KeyBank 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Focused For ward

Building on our results

KeyCorp

2013 Annual Report

Table of contents

-

Page 1

KeyCorp 2013 Annual Report Focused Forward Building on our results -

Page 2

... highlights Key Community Bank Key Community Bank serves individuals and small to mid-sized businesses through a footprint of over 1,000 branches, more than 1,300 ATMs, telephone banking centers, and robust online and mobile capabilities. 4 2013 results 6 KeyCorp Board of Directors and Management... -

Page 3

...million in common shares. These actions resulted in Key returning 76% of net income to shareholders, a 47% increase from the prior year, and the highest among peer banks participating in the Federal Reserve's 2013 Comprehensive Capital Analysis and Review and 2013 Capital Plan Review processes. Our... -

Page 4

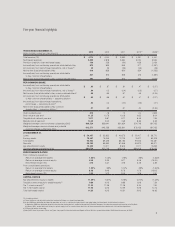

... dividends paid Book value at year end Tangible book value at year end Market price at year end Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT DECEMBER 31, Loans Earning assets Total assets Deposits Key shareholders... -

Page 5

... in mobile penetration by year end. Over the past year, our key.com website has evolved into a robust resource for current and prospective clients to open and service accounts, execute transactions, and access tools to manage their ï¬nances. We also invested in our Key Total Treasury offering... -

Page 6

... .32% Peer-leading capital management 2013 total shareholder payout (dividends and share repurchases as a % of net income) - highest among peers.(b) 80% 60% 40% 20% 0% 76% Key Peers (a) Non-GAAP ï¬nancial measure. Please see Figure 4 on page 42 of the attached Annual Report on Form 10-K for... -

Page 7

... in New Markets Tax Credit investments to Uptown. A strong, diverse team In 2013, the Corporate Bank added senior bankers with industry expertise to further leverage our platform by solidifying new business relationships. During the same period, the Community Bank invested extensive time realigning... -

Page 8

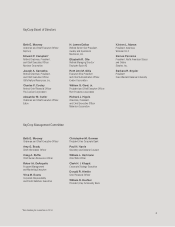

... Public Relations Executive Christopher M. Gorman President, Key Corporate Bank Paul N. Harris Secretary and General Counsel William L. Hartmann Chief Risk Ofï¬cer Clark H. I. Khayat Corporate Strategy Executive Donald R. Kimble Chief Financial Ofï¬cer William R. Koehler President, Key Community... -

Page 9

... manage, deploy, invest, and return capital. Remaining consistent with these priorities is an integral part of maximizing shareholder value and has allowed us to return a peer-leading 76% of net income to shareholders through dividends and share repurchases in 2013. KeyBank volunteers help restore... -

Page 10

... the paper proxy card. Key's Investor Relations website, key.com/IR, provides quick access to useful information and shareholder services, including live webcasts of management's quarterly earnings discussions. Annual meeting of shareholders May 22, 2014 • 8:30 a.m. One Cleveland Center 1375 East... -

Page 11

... STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 Commission file number: 1-11302 Exact name of Registrant as specified in its charter: Ohio... -

Page 12

-

Page 13

... are not limited to: / deterioration of commercial real estate market fundamentals; / defaults by our loan counterparties or clients; / adverse changes in credit quality trends; / declining asset prices; / changes in local, regional and international business, economic or political conditions; / the... -

Page 14

... or circumstances. Before making an investment decision, you should carefully consider all risks and uncertainties disclosed in our SEC filings, including this report on Form 10-K and our subsequent reports on Forms 10-Q and 8-K and our registration statements under the Securities Act of 1933, as... -

Page 15

... Risk ...Financial Statements and Supplementary Data ...Management's Annual Report on Internal Control over Financial Reporting ...Reports of Independent Registered Public Accounting Firm ...Consolidated Financial Statements and Related Notes ...Consolidated Balance Sheets ...Consolidated Statements... -

Page 16

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 17

... 2013. In addition to the customary banking services of accepting deposits and making loans, our bank and trust company subsidiaries offer personal, securities lending and custody services, personal financial services, access to mutual funds, treasury services, investment banking and capital markets... -

Page 18

..., public sector and real estate. Key Corporate Bank delivers a broad product suite of banking and capital markets products to its clients, including syndicated finance, debt and equity capital markets, commercial payments, equipment finance, commercial mortgage banking, derivatives, foreign exchange... -

Page 19

... the New York Stock Exchange, we will post on our website any amendment to the Code of Ethics and any waiver applicable to any senior executive officer or director. We also make available a summary of filings made with the SEC of statements of beneficial ownership of our equity securities filed by... -

Page 20

...holding companies, commercial banks, savings associations, credit unions, mortgage banking companies, finance companies, mutual funds, insurance companies, investment management firms, investment banking firms, broker-dealers, and other local, regional, and national institutions that offer financial... -

Page 21

... the FDIC for non-member state banks and savings associations, the Federal Reserve for member state banks, the CFPB for consumer financial products or services, the SEC and FINRA for securities broker/dealer activities, the SEC and CFTC for swaps and other derivatives, and state insurance regulators... -

Page 22

... particular condition, risk profile or growth plans. At December 31, 2013, Key and KeyBank had regulatory capital in excess of all current minimum risk-based capital (including all adjustments for market risk) and leverage ratio requirements. The FDIA requires the relevant federal banking regulator... -

Page 23

...consolidated assets less any amounts that were also deducted from Tier 1 capital). In addition, the Regulatory Capital Rules address two capital-related provisions of the Dodd-Frank Act: first, the provision that general risk-based and leverage capital requirements applicable to FDIC-insured deposit... -

Page 24

... published by the federal banking agencies in August 2013 (the "August 2013 NPR"). Revised prompt corrective action standards Under the Regulatory Capital Rules, the prompt corrective action capital category threshold ratios applicable to FDIC-insured depository institutions such as KeyBank will be... -

Page 25

... top-tier BHC with total consolidated assets of at least $50 billion (like KeyCorp) to develop and maintain a written capital plan supported by a robust internal capital adequacy process. The capital plan must be submitted annually to the Federal Reserve for supervisory review in connection with its... -

Page 26

... the Federal Reserve. KeyCorp and KeyBank must also conduct their own company-run stress tests to assess the impact of stress scenarios on their consolidated earnings, losses, and capital over a nine-quarter planning horizon, taking into account their current condition, risks, exposures, strategies... -

Page 27

...a bridge financial company for the failed holding company and would transfer the assets and a very limited set of liabilities of the receivership estate. The claims of unsecured creditors and other claimants in the receivership would be satisfied by the exchange of their claims for the securities of... -

Page 28

... business activities and the significance of KeyBank to Key. This resolution plan, the first required from KeyCorp and KeyBank, was submitted on December 9, 2013. In January 2014, the Federal Reserve and FDIC made available on their websites the public sections of resolution plans for the companies... -

Page 29

... of the residential mortgage loan process, ranging from the customer application to servicing of the loan. These changes and additions to consumer mortgage banking rules have required enhancements to our compliance programs, as well as changes to Key's systems and loan processing practices. The... -

Page 30

.... On February 18, 2014, the Federal Reserve issued its final rule implementing a number of enhanced prudential standards regarding liquidity, risk management, and capital. Key is currently reviewing the final rule to determine its impact. Bank transactions with affiliates Federal banking law and... -

