented below. December 31, in millions Held-to-maturity securities Portfolio loans at fair value Loans, net of unearned income (a) Less: Allowance for loan and lease... -

Page 204

..., net of tax" on our income statement. On June 27, 2014, we purchased the private loans from one of the education loan securitization trusts through the execution of a clean-up call option. The trust used the cash proceeds from the sale of these loans to retire the outstanding securities related to... -

Page 205

... balance, contractual term, interest rate). Cash flows for these loan pools were developed using a financial model that reflected certain assumptions for defaults, recoveries, status changes, and prepayments. A net earnings stream, taking into account cost of funding, was calculated and discounted... -

Page 206

...in Note 1 ("Summary of Significant Accounting Policies") under the heading "Nonperforming Loans." December 31, 2015 in millions Portfolio loans at carrying value Accruing loans past due 90 days or more Loans placed on nonaccrual status Portfolio loans at fair value Accruing loans past due 90 days or... -

Page 207

... 31, 2015. Victory Capital Management and Victory Capital Advisors. On July 31, 2013, we completed the sale of Victory to a private equity fund. During March 2014, client consents were secured and assets under management were finalized and, as a result, we recorded an additional after-tax cash gain... -

Page 208

... 31, in millions Cash and due from banks Held-to-maturity securities Portfolio loans at fair value Loans, net of unearned income (a) Less: Allowance for loan and lease losses Net loans Accrued income and other assets Total assets Accrued expense and other liabilities Total liabilities $ $ 2015 15... -

Page 209

... of set off, the assets and liabilities are reported on a gross basis. Repurchase agreements and securities borrowed transactions are included in "short-term investments" on the balance sheet; reverse repurchase agreements are included in "federal funds purchased and securities sold under repurchase... -

Page 210

... is the closing price of our common shares on the grant date. We determine the fair value of options granted using the Black-Scholes option-pricing model. This model was originally developed to determine the fair value of exchange-traded equity options, which (unlike employee stock options) have... -

Page 211

... "Program") rewards senior executives critical to our longterm financial success. Awards are granted annually in a variety of forms: / / / / deferred cash payments that generally vest and are payable at the rate of 25% per year; time-lapsed (service condition) restricted stock units payable in stock... -

Page 212

...or unit awards granted under the Program is calculated using the closing trading price of our common shares on the grant date. Unlike time-lapsed and performance-based restricted stock or units, we do not pay dividends during the vesting period for performance shares or units that may become payable... -

Page 213

... our cash balance pension plan and other defined benefit plans to freeze all benefit accruals and close the plans to new employees. We will continue to credit participants' existing account balances for interest until they receive their plan benefits. We changed certain pension plan assumptions... -

Page 214

... of year Actual return on plan assets Employer contributions Benefit payments FVA at end of year $ 2015 957 $ (15) 14 (87) 869 $ 2014 970 66 14 (93) 957 $ The following table summarizes the funded status of the pension plans, which equals the amounts recognized in the balance sheets at December... -

Page 215

...provide the necessary cash flows to pay benefits when due. We determine the expected return on plan assets using a calculated market-related value of plan assets that smoothes what might otherwise be significant year-to-year volatility in net pension cost. Changes in the value of plan assets are not... -

Page 216

...by the pension funds' investment policies based on the plan's funded status at December 31, 2015. Target Allocation 2015 20 % 16 40 5 13 6 100 % Asset Class Equity securities: U.S. International Fixed income securities Convertible securities Real assets Other assets Total Equity securities include... -

Page 217

...Fixed income - U.S. Fixed income - International Collective investment funds: Equity - U.S. Equity - International Convertible securities Fixed income securities Short-term investments Real assets Insurance investment contracts and pooled separate accounts Other assets Total net assets at fair value... -

Page 218

...Fixed Income - U.S. Fixed Income - International Collective investment funds: Equity - U.S. Equity - International Convertible securities Fixed income securities Short-term investments Real assets Insurance investment contracts and pooled separate accounts Other assets Total net assets at fair value... -

