John Deere 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

The company’s balance sheet has remained strong. At

year-end, Deere carried some $5 billion of cash and securities.

Our equipment operations had relatively low debt, while

nancial services continued to be conservatively capitalized.

BROAD LINEUP MAKING IMPACT

Although results were down, the Agriculture & Turf (A&T) division

remained solidly protable, with operating margins near

14 percent. This performance was achieved in spite of a sharp

decline in sales of some of our most protable models of farm

machinery. Further, Deere’s largest division brought important

products to market and continued to broaden its customer base.

In other businesses, Construction & Forestry (C&F) rebounded

strongly. It was helped by a recovering U.S. economy, an improved

market for forestry products, and an expanded product lineup.

Of signicance, the division started up two new factories in Brazil,

one with joint-venture partner Hitachi. The nation is expected

to play a central role in C&F’s growth ambitions.

Deere’s nancial-services unit posted record prots while

providing competitive nancing to our equipment customers.

Net income climbed to $624 million as the loan and lease portfolio

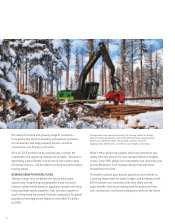

Setting new productivity standards, the 617-horsepower

8600 forage harvester meets the challenging requirements of

commercial-scale operations and contractors. Real-time

crop monitoring works in both corn and grass, an industry exclusive.

grew by more than $3 billion. Credit quality remained strong

with the provision for loss equaling less than one dollar for each

$1,000 of portfolio value. Over many years, Financial Services

has proved to be a reliable source of prots and a major driver

of John Deere equipment sales.

PIVOTAL YEAR AHEAD

While the company is well-positioned for long-term success,

2015 is likely to be a year of challenge. Our nancial forecast is

calling for a signicant reduction in sales and earnings, driven by

sharply lower demand for agricultural equipment, especially

larger, more protable models.

Despite the prospect of lower results, we do not view next year’s

outlook as discouraging. That the company expects to remain

solidly protable in the face of such a slowdown speaks to the

impact of our aggressive actions to control costs and assets

and balance factory production with demand. It also shows

the value of having a well-rounded business lineup that serves