Page 31

... total consolidated assets for the Federal Reserve's examination, supervision, and regulation of such companies. ITEM 1A. RISK FACTORS As a financial services organization, we are subject to a number of risks inherent in our transactions and present in the business decisions we make. Described... -

Page 32

...that we make significant estimates of current credit risks and future trends, all of which may undergo material changes. Changes in economic conditions affecting borrowers, the stagnation of certain economic indicators that we are more susceptible to, such as unemployment and real estate values, new... -

Page 33

... comply. Such changes may also limit the types of financial services and products we may offer, affect the investments we make, and change the manner in which we operate. For more information, see "Supervision and Regulation" in Item 1 of this report. Additionally, federal banking law grants... -

Page 34

... business relationships with certain customers. It could reduce our ability to invest in longer-term assets even if more desirable from a balance sheet management perspective. In addition, the Federal Reserve requires bank holding companies to obtain approval before making a "capital distribution... -

Page 35

...borrowings, purchasing deposits from other banks, borrowing under certain secured wholesale facilities, using relationships developed with a variety of fixed income investors, and further managing loan growth and investment opportunities. These alternative means of funding may not be available under... -

Page 36

.... These regulations may affect the circumstances and conditions under which we work with third parties and the cost of managing such relationships. We are subject to claims and litigation. From time to time, customers, vendors or other parties may make claims and take legal action against us. We... -

Page 37

... in domestic or international markets: / A loss of confidence in the financial services industry and the equity markets by investors, placing pressure on the price of Key's common shares or decreasing the credit or liquidity available to Key; / A decrease in consumer and business confidence levels... -

Page 38

... States or other governments whose securities we hold; and / An increase in limitations on or the regulation of financial services companies like Key. We are subject to interest rate risk, which could adversely affect our earnings on loans and other interestearning assets. Our earnings and cash... -

Page 39

... and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional clients. Financial services institutions, however, are interrelated as a result of trading, clearing, counterparty or other relationships. Defaults by one or more financial services institutions have... -

Page 40

..., including, without limitation, savings associations, credit unions, mortgage banking companies, finance companies, mutual funds, insurance companies, investment management firms, investment banking firms, broker-dealers and other local, regional and national financial services firms. In addition... -

Page 41

... value. Acquiring other banks, bank branches, or other businesses involves various risks commonly associated with acquisitions, including exposure to unknown or contingent liabilities of the target company, diversion of our management's time and attention, and the possible loss of key employees... -

Page 42

ITEM 2. PROPERTIES The headquarters of KeyCorp and KeyBank are located in Key Tower at 127 Public Square, Cleveland, Ohio 44114-1306. At December 31, 2013, Key leased approximately 686,002 square feet of the complex, encompassing the first twenty-three floors and the 54th through 56th floors of the ... -

Page 43

... subsidiary, KeyBank, may seek to retire, repurchase or exchange outstanding debt of KeyCorp or KeyBank and capital securities or preferred stock of KeyCorp through cash purchase, privately negotiated transactions or otherwise. Such transactions, if any, depend on prevailing market conditions, our... -

Page 44

ITEM 6. SELECTED FINANCIAL DATA The information included under the caption "Selected Financial Data" in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page 32 is incorporated herein by reference. 31 -

Page 45

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 46

... lease expense FDIC assessment Intangible asset amortization Other expense Income taxes Line of Business Results Key Community Bank summary of operations Key Corporate Bank summary of operations Other Segments Financial Condition Loans and loans held for sale Commercial loan portfolio Commercial... -

Page 47

... extend credit or funding Other off-balance sheet arrangements Contractual obligations Guarantees Risk Management Overview Market risk management Trading market risk Management of trading market risks Covered positions VaR and stressed VaR Internal capital adequacy assessment Nontrading market risk... -

Page 48

... this discussion, references to "Key," "we," "our," "us," and similar terms refer to the consolidated entity consisting of KeyCorp and its subsidiaries. "KeyCorp" refers solely to the parent holding company, and "KeyBank" refers to KeyCorp's subsidiary bank, KeyBank National Association. We want to... -

Page 49

...value at year end Market price at year end Dividend payout ratio Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT DECEMBER 31. Loans Earning assets Total assets Deposits Long-term debt Key common shareholders' equity Key... -

Page 50

...(excluding education loans in securitizations trusts) divided by period-end consolidated total deposits (excluding deposits in foreign office). Economic overview The economy continued its modest recovery in 2013, with overall GDP starting slowly and accelerating as the year progressed, resulting in... -

Page 51

... return on average assets in the range of 1.00% to 1.25%. Figure 2 shows the evaluation of our long-term financial goals for the fourth quarter of 2013 and the year ended 2013. Figure 2. Evaluation of Our Long-Term Financial Goals KEY Business Model Core funded Key Metrics (a) Loan to deposit ratio... -

Page 52

... financial strength - With the foundation of a strong balance sheet, we will remain focused on sustaining strong reserves, liquidity and capital. We will work closely with our Board of Directors and regulators to manage capital to support our clients' needs and create shareholder value. Our capital... -

Page 53

...in managing hedge fund investments for institutional customers. In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank. In February 2013, we decided to sell Victory to a private equity... -

Page 54

Our full-year results for 2013 reflect success in executing our strategies by growing loans, acquiring a commercial real estate servicing portfolio and special servicing business, and achieving annualized run rate savings in excess of our goal. We ended 2013 with annual run rate savings of ... -

Page 55

... net income to shareholders through both common share repurchases and dividends in 2013. We also used our capital to acquire a commercial real estate servicing portfolio and special servicing business. The Federal Reserve is currently reviewing of our 2014 capital plan under the CCAR process. Until... -

Page 56

... assets ratio (non-GAAP) Tier 1 common equity at period end Key shareholders' equity (GAAP) Qualifying capital securities Less: Goodwill Accumulated other comprehensive income (loss) (d) Other assets (e) Total Tier 1 capital (regulatory) Less: Qualifying capital securities Series B Preferred Stock... -

Page 57

...-end purchased credit card receivable intangible assets. (c) Net of capital surplus for the year ended December 31, 2013. (d) Includes net unrealized gains or losses on securities available for sale (except for net unrealized losses on marketable equity securities), net gains or losses on cash flow... -

Page 58

... prior year. Total 2013 net interest income increased compared to the prior year because the interest expense associated with lower deposit costs declined by more than interest income. The decrease in interest income is primarily attributable to a change in the mix of average earning assets: higher... -

Page 59

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 60

...Securities available for sale (c),(e) Held-to-maturity securities (c) Trading account assets Short-term investments Other investments (e) Total earning assets Allowance for loan and lease losses Accrued income and other assets Discontinued assets Total assets LIABILITIES NOW and money market deposit... -

Page 61

... average balances for the years ended December 31, 2013, and December 31, 2012, include $95 million and $36 million, respectively, of assets from commercial credit cards. (i) (j) In late March 2009, Key transferred $1.5 billion of loans from the construction portfolio to the commercial mortgage... -

Page 62

... Securities available for sale Held-to-maturity securities Trading account assets Short-term investments Other investments Total interest income (TE) INTEREST EXPENSE NOW and money market deposit accounts Certificates of deposit ($100,000 or more) Other time deposits Deposits in foreign office Total... -

Page 63

... on deposit accounts Operating lease income and other leasing gains Corporate services income Cards and payments income Corporate-owned life insurance income Consumer mortgage income Mortgage servicing fees Net gains (losses) from principal investing Other income (a) Total noninterest income $ 2013... -