Page 219

...benefit plans presented in the following tables is based on current actuarial reports using measurement dates of December 31, 2015, and December 31, 2014. The following table summarizes changes in the APBO. Year ended December 31, in millions APBO at beginning of year Service cost Interest cost Plan... -

Page 220

... Class Equity securities Fixed income securities Convertible securities Cash equivalents Total Investments consist of mutual funds and common investment funds that invest in underlying assets in accordance with the target asset allocations shown above. Exchange-traded mutual funds are valued using... -

Page 221

... 31, 2014 in millions ASSET CLASS Mutual funds: Equity - U.S. Equity - International Fixed income - U.S. Fixed income - International Common investment funds: Equity - U.S. Equity - International Convertible securities Short-term investments Total net assets at fair value Level 1 Level 2 Level... -

Page 222

... the guarantor of some of the third-party facilities. Short-term credit facilities. We maintain cash on deposit in our Federal Reserve account, which has reduced our need to obtain funds through various short-term unsecured money market products. This account, which was maintained at $1.9 billion at... -

Page 223

... commercial lease financing receivables is included in Note 4 ("Loans and Loans Held for Sale"). (g) Long-term advances from the Federal Home Loan Bank had a weighted-average interest rate of 3.58% at December 31, 2015, and 3.47% at December 31, 2014. These advances, which had fixed interest rates... -

Page 224

... may be denominated in U.S. dollars or in foreign currencies. Amounts outstanding under the program and any prior bank note programs are classified as "long-term debt" on the balance sheet. Prior to updating its Global Bank Note Program on September 29, 2015, KeyBank issued the following notes under... -

Page 225

... an explanation of fair value hedges. The principal amount of debentures, net of discounts, is included in "long-term debt" on the balance sheet. (c) The interest rates for the trust preferred securities issued by KeyCorp Capital II and KeyCorp Capital III are fixed. KeyCorp Capital I has a floating... -

Page 226

...other Commercial real estate and construction Home equity Credit cards Total loan commitments When-issued and to be announced securities commitments Commercial letters of credit Purchase card commitments Principal investing commitments Tax credit investment commitments Liabilities of certain limited... -

Page 227

... Underwriting and Servicing program. FNMA delegates responsibility for originating, underwriting, and servicing mortgages, and we assume a limited portion of the risk of loss during the remaining term on each commercial mortgage loan that we sell to FNMA. We maintain a reserve for such potential... -

Page 228

...KeyBank, offered limited partnership interests to qualified investors. Partnerships formed by KAHC invested in low-income residential rental properties that qualify for federal low-income housing tax credits under Section 42 of the Internal Revenue Code. In certain partnerships, investors paid a fee... -

Page 229

... with loan and lease sales and other ongoing activities, as well as in connection with purchases and sales of businesses. We maintain reserves, when appropriate, with respect to liability that reasonably could arise as a result of these indemnities. Intercompany guarantees. KeyCorp, KeyBank, and... -

Page 230

...from continuing operations before income taxes Income taxes Income (loss) from continuing operations Foreign currency translation adjustment $ (1) (1) (0) $ (1) Net pension and postretirement benefit costs Amortization of losses Settlement loss Amortization of prior service credit $ (18) (23) 1 (40... -

Page 231

... operations Foreign currency translation adjustment $ 3 3 - $ Net pension and postretirement benefit costs Amortization of losses Settlement loss Amortization of prior service credit 3 $ (15) (23) 1 (37) (14) $ (23) 22. Shareholders' Equity Comprehensive Capital Plan As previously reported and... -

Page 232

... commencement of new activities, and could make clients and potential investors less confident. As of December 31, 2015, KeyCorp and KeyBank (consolidated) met all regulatory capital requirements. As previously indicated in the "Supervision and Regulation" section in Item 1 of this report under the... -

Page 233

...Mid-sized businesses are provided products and services, some of which are delivered by Key Corporate Bank, that include commercial lending, cash management, equipment leasing, investment and employee benefit programs, succession planning, access to capital markets, derivatives, and foreign exchange... -

Page 234

clients, including syndicated finance, debt and equity capital markets, commercial payments, equipment finance, commercial mortgage banking, derivatives, foreign exchange, financial advisory, and public finance. Key Corporate Bank is also a significant servicer of commercial mortgage loans and a ... -

