John Deere 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

A&T SETTING PACE

Our performance was led by the Agriculture & Turf division (A&T),

which had another banner year. Deere’s largest division brought

advanced new products to market, broadened its customer

base, and reinforced its preeminent position in key markets.

A&T results were aided by positive farm conditions and higher

sales of large equipment, particularly in the United States.

In other businesses, Construction & Forestry (C&F) continued

a turnaround with operating profit climbing 21 percent on a sales

increase of 19 percent. Division sales have risen well over two-fold

since 2009. C&F introduced advanced new products, continued

its expansion into new geographies and gained market share in

key product categories.

Deere’s financial services organization delivered solid profits while

providing competitive financing to our equipment customers on

an increasingly global scale. Although net earnings declined slightly

from 2011 record levels, the loan portfolio grew by about $4 billion.

Credit quality remained exceptionally strong, with the provision

for loss declining to a negligible amount.

Investors shared in our success of 2012. Stockholders realized a

total return of about 15 percent for the fiscal year compared with

a slight decline for the overall U.S. equity market. Deere common-

stock dividends totaled about $700 million, a record, while share

repurchases of $1.6 billion were completed. Since mid-2004, the

company has increased the quarterly dividend rate on 10 occasions

and repurchased about 160 million shares of stock.

POWERFUL TRENDS DRIVING PLANS

Despite persistent global economic concerns, longer-term trends

based on population growth and rising living standards remain

quite powerful. It is widely believed that agricultural output will

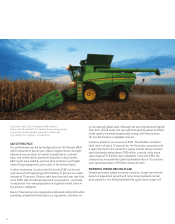

Launched in early 2012, the agship S690 Combine

(shown with 18-row 618C Corn Head) is finding strong demand

in large-farm markets globally, especially in regions with

high-yielding corn, soybeans, or small grains.