Page 64

... on this business, which resulted in lower transaction volumes, client departures, and fewer assets under management. Figure 9. Assets Under Management December 31, dollars in millions Assets under management by investment type: Equity Securities lending Fixed income Money market Total 2013 $ 20,971... -

Page 65

...Expense Year ended December 31, dollars in millions Personnel Net occupancy Computer processing Business services and professional fees Equipment Operating lease expense Marketing FDIC assessment Intangible asset amortization on credit cards Other intangible asset amortization Provision (credit) for... -

Page 66

... expenses associated with the acquisitions of the credit card portfolios and Western New York branches. Income taxes We recorded a tax provision from continuing operations of $271 million for 2013, compared to a tax provision of $231 million for 2012 and $364 million for 2011. The effective tax rate... -

Page 67

... amount that would be calculated using the federal statutory tax rate, primarily because we generate income from investments in tax-advantaged assets, such as corporate-owned life insurance, earn credits associated with investments in low-income housing projects, and make periodic adjustments to our... -

Page 68

... from 2012. Trust and investment services income increased $17 million due to an increase in assets under management resulting from market appreciation and increased production. Cards and payments income increased $26 million due to the full year impact of the credit card portfolio acquisition in... -

Page 69

... income AVERAGE DEPOSITS OUTSTANDING NOW and money market deposit accounts Savings deposits Certificates of deposits ($100,000 or more) Other time deposits Deposits in foreign office Noninterest-bearing deposits Total deposits HOME EQUITY LOANS Average balance Weighted-average loan-to-value ratio... -

Page 70

... income Investment banking and debt placement fees Operating lease income and other leasing gains Corporate services income Service charges on deposit accounts Cards and payments income Payments and services income Mortgage servicing fees Other noninterest income Total noninterest income $ $ 2013... -

Page 71

Other Segments Other Segments consists of Corporate Treasury, our Principal Investing unit, and various exit portfolios. Other Segments generated net income attributable to Key of $314 million for 2013, compared to $256 million for 2012. The 2013 results reflect an increase in taxable-equivalent net... -

Page 72

...100.0 % 2010 Amount COMMERCIAL Commercial, financial and agricultural Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans CONSUMER Real estate - residential mortgage Home equity: Key Community Bank Other Total... -

Page 73

..., financial and agricultural portfolio, along with the credit card portfolio and Western New York branch acquisitions. For more information on balance sheet carrying value, see Note 1 ("Summary of Significant Accounting Policies") under the headings "Loans" and "Loans Held for Sale." Commercial loan... -

Page 74

...and accounted for approximately 55.8% of our average year-to-date CRE loans, compared to 54.3% one year ago. KeyBank Real Estate Capital generally focuses on larger owners and operators of CRE. Figure 17 includes commercial mortgage and construction loans in both Key Community Bank and Key Corporate... -

Page 75

... income and asset values), leading to reduced cash flow to support debt service payments. Reduced client cash flow would adversely affect our ability to collect such payments. Accordingly, the value of CRE loan portfolio could be adversely affected. Commercial lease financing. We conduct commercial... -

Page 76

... lines of business.) Appropriately sized A notes are more likely to return to accrual status, allowing us to resume recognizing interest income. As the borrower's payment performance improves, these restructured notes typically also allow for an upgraded internal quality risk rating classification... -

Page 77

... statements are required at least annually within 90-120 days of the calendar/ fiscal year end. Income statements and rent rolls for project collateral are required quarterly. We may require certain information, such as liquidity, certifications, status of asset sales or debt resolutions, and real... -

Page 78

... since the fourth quarter of 2007, was originated from the Consumer Finance line of business and is now included in Other Segments. Home equity loans in Key Community Bank increased by $524 million, or 5.3%, over the past twelve months as a result of stabilized home values, improved employment, and... -

Page 79

...our relationship banking strategy; our A/LM needs; the cost of alternative funding sources; the level of credit risk; capital requirements; and market conditions and pricing. Figure 20 summarizes our loan sales for 2013 and 2012. Figure 20. Loans Sold (Including Loans Held for Sale) Commercial $ 39... -

Page 80

... of related servicing assets. In addition, we earn interest income from investing funds generated by escrow deposits collected in connection with the servicing of CRE loans. Additional information about our mortgage servicing assets is included in Note 9 ("Mortgage Servicing Assets"). Maturities... -

Page 81

...Western New York branch acquisition in July 2012 (including credit card assets obtained in September 2012) and the acquisition of Key-branded credit card assets in August 2012. Figure 24 shows the composition, yields and remaining maturities of our securities available for sale. For more information... -

Page 82

... is based upon expected average lives rather than contractual terms. (b) Includes primarily marketable equity securities. (c) Weighted-average yields are calculated based on amortized cost. Such yields have been adjusted to a taxable-equivalent basis using the statutory federal income tax rate of 35... -

Page 83

...million decrease in foreign office deposits, a $19 million decrease in bank notes and other short-term borrowings, and a $12 million decrease in federal funds purchased and securities sold under agreements to repurchase. At December 31, 2013, Key had $3.2 billion in time deposits of $100,000 or more... -

Page 84

... the BHC's risk profile, business strategies, or corporate structure, including but not limited to changes in planned capital actions. As previously reported, on January 7, 2013, we submitted to the Federal Reserve and provided to the OCC our 2013 capital plan under the annual CCAR process. On March... -

Page 85

... in Item 1 of this report, we are required to annually submit a capital plan to the Federal Reserve setting forth planned capital actions, including any share repurchases our Board of Directors and management intend to make during the year (subject to the Federal Reserve's notice of non-objection... -

Page 86

... as Key, will result in our trust preferred securities issued by the KeyCorp capital trusts being treated only as Tier 2 capital by 2016. These changes apply the same leverage and risk-based capital requirements that apply to depository institutions to BHCs, savings and loan holding companies, and... -

Page 87

... taxable income for the year, or (ii) 10% of the amount of an institution's Tier 1 capital. At December 31, 2013, and December 31, 2012, we had no net deferred tax assets deducted from Tier 1 capital and risk-weighted assets. At December 31, 2013, for Key's consolidated operations, we had a federal... -

Page 88

...equity securities available for sale Qualifying long-term debt Total Tier 2 capital Total risk-based capital TIER 1 COMMON EQUITY Tier 1 capital Less: Qualifying capital securities Series A Preferred Stock (d) Total Tier 1 common equity RISK-WEIGHTED ASSETS Risk-weighted assets on balance sheet Risk... -

Page 89

... carried at cost. Investments held by our registered broker-dealer and investment company subsidiaries (primarily principal investments) are carried at fair value. Commitments to extend credit or funding Loan commitments provide for financing on predetermined terms as long as the client continues to... -

Page 90

...tax benefits Purchase obligations: Banking and financial data services Telecommunications Professional services Technology equipment and software Other Total purchase obligations Total Lending-related and other off-balance sheet commitments: Commercial, including real estate Home equity Credit cards... -

Page 91

... management and the processes related to risk review and compliance. The Audit Committee has responsibility over financial reporting, compliance risk and legal matters, the implementation, management and evaluation of operational risk controls and information, security and fraud risk, and associated... -

Page 92

...interest rates. Trading market risk Key incurs market risk as a result of trading, investing, and client facilitation activities, principally within our investment banking and capital markets business. Key has exposures to a wide range of interest rates, equity prices, foreign exchange rates, credit... -