Page 235

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 236

... BALANCES (b) Loans and leases Total assets (a) Deposits OTHER FINANCIAL DATA Expenditures for additions to long-lived assets (a), (b) Net loan charge-offs (b) Return on average allocated equity (b) Return on average allocated equity Average full-time equivalent employees (c) $ $ Key Community Bank... -

Page 237

...2015 (6) 183 177 (8) 8 51 126 (1) 127 - 127 3 $ 124 $ $ 2014 27 230 257 (15) 12 70 190 27 163 - 163 5 158 $ $ 2013 21 222 243 (26) 12 76 181 23 158 - 158 - 158 $ $ 2015... 2013 1 (2) (1) 3 144 (85) (63) (49) (14) 40 26 - 26 $ $ 2015 2,376 1,880 4,256 166 255 2,585 1,250 331 919 1 920 4 916 $ $ Key ... -

Page 238

24. Condensed Financial Information of the Parent Company CONDENSED BALANCE SHEETS December 31, in millions ASSETS Cash and due from banks Short-term investments Securities available for sale Other investments Loans to: Banks Nonbank subsidiaries Total loans Investment in subsidiaries: Banks Nonbank... -

Page 239

... Net (increase) decrease in other assets Net increase (decrease) in other liabilities Other operating activities, net NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES INVESTING ACTIVITIES Net (increase) decrease in short-term investments Purchases of securities available for sale Cash used... -

Page 240

... it files or submits under the Exchange Act, is recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to KeyCorp's management, including its Chief Executive Officer and Chief Financial... -

Page 241

.../ "The Board of Directors and Its Committees - Audit Committee" KeyCorp expects to file the 2016 Proxy Statement with the SEC on or about April 6, 2016. Any amendment to, or waiver from a provision of, the Code of Ethics that applies to its Chief Executive Officer, Chief Financial Officer, and Chief... -

Page 242

... of Award of Non-Qualified Stock Options (effective June 12, 2009), filed as Exhibit 10.1 to Form 10-K for the year ended December 31, 2014.* Form of Award of KeyCorp Executive Officer Grants (Award of Cash Performance Shares and Above-Target Performance Shares) (2013-2015), filed as Exhibit 10.6 to... -

Page 243

... for the quarter ended June 30, 2015.* Form of Merger Integration Performance Shares Award Agreement. Computation of Consolidated Ratio of Earnings to Combined Fixed Charges and Preferred Stock Dividends. Subsidiaries of the Registrant. Consent of Independent Registered Public Accounting Firm. Power... -

Page 244

... have been filed with the SEC. Exhibits that are not incorporated by reference are filed with this report. Shareholders may obtain a copy of any exhibit, upon payment of reproduction costs, by writing KeyCorp Investor Relations, 127 Public Square, Mail Code OH-0127-0737, Cleveland, OH 44114-1306... -

Page 245

... Executive Officer (Principal Executive Officer), President and Director Chief Financial Officer (Principal Financial Officer) Chief Accounting Officer (Principal Accounting Officer) Director Director Director Director Director Director Director Director Director Director Director Director Director... -

Page 246

... 12 KEYCORP COMPUTATION OF CONSOLIDATED RATIO OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS (dollars in millions) (unaudited) 2015 Year ended December 31, 2014 2013 2012 2011 Computation of Earnings Net income (loss) attributable to Key Add: Provision for income taxes Less... -

Page 247

... SUBSIDIARIES OF THE REGISTRANT AT DECEMBER 31, 2015 Jurisdiction of Incorporation or Organization United States Subsidiaries (a) KeyBank National Association Parent Company KeyCorp (a) Subsidiaries of KeyCorp other than KeyBank National Association are not listed above since, in the aggregate... -

Page 248

...of our reports dated February 24, 2016, with respect to the consolidated financial statements of KeyCorp and the effectiveness of internal control over financial reporting of KeyCorp included in this Annual Report (Form 10-K) of KeyCorp for the year ended December 31, 2015. Cleveland, Ohio February... -

Page 249

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 250