Johnson and Johnson 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Johnson and Johnson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

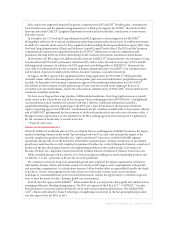

Medical Devices and Diagnostics Segment

The Medical Devices and Diagnostics segment achieved sales of $27.4 billion in 2012, representing an increase of 6.4%

over the prior year, with operational growth of 8.7% and a negative currency impact of 2.3%. U.S. sales were $12.4 billion,

an increase of 8.7% as compared to the prior year. International sales were $15.1 billion, an increase of 4.5% over the

prior year, with operational growth of 8.6% and a negative currency impact of 4.1%. The acquisition of Synthes, Inc., net of

the related divestiture, increased both total sales growth and operational growth for the Medical Devices and Diagnostics

segment by 7.9%.

Major Medical Devices and Diagnostics Franchise Sales:*

% Change

(Dollars in Millions) 2012 2011 2010 ’12 vs. ’11 ’11 vs. ’10

Orthopaedics $7,799 5,809 5,585 34.3% 4.0

Surgical Care 6,483 6,637 6,272 (2.3) 5.8

Vision Care 2,996 2,916 2,680 2.7 8.8

Diabetes Care 2,616 2,652 2,470 (1.4) 7.4

Specialty Surgery 2,526 2,407 2,186 4.9 10.1

Diagnostics 2,069 2,164 2,053 (4.4) 5.4

Cardiovascular Care 1,985 2,288 2,552 (13.2) (10.3)

Infection Prevention/Other 952 906 803 5.1 12.8

Total Medical Devices and Diagnostics Sales $27,426 25,779 24,601 6.4% 4.8

* Prior year amounts have been reclassified to conform to current year presentation.

The Orthopaedics franchise achieved sales of $7.8 billion in 2012, a 34.3% increase over the prior year. Growth was

primarily due to sales of newly acquired products from Synthes, Inc., and sales of joint reconstruction and Mitek sports

medicine products. Sales were impacted by the divestitures of the surgical instruments business of Codman & Shurtleff,

Inc., in the fiscal fourth quarter of 2011, and the divestiture of certain rights and assets related to the DePuy trauma

business. The positive impact on the Orthopaedics franchise total sales growth and operational growth due to the newly

acquired products from Synthes, Inc. net of the related trauma business divestiture was 34.7%.

The Surgical Care franchise sales were $6.5 billion in 2012, a decrease of 2.3% from the prior year. Lower sales of

mechanical, breast care and pelvic floor products were partially offset by increased sales of sutures and endoscopy

products with the success of the ECHELON FLEX™ powered ENDOPATH®Stapler.

The Vision Care franchise achieved sales of $3.0 billion in 2012, a 2.7% increase over the prior year. The growth was

driven by ACUVUE®TruEye®, 1-DAY ACUVUE®MOIST®for Astigmatism and 1-DAY ACUVUE®MOIST®.

The Diabetes Care franchise sales were $2.6 billion, a decrease of 1.4% versus the prior year. Sales growth in Asia and

Latin America was offset by the negative impact of currency.

The Specialty Surgery franchise achieved sales of $2.5 billion in 2012, a 4.9% increase over the prior year. Incremental

sales from the acquisition of SterilMed Inc., sales of biosurgery products and international sales of energy products were

the major contributors to the growth.

The Diagnostics franchise sales were $2.1 billion, a decline of 4.4% versus the prior year. The decline was primarily due to

lower sales in donor screening due to competitive pressures, and the divestiture of the RhoGAM®business during the

third quarter of 2012. In January 2013, the Company announced it is exploring strategic alternatives for the Ortho-Clinical

Diagnostics business, including a possible divestiture.

The Cardiovascular Care franchise sales were $2.0 billion, a decline of 13.2% versus the prior year. Sales were impacted

by the Company’s decision to exit the drug-eluting stent market in the second quarter of 2011, and lower sales of

endovascular products, impacted by competitive launches and a disruption in supply that was resolved late in the third

quarter. The decline in sales was partially offset by strong growth in Biosense Webster’s electrophysiology business

primarily due to the success of the THERMOCOOL®catheter launches.

The Infection Prevention/Other franchise achieved sales of $1.0 billion in 2012, a 5.1% increase over the prior year

primarily due to growth in the advanced sterilization business.

Johnson & Johnson 2012 Annual Report •7