Page 93

..., foreign exchange rates, equity prices, and credit spreads on the fair value of our covered positions. Historical scenarios are customized for specific covered positions, and numerous risk factors are incorporated in the calculation. VaR is calculated using daily observations over a one-year time... -

Page 94

... not calculated for market risk regulatory capital purposes during 2012. Figure 32. Stressed VaR for Significant Portfolios of Covered Positions 2013 Three months ended December 31, in millions High Low Mean December 31, Trading account assets: Fixed income Derivatives: Interest rate Foreign... -

Page 95

... Board approved policy limits. Interest rate risk positions are influenced by a number of factors including the balance sheet positioning that arises out of consumer preferences for loan and deposit products, economic conditions, the competitive environment within our markets, and changes in market... -

Page 96

...balance sheet financial instruments to achieve the desired residual risk profile. However, actual results may differ from those derived in simulation analysis due to unanticipated changes to the balance sheet composition, customer behavior, product pricing, market interest rates, investment, funding... -

Page 97

... monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens, and in particular expects to keep the federal funds rate at exceptionally low levels. Key will continue to monitor balance sheet flows and expects the benefit... -

Page 98

... affect the cost and availability of normal funding sources. Our credit ratings at December 31, 2013, are shown in Figure 35. We believe these credit ratings, under normal conditions in the capital markets, will enable the parent company or KeyBank to issue fixed income securities to investors. 83 -

Page 99

... of funding to provide time to develop and execute a longer-term strategy. The liquid asset portfolio at December 31, 2013, totaled $11.6 billion, consisting of $6.0 billion of unpledged securities, $1.0 billion of securities available for secured funding at the Federal Home Loan Bank of Cincinnati... -

Page 100

execute business initiatives. Key's client-based relationship strategy provides for a strong core deposit base which, in conjunction with intermediate and long-term wholesale funds managed to a diversified maturity structure and investor base, supports our liquidity risk management strategy. We use ... -

Page 101

...the years ended December 31, 2013, and 2012. Credit risk management Credit risk is the risk of loss to us arising from an obligor's inability or failure to meet contractual payment or performance terms. Like other financial services institutions, we make loans, extend credit, purchase securities and... -

Page 102

...the balance sheet at fair value. Related gains or losses, as well as the premium paid or received for credit protection, are included in the "corporate services income" and "other income" components of noninterest income. We may also manage the loan portfolio using portfolio swaps and bulk purchases... -

Page 103

... such as changes in economic conditions, lending policies including underwriting standards, and the level of credit risk associated with specific industries and markets. For all commercial and consumer loan TDRs, regardless of size, as well as impaired commercial loans with an outstanding balance of... -

Page 104

...29.8 100.0 % December 31, dollars in millions Commercial, financial and agricultural Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other... -

Page 105

... Year ended December 31, dollars in millions Commercial, financial and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease financing Total commercial loans Home equity - Key Community Bank Home equity - Other Credit cards Marine Other Total consumer loans Total... -

Page 106

... real estate loans(b) Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans... -

Page 107

...31, dollars in millions Commercial, financial and agricultural (a) Real estate - commercial mortgage Real estate - construction Total commercial real estate loans (b) Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home... -

Page 108

... properties - homebuilder Marine and RV floor plan Commercial lease financing (a) Total commercial loans Home equity - Other Marine RV and other consumer Total consumer loans Total exit loans in loan portfolio Discontinued operations - education lending business (not included in exit loans... -

Page 109

...Changes in Nonperforming Loans from Continuing Operations 2013 Quarters in millions Balance at beginning of period Loans placed on nonaccrual status Charge-offs Loans sold Payments Transfers to OREO Transfers to nonperforming loans held for sale Transfers to other nonperforming assets Loans returned... -

Page 110

... and our system of internal controls. Risk Review reports the results of reviews on internal controls and systems to senior management and the Audit Committee, and independently supports the Audit Committee's oversight of these controls. Cybersecurity Key devotes significant time and resources to... -

Page 111

...deposits. Noninterest income Our noninterest income was $453 million for the fourth quarter of 2013, compared to $439 million for the year-ago quarter. The fourth quarter reflects the benefits from Key's recent investments in payments and commercial mortgage servicing, with cards and payments income... -

Page 112

...book value at period end Market price: High Low Close Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT PERIOD END Loans Earning assets Total assets Deposits Long-term debt Key common shareholders' equity Key shareholders... -

Page 113

...in managing hedge fund investments for institutional customers. In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank. In February 2013, we decided to sell Victory to a private equity... -

Page 114

... Other assets (d) Less: Total Tier 1 capital (regulatory) Qualifying capital securities Series A Preferred Stock (b) Total Tier 1 common equity (non-GAAP) Net risk-weighted assets (regulatory) Tier 1 common equity ratio (non-GAAP) Average tangible common equity Average Key shareholders' equity (GAAP... -

Page 115

...-end purchased credit card receivable intangible assets. (b) Net of capital surplus for the three months ended December 31, 2013, September 30, 2013, and June 30, 2013. (c) Includes net unrealized gains or losses on securities available for sale (except for net unrealized losses on marketable equity... -

Page 116

...perform have a direct bearing on the recorded amounts of assets and liabilities, including loans held for sale, principal investments, goodwill, and pension and other postretirement benefit obligations. At December 31, 2013, $14.5 billion, or 15.6%, of our total assets were measured at fair value on... -

Page 117

... direct and indirect investments, predominantly in privately-held companies. The fair values of these investments are determined by considering a number of factors, including the target company's financial condition and results of operations, values of public companies in comparable businesses... -

Page 118

... to hedge interest rate risk for asset and liability management purposes. These derivative instruments modify the interest rate characteristics of specified on-balance sheet assets and liabilities. Our accounting policies related to derivatives reflect the current accounting guidance, which provides... -

Page 119

... to hedge our balance sheet asset and liability needs, and to accommodate our clients' trading and/or hedging needs. Our derivative mark-to-market exposures are calculated and reported on a daily basis. These exposures are largely covered by cash or highly marketable securities collateral with daily... -

Page 120

... limited to commercial facilities; these exposures are actively monitored by management. We do not have at-risk exposures in the rest of the world. ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK The information included under the caption "Risk Management - Market risk management... -

Page 121

...to Consolidated Financial Statements Note 1. Summary of Significant Accounting Policies Note 2. Earnings Per Common Share Note 3. Restrictions on Cash, Dividends and Lending Activities Note 4. Loans and Loans Held for Sale Note 5. Asset Quality Note 6. Fair Value Measurements Note 7. Securities Note... -

Page 122

... reporting as of December 31, 2013. Our independent registered public accounting firm has issued an attestation report, dated February 26, 2014, on our internal control over financial reporting, which is included in this annual report. Beth E. Mooney Chairman, Chief Executive Officer and President... -

Page 123

...accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of KeyCorp as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, changes in equity and cash flows for each of the three... -

Page 124

... Registered Public Accounting Firm The Board of Directors and Shareholders of KeyCorp We have audited the accompanying consolidated balance sheets of KeyCorp as of December 31, 2013 and 2012, and the related consolidated statements of income, comprehensive income, changes in equity and cash flows... -

Page 125

Consolidated Balance Sheets December 31, in millions, except per share data ASSETS Cash and due from banks Short-term investments Trading account assets Securities available for sale Held-to-maturity securities (fair value: $4,617 and $3,992) Other investments Loans, net of unearned income of $805 ... -

