John Deere 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

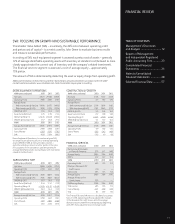

Equipment Operations outside U.S. and Canada

The equipment operations outside the U.S. and Canada had

an operating profit of $561 million in 2012, compared with

$941 million in 2011. The decrease was primarily due to higher

production and raw material costs, the unfavorable effects of

foreign currency exchange, increased selling, administrative and

general expenses and higher research and development expenses,

partially offset by the effects of higher shipment volumes and

improved price realization. Net sales were 5 percent higher

primarily reflecting increased shipment volumes and price

realization, partially offset by the effect of foreign currency

translation. The physical volume of sales increased 7 percent,

compared with 2011.

MARKET CONDITIONS AND OUTLOOK

Company equipment sales are projected to increase by about

5 percent for fiscal year 2013 and about 10 percent for the first

quarter, compared with the same periods of 2012. For fiscal year

2013, net income attributable to Deere & Company is anticipated

to be approximately $3.2 billion.

Agriculture and Turf.

The company’s worldwide sales of

agriculture and turf equipment are forecast to increase by about

4 percent for fiscal year 2013. Relatively high commodity

prices and strong farm incomes are expected to continue

supporting a favorable level of demand for farm machinery

during the year. The company’s sales are expected to benefit

from global expansion and lines of advanced new equipment.

Industry sales for agricultural machinery in the U.S. and

Canada are forecast to be about the same for 2013 in relation

to the prior year’s healthy levels. Caution around the U.S.

livestock and dairy sectors is expected to offset continued

strength in demand for large equipment, such as high horse-

power tractors.

Fiscal year industry sales in the EU27 are forecast to be

about the same to 5 percent lower due to continuing deteriora-

tion in the overall economy and a poor harvest in the U.K.

Sales in the Commonwealth of Independent States are expected

to be modestly higher in 2013. In South America, industry sales

are projected to increase about 10 percent as a result of favor-

able commodity prices and increased planting intentions.

Industry sales in Asia are projected to be approximately the

same as 2012 due to softer economic conditions in India and

China.

U.S. and Canada industry sales of turf and utility

equipment are expected to increase about 5 percent for

2013, reflecting some improvement in the U.S. economy.

The company’s sales are expected to increase more than the

industry due to