Page 126

... of Income Year ended December 31, dollars in millions, except per share amounts INTEREST INCOME Loans Loans held for sale Securities available for sale Held-to-maturity securities Trading account assets Short-term investments Other investments Total interest income INTEREST EXPENSE Deposits Federal... -

Page 127

... (losses) on securities available for sale, net of income taxes of ($173), ($58), and $46 Net unrealized gains (losses) on derivative financial instruments, net of income taxes of ($17), $12, and ($6) Foreign currency translation adjustments, net of income taxes of ($3), ($3), and $5 Net pension and... -

Page 128

Consolidated Statements of Changes in Equity Key Shareholders' Equity Preferred Shares Outstanding (000) Common Shares Outstanding (000) Common Stock Capital Retained Warrant Surplus Earnings Accumulated Treasury Other Stock, at Comprehensive Noncontrolling Cost Income (Loss) Interests dollars in ... -

Page 129

... loans Proceeds from corporate-owned life insurance Purchases of premises, equipment, and software Proceeds from sales of premises and equipment Proceeds from sales of other real estate owned NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES FINANCING ACTIVITIES Net increase (decrease) in deposits... -

Page 130

...Earnings per share. ERISA: Employee Retirement Income Security Act of 1974. ERM: Enterprise risk management. EVE: Economic value of equity. FASB: Financial Accounting Standards Board. FDIA: Federal Deposit Insurance Act, as amended. FDIC: Federal Deposit Insurance Corporation. Federal Reserve: Board... -

Page 131

... offices, online and mobile banking capabilities, and a telephone banking call center. Additional information pertaining to our two major business segments, Key Community Bank and Key Corporate Bank, is included in Note 23 ("Line of Business Results"). Use of Estimates Our accounting policies... -

Page 132

... costs of originating or acquiring loans. The net deferred amount is amortized over the estimated lives of the related loans as an adjustment to the yield. Direct financing leases are carried at the aggregate of the lease receivable plus estimated unguaranteed residual values, less unearned income... -

Page 133

.... Home equity and residential mortgage loans generally are charged down to the fair value of the underlying collateral when payment is 180 days past due. Credit card loans, and similar unsecured products, continue to accrue interest until the account is charged off at 180 days past due. Commercial... -

Page 134

... of the individual impairment for commercial loans and TDRs by comparing the recorded investment of the loan with the estimated present value of its future cash flows, the fair value of its underlying collateral, or the loan's observable market price. Secured consumer loan balances of TDRs that are... -

Page 135

... not necessarily result in a change in the amount recorded on the balance sheet, assets and liabilities are considered to be fair valued on a nonrecurring basis. This generally occurs when we apply accounting guidance that requires assets and liabilities to be recorded at the lower of cost or fair... -

Page 136

... changes in interest rates, prepayment risk, liquidity needs or other factors. Securities available for sale are reported at fair value. Unrealized gains and losses (net of income taxes) deemed temporary are recorded in equity as a component of AOCI on the balance sheet. Unrealized losses on equity... -

Page 137

... changes in the carrying value of investments as a result of changes in the related foreign exchange rates. The effective portion of a gain or loss on a net investment hedge is recorded as a component of AOCI on the balance sheet when the terms of the derivative match the notional and currency risk... -

Page 138

... assets) is available to determine the fair value of servicing assets, fair value is determined by calculating the present value of future cash flows associated with servicing the loans. This calculation is based on a number of assumptions, including the market cost of servicing, the discount rate... -

Page 139

... intangible assets must be subjected to impairment testing at least annually. We perform quantitative goodwill impairment testing in the fourth quarter of each year. Our reporting units for purposes of this testing are our two business segments, Key Community Bank and Key Corporate Bank. Because... -

Page 140

...-line method over the estimated useful lives of the particular assets. Leasehold improvements are amortized using the straight-line method over the terms of the leases. Accumulated depreciation and amortization on premises and equipment totaled $1.2 billion at December 31, 2013, and 2012. Internally... -

Page 141

.... Shares issued under the discounted stock purchase plan are purchased on the open market. We estimate the fair value of options granted using the Black-Scholes option-pricing model, as further described in Note 15 ("Stock-Based Compensation"). Marketing Costs We expense all marketing-related costs... -

Page 142

... March 2013, the FASB issued new accounting guidance that addresses the accounting for the cumulative translation adjustment when a parent either sells a part or all of its investment in a foreign entity, or no longer holds a controlling financial interest in a subsidiary or group of assets that is... -

Page 143

... effect on our financial condition or results of operations. Investments in qualified affordable housing projects. In January 2014, the FASB issued new accounting guidance that modifies the conditions that must be met to make an election to account for investments in qualified affordable housing... -

Page 144

...in managing hedge fund investments for institutional customers. In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank. In February 2013, we decided to sell Victory to a private equity... -

Page 145

... from KeyBank and other subsidiaries are our principal source of cash flows for paying dividends on our common and preferred shares, servicing our debt, and financing corporate operations. Federal banking law limits the amount of capital distributions that a bank can make to its holding company... -

Page 146

...,822 Total commercial real estate loans Commercial lease financing (b) Total commercial loans Residential - Prime Loans: Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Total residential - prime loans Consumer other - Key Community Bank Credit cards... -

Page 147

... financing lease receivables Unearned income Unguaranteed residual value Deferred fees and costs Net investment in direct financing leases $ 2013 3,176 (219) 231 21 3,209 $ 2012 3,429 (260) 261 25 3,455 $ $ At December 31, 2013, minimum future lease payments to be received are as follows: 2014... -

Page 148

... value and the cash flows expected to be collected from the purchased loans is accreted to interest income over the remaining term of the loans. At December 31, 2013, the outstanding unpaid principal balance and carrying value of all PCI loans was $24 million and $16 million, respectively. Changes... -

Page 149

... real estate loans Total commercial loans with an allowance recorded Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans... -

Page 150

... real estate loans Total commercial loans with an allowance recorded Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total loans... -

Page 151

... Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total prior-year accruing TDRs Total TDRs Number of loans... -

Page 152

... mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards Consumer other: Marine Other Total consumer other Total consumer loans Total nonperforming TDRs Prior-year accruing (a) Commercial, financial and agricultural Commercial real... -

Page 153

... payments on nonaccrual loans, and resuming accrual of interest for our commercial and consumer loan portfolios are disclosed in Note 1 ("Summary of Significant Accounting Policies") under the heading "Nonperforming Loans." At December 31, 2013, approximately $53.5 billion, or 98.3%, of our total... -

Page 154

...2013 in millions Total Loans LOAN TYPE Commercial, financial and agricultural Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total... -

Page 155

... assigned at the time of origination, verified by credit risk management, and periodically reevaluated thereafter. This risk rating methodology blends our judgment with quantitative modeling. Commercial loans generally are assigned two internal risk ratings. The first rating reflects the probability... -

Page 156

... in economic conditions, changes in credit policies or underwriting standards, and changes in the level of credit risk associated with specific industries and markets. For all commercial and consumer loan TDRs, regardless of size, as well as impaired commercial loans with an outstanding balance of... -

Page 157

... Commercial, financial and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards... -

Page 158

... Commercial, financial and agricultural Real estate - commercial mortgage Real estate - construction Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans Consumer other - Key Community Bank Credit cards... -

Page 159

... 31, 2013 in millions Commercial, financial and agricultural Commercial real estate: Commercial mortgage Construction Total commercial real estate loans Commercial lease financing Total commercial loans Real estate - residential mortgage Home equity: Key Community Bank Other Total home equity loans... -

Page 160

...absence of quoted market prices, we determine the fair value of our assets and liabilities using valuation models or third-party pricing services. Both of these approaches rely on market-based parameters, when available, such as interest rate yield curves, option volatilities, and credit spreads, or... -

Page 161

... in the underlying loan credit quality or increase in the market discount rate would negatively impact the bond value. The fair values of our Level 2 securities available for sale are determined by a third-party pricing service. The valuations provided by the third-party pricing service are based on... -

Page 162

...a quarterly basis. Direct investments in properties are initially valued based upon the transaction price. This amount is then adjusted to fair value based on current market conditions using the discounted cash flow method based on the expected investment exit date. The fair values of the assets are... -

Page 163

...investment managers). This process involves an in-depth review of the condition of each investment depending on the type of investment. Our direct investments include investments in debt and equity instruments of both private and public companies. When quoted prices are available in an active market... -

Page 164

Valuations of equity instruments of private companies, which are prepared on a quarterly basis, are based on current market conditions and the current financial status of each company. A valuation analysis is performed to value each investment. The valuation analysis is reviewed by the Principal ... -

Page 165

... 3. Our Market Risk Management group is responsible for the valuation policies and procedure related to this default reserve. A weekly reconciliation process is performed to ensure that all applicable derivative positions are covered in the calculation, which includes transmitting customer exposures... -

Page 166

...account securities Commercial loans Total trading account assets Securities available for sale: States and political subdivisions Collateralized mortgage obligations Other mortgage-backed securities Other securities Total securities available for sale Other investments: Principal investments: Direct... -

Page 167

...account securities Commercial loans Total trading account assets Securities available for sale: States and political subdivisions Collateralized mortgage obligations Other mortgage-backed securities Other securities Total securities available for sale Other investments: Principal investments: Direct... -

Page 168

... Earnings Unrealized Gains (Losses) Included in Earnings in millions Year ended December 31, 2013 Trading account assets Other mortgage-backed securities Other securities State and political subdivisions Other investments Principal investments Direct Indirect Equity and mezzanine investments Direct... -

Page 169

...a quarterly basis, based on current borrower developments, market conditions and collateral values. The following two internal methods are used to value impaired loans: / Cash flow analysis considers internally developed inputs, such as discount rates, default rates, costs of foreclosure and changes... -

Page 170

...3 assets. Direct financing leases and operating lease assets held for sale. Our KEF Accounting and Capital Markets groups are responsible for the valuation policies and procedures related to these assets. The Managing Director of the KEF Capital Markets group reports to the President of the KEF line... -

Page 171

...The Asset Management team within our Risk Operations group is responsible for valuation policies and procedures in this area. The current vendor partner provides monthly reporting of all broker price opinion evaluations, appraisals and the monthly market plans. Market plans are reviewed monthly, and... -

Page 172

... ASSETS Cash and short-term investments (a) Trading account assets (b) Securities available for sale (b) Held-to-maturity securities (c) Other investments (b) Loans, net of allowance (d) Loans held for sale (b) Mortgage servicing assets (e) Derivative assets (b) LIABILITIES Deposits with no stated... -

Page 173

... ASSETS Cash and short-term investments (a) Trading account assets (b) Securities available for sale (b) Held-to-maturity securities (c) Other investments (b) Loans, net of allowance (d) Loans held for sale (b) Mortgage servicing assets (e) Derivative assets (b) LIABILITIES Deposits with no stated... -

Page 174

...value of securities on the balance sheet as of the dates indicated. Accordingly, the amount of these gains and losses may change in the future as market conditions change. For more information about our securities available for sale and held-to-maturity securities and the related accounting policies... -

Page 175

... to 60 fixed-rate collateralized mortgage obligations that we invested in as part of our overall A/LM strategy. These securities have a weightedaverage maturity of 5.1 years at December 31, 2013. Since these securities have a fixed interest rate, their fair value is sensitive to movements in market... -

Page 176

... for the year ended December 31, 2013. At December 31, 2013, securities available for sale and held-to-maturity securities totaling $11.1 billion were pledged to secure securities sold under repurchase agreements, to secure public and trust deposits, to facilitate access to secured funding, and for... -

Page 177

... fixed-rate debt. We also use these swaps to manage the interest rate risk associated with anticipated sales of certain commercial real estate loans. The swaps protect against the possible short-term decline in the value of the loans that could result from changes in interest rates between the time... -

Page 178

... floating-rate debt that funds fixed-rate leases entered into by our equipment finance line of business. These swaps are designated as cash flow hedges to mitigate the interest rate mismatch between the fixed-rate lease cash flows and the floating-rate payments on the debt. We use foreign currency... -

Page 179

... the pre-tax net gains (losses) on our fair value hedges for the years ended December 31, 2013, and 2012, and where they are recorded on the income statement. Year ended December 31, 2013 Income Statement Location of Net Gains (Losses) on Derivative Other income Interest expense - Long-term debt... -

Page 180

... on the balance sheet. This amount is subsequently reclassified into income when the hedged transaction affects earnings (e.g., when we pay variable-rate interest on debt, receive variable-rate interest on commercial loans, or sell commercial real estate loans). The ineffective portion of cash flow... -

Page 181

... rate Net Investment Hedges Foreign exchange contracts Total 105 Interest income - Loans (6) Interest expense - Long-term debt - Investment banking and debt placement fees (14) $ 85 Other Income $ - 56 Other income - - The after-tax change in AOCI resulting from cash flow and net investment... -

Page 182

... rate Foreign exchange Commodity Credit Derivative assets before collateral Less: Related collateral Total derivative assets $ $ 2013 633 23 58 1 715 308 407 $ $ 2012 1,114 23 47 3 1,187 494 693 We enter into derivative transactions with two primary groups: broker-dealers and banks, and clients... -

Page 183

... of two ways if the underlying reference entity experiences a predefined credit event. We may be required to pay the purchaser the difference between the par value and the market price of the debt obligation (cash settlement) or receive the specified referenced asset in exchange for payment of the... -

Page 184

... have to make a payment under the credit derivative contracts. 2013 December 31, dollars in millions Single-name credit default swaps Traded credit default swap indices Other Total credit derivatives sold $ Notional Amount 55 - 13 68 Average Term (Years) .77 - 5.03 - Payment / Performance Risk 22.28... -

Page 185

... regarding this acquisition. The fair value of mortgage servicing assets is determined by calculating the present value of future cash flows associated with servicing the loans. This calculation uses a number of assumptions that are based on current market conditions. The range and weighted-average... -

Page 186

... assets acquired in a business combination exceeds their fair value. Other intangible assets are primarily the net present value of future economic benefits to be derived from the purchase of credit card receivable assets and core deposits. Additional information pertaining to our accounting policy... -

Page 187

... accelerated basis over its useful life of 8 years. As a result of the purchase of Key-branded credit card assets from Elan Financial Services, Inc. on August 1, 2012, a PCCR intangible asset was recognized at its acquisition date fair value of $135 million. This PCCR asset is being amortized on an... -

Page 188

... losses or residual returns, even though we do not have the power to direct the activities that most significantly impact the entity's economic performance. Consolidated VIEs in millions December 31, 2013 LIHTC funds Education loan securitization trusts LIHTC investments Total Assets $ 22 1,980... -

Page 189

... not formed nonguaranteed funds since October 2003. LIHTC investments. Through Key Community Bank, we have made investments directly in LIHTC operating partnerships formed by third parties. As a limited partner in these operating partnerships, we are allocated tax credits and deductions associated... -

Page 190

... Income taxes included in the income statement are summarized below. We file a consolidated federal income tax return. Year ended December 31, in millions Currently payable: Federal State Total currently payable Deferred: Federal State Total deferred Total income tax (benefit) expense (a) $ $ 2013... -

Page 191

...investments Foreign tax adjustments Reduced tax rate on lease financing income Tax-exempt interest income Corporate-owned life insurance income Increase (decrease) in tax reserves Interest refund (net of federal tax benefit) State income tax, net of federal tax benefit Tax credits Other Total income... -

Page 192

... million in the Community Bank reporting unit. Western New York Branches. On July 13, 2012, we acquired 37 retail banking branches in Western New York. This acquisition was accounted for as a business combination. The acquisition date fair value of the assets and deposits acquired was approximately... -

Page 193

...of our education lending business included on the balance sheet are as follows: December 31, in millions Trust loans at fair value Portfolio loans at fair value Loans, net of unearned income of ($6) and ($5) Less: Allowance for loan and lease losses Net loans Trust accrued income and other assets at... -

Page 194

... the line of business, Credit and Market Risk Management, Accounting, Business Finance (part of our Finance area), and Corporate Treasury. The Working Group is a subcommittee of the Fair Value Committee that is discussed in more detail in Note 6 ("Fair Value Measurements"). The Working Group reviews... -

Page 195

... similar student loans and asset-backed securities and are developed by the consultant using market-based data. On a quarterly basis, the Working Group reviews the discount rate inputs used in the valuation process for reasonableness. A quarterly variance analysis reconciles valuation changes in the... -

Page 196

... the consolidated trusts' assets and liabilities at fair value and the portfolio loans at fair value and their related contractual values as of December 31, 2013, and 2012. December 31, 2013 in millions ASSETS Portfolio loans Trust loans Trust other assets LIABILITIES Trust securities Trust other... -

Page 197

... 26 2,552 $ Total 157 2,369 26 2,552 $ $ - - - - - - $ $ 2,159 22 2,181 $ $ 2,159 22 2,181 The following table shows the change in the fair values of the Level 3 consolidated education loan securitization trusts and portfolio loans for the years ended December 31, 2013, and 2012. Portfolio... -

Page 198

... one-year probability of default for similar risk-rated loans calculated under our internal risk rating system and credit policy. The discount rate used for the Seller note at December 31, 2013, was 13.25%. A Mergers & Acquisitions Working Group, which is a subcommittee of the Fair Value Committee... -

Page 199

... that specialized in managing hedge fund investments for institutional customers. As a result, we have accounted for this business as a discontinued operation. The results of this discontinued business are included in "income (loss) from discontinued operations, net of taxes" on the income statement... -

Page 200

...: Allowance for loan and lease losses Net loans Trust accrued income and other assets at fair value Accrued income and other assets Total assets Trust accrued expense and other liabilities at fair value Accrued expense and other liabilities Trust securities at fair value Total liabilities $ 2013 20... -

Page 201

...securities financing agreements as of December 31, 2013, and 2012: December 31, 2013 Gross Amount Presented in Balance Sheet $ $ 347 12 359 Netting Adjustments $ $ (278) - (278) Net Amounts $ - $ 3 3 in millions Offsetting of financial assets: Reverse repurchase agreements Securities borrowed Total... -

Page 202

... which may not be denominated or payable in or valued by reference to our common shares or other factors, discounted stock purchases, and deferred compensation to eligible employees and directors. At December 31, 2013, we had 89,016,390 common shares available for future grant under our compensation... -

Page 203

... Our Long-Term Incentive Compensation Program (the "Program") rewards senior executives critical to our longterm financial success. Awards are granted annually in a variety of forms: / / / / deferred cash payments that generally vest at the rate of 25% per year; time-lapsed restricted stock units... -

Page 204

...the closing price of our common shares on the deferral date. We did not pay any stock-based liabilities during 2013, 2012, or 2011. The following table summarizes activity and pricing information for the nonvested shares in our deferred compensation plans for the year ended December 31, 2013. Number... -

Page 205

... accruals and close the plans to new employees. We will continue to credit participants' existing account balances for interest until they receive their plan benefits. We changed certain pension plan assumptions after freezing the plans. Pre-tax AOCI not yet recognized as net pension cost was $529... -

Page 206

... changes in the FVA. Year ended December 31, in millions FVA at beginning of year Actual return on plan assets Employer contributions Benefit payments FVA at end of year $ 2013 942 $ 119 18 (109) 970 $ 2012 918 92 16 (84) 942 $ The following table summarizes the funded status of the pension plans... -

Page 207

... were in 2013 due to the 2013 settlement loss. We determine the expected return on plan assets using a calculated market-related value of plan assets that smoothes what might otherwise be significant year-to-year volatility in net pension cost. Changes in the value of plan assets are not recognized... -

Page 208

... the pension funds' investment policies. Target Allocation 2013 46 % 28 5 21 100 % Asset Class Equity securities Fixed income securities Convertible securities Other assets Total Equity securities include common stocks of domestic and foreign companies, as well as foreign company stocks traded as... -

Page 209

... Fixed income - International Collective investment funds: U.S. equity International equity Convertible securities Fixed income securities Short-term investments Emerging markets Real assets Insurance investment contracts and pooled separate accounts Other assets Total net assets at fair value Level... -

Page 210

...- U.S. Fixed Income - International Collective investment funds: U.S. equity International equity Convertible securities Fixed income securities Short-term investments Emerging markets Real assets Insurance investment contracts and pooled separate accounts Other assets Total net assets at fair value... -

Page 211

... Balance Pension Plan; and (iii) Key employees who otherwise were provided a historical death benefit at the time of their termination. The death benefit plan was noncontributory, and was funded by a separate VEBA trust. In the fourth quarter of 2012, we used the assets of the VEBA trust to purchase... -

Page 212

...benefit cost, we assumed the following weighted-average rates. Year ended December 31, Discount rate Expected return on plan assets 2013 3.50% 5.25 2012 4.00% 5.58 2011 4.75% 5.45 The realized net investment income for the postretirement healthcare plan VEBA trust is subject to federal income taxes... -

Page 213

... by the trust's investment policy. Target Allocation Range 2013 70 - 90% 0 - 10 0 - 10 10 - 30 Asset Class Equity securities Fixed income securities Convertible securities Cash equivalents and other assets Investments consist of mutual funds and common investment funds that invest in underlying... -

Page 214

...Education Reconciliation Act of 2010, which were both signed into law in March 2010, changed the tax treatment of the federal subsidies described above. As a result of these laws, these subsidy payments become taxable in tax years beginning after December 31, 2012. The accounting guidance applicable... -

Page 215

... (e) 6.95% Subordinated notes due 2028 (e) Lease financing debt due through 2016 (f) Secured borrowing due through 2018 (g) Federal Home Loan Bank advances due through 2036 (h) Investment Fund Financing due through 2052 (i) Total subsidiaries Total long-term debt 2013 $ 2,553 162 103 133 2,951 1,858... -

Page 216

... from the related receivables. Additional information pertaining to these commercial lease financing receivables is included in Note 4 ("Loans and Loans Held for Sale"). (h) Long-term advances from the Federal Home Loan Bank had weighted-average interest rates of 3.47% at December 31, 2013, and 1.09... -

Page 217

...Term Debt on the balance sheet. (c) The interest rates for the trust preferred securities issued by KeyCorp Capital II and KeyCorp Capital III are fixed. KeyCorp Capital I has a floating interest rate, equal to three-month LIBOR plus 74 basis points, that reprices quarterly. The total interest rates... -

Page 218

... real estate and construction Home equity Credit cards Total loan commitments When-issued and to be announced securities commitments Commercial letters of credit Principal investing commitments Liabilities of certain limited partnerships and other commitments Total loan and other commitments 2013... -

Page 219

... federal securities laws and ERISA, were consolidated into one action styled In re Austin Capital Management, Ltd., Securities & Employee Retirement Income Security Act (ERISA) Litigation, pending in the United States District Court for the Southern District of New York. The KeyCorp defendants filed... -

Page 220

...the collateral. Return guarantee agreement with LIHTC investors. KAHC, a subsidiary of KeyBank, offered limited partnership interests to qualified investors. Partnerships formed by KAHC invested in low-income residential rental properties that qualify for federal low income housing tax credits under... -

Page 221

...are required to make payments to the counterparty (the client) based on changes in an underlying variable that is related to an asset, a liability, or an equity security that the client holds. We are obligated to pay the client if the applicable benchmark interest rate or commodity price is above or... -

Page 222

... for the year ended December 31, 2013, are as follows: Unrealized gains (losses) on available for sale securities $ 229 (291) Unrealized gains (losses) on derivative financial instruments $ 18 6 Foreign currency translation adjustment $ 55 (9) Net pension and postretirement benefit costs $(426) 78... -

Page 223

...to be executed through the first quarter of 2014. In addition, we completed $65 million of common share repurchases in the first quarter of 2013 under our 2012 capital plan for a total of $474 million of open market common share repurchases during 2013. Capital Adequacy KeyCorp and KeyBank must meet... -

Page 224

... credit products, and business advisory services. Mid-sized businesses are provided products and services that include commercial lending, cash management, equipment leasing, investment and employee benefit programs, succession planning, access to capital markets, derivatives, and foreign exchange... -

Page 225

... equity capital markets, commercial payments, equipment finance, commercial mortgage banking, derivatives, foreign exchange, financial advisory and public finance. Key Corporate Bank is also a significant servicer of commercial mortgage loans and a significant special servicer of CMBS. Key Corporate... -

Page 226

...(b) Loans and leases Total assets (a) Deposits OTHER FINANCIAL DATA Expenditures for additions to long-lived assets (a), (b) Net loan charge-offs (b) Return on average allocated equity (b) Return on average allocated equity Average full-time equivalent employees (c) $ $ Key Community Bank 2013 1,425... -

Page 227

...100 250 (10) 260 - 260 4 256 $ $ 2011 61 238 299 (5) 18 95 191 (30) 221 - 221 12 209 $ $ 2013 2,347 1,769 4,116 129 125 2,596 1,266 357 909 - 909 - 909 Total...) 1 (35) (34) - (34) $ $ 2013 2,348 1,766 4,114 130 259 2,561 1,164 294 870 40 910 - 910 $ $ Key 2012 2,288 1,856 4,144 229 250 2,568 1,097 ... -

Page 228

24. Condensed Financial Information of the Parent Company CONDENSED BALANCE SHEETS December 31, in millions ASSETS Cash and due from banks and interest-bearing deposits Loans and advances to: Banks Nonbank subsidiaries Total loans and advances Investment in subsidiaries: Banks Nonbank subsidiaries ... -

Page 229

... in loans and advances to subsidiaries Net (increase) decrease in investments in subsidiaries NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES FINANCING ACTIVITIES Net proceeds from issuance of long-term debt Payments on long-term debt Repurchase of Treasury Shares Series B Preferred Stock - TARP... -

Page 230

... Exchange Act) during the last fiscal quarter that materially affected, or are reasonably likely to materially affect, KeyCorp's internal control over financial reporting. Management's Annual Report on Internal Control over Financial Reporting, the Report of Independent Registered Public Accounting... -

Page 231

...Executive Officers" "Ownership of KeyCorp Equity Securities - Section 16(a) Beneficial Ownership Reporting Compliance" "Corporate Governance Documents - Code of Ethics" "Audit Matters - Audit Committee Independence and Financial Experts" KeyCorp expects to file the 2014 Proxy Statement with the SEC... -

Page 232

... (2014-2016). Form of Award of KeyCorp Executive Officer Grants (Award of Cash Performance Shares and Above-Target Performance Shares) (2013-2015), filed as Exhibit 10.6 to Form 10-K for the year ended December 31, 2012.* Form of Award of KeyCorp Executive Officer Grants (Award of Restricted Stock... -

Page 233

... Deferred Equity Allocation Plan filed as Exhibit 10.47 to Form 10-K for the year ended December 31, 2009.* Computation of Consolidated Ratio of Earnings to Combined Fixed Charges and Preferred Stock Dividends. Subsidiaries of the Registrant. Consent of Independent Registered Public Accounting Firm... -

Page 234

... by reference are filed with this report. Shareholders may obtain a copy of any exhibit, upon payment of reproduction costs, by writing KeyCorp Investor Relations, 127 Public Square, Mail Code OH-0127-1113, Cleveland, OH 44114-1306. KeyCorp hereby agrees to furnish the SEC upon request, copies... -

Page 235

... Officer (Principal Financial Officer) February 26, 2014 /s/ Robert L. Morris Robert L. Morris Chief Accounting Officer (Principal Accounting Officer) February 26, 2014 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons... -

Page 236

... OF CONSOLIDATED RATIO OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS (dollars in millions) (unaudited) Year ended December 31, 2012 2011 2010 (a) 2013 2009 (a) Computation of Earnings Net income (loss) attributable to Key Add: Provision for income taxes Less: Income (loss... -

Page 237

... States Subsidiaries (a) KeyBank National Association Parent Company KeyCorp (a) Subsidiaries of KeyCorp other than KeyBank National Association are not listed above since, in the aggregate, they would not constitute a significant subsidiary. KeyBank National Association is 100% owned by KeyCorp... -

Page 238

... of KeyCorp of our reports dated February 26, 2014, with respect to the consolidated financial statements of KeyCorp and the effectiveness of internal control over financial reporting of KeyCorp, included in this Annual Report (Form 10-K) of KeyCorp for the year ended December 31, 2013: Form S-3 No... -

Page 239

[THIS PAGE LEFT INTENTIONALLY BLANK.] -

Page 240

... report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Date: February 26, 2014 Beth E. Mooney Chairman, Chief Executive Officer and President -

Page 241

..., process, summarize and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Date: February 26, 2014 Donald R. Kimble Chief Financial Officer -

Page 242

...as applicable, of the Securities Exchange Act of 1934 and that the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: February 26, 2014 Beth E. Mooney Chairman, Chief Executive Officer and President... -

Page 243

... as applicable, of the Securities Exchange Act of 1934 and that the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: February 26, 2014 Donald R. Kimble Chief Financial Officer A signed original... -

Page 244

... personal and business success. To employees Together, we have a strong sense of community where each one of us has the opportunity for personal growth, to do work that matters, and work in a place where results are rewarded. Our strategy: Key grows by building enduring relationships through client... -

Page 245

127 Public Square Cleveland, OH 44114-1306 key.com ©2014 KeyCorp KeyBank is Member FDIC ADP1162 001CSN14E6 Form No. 77-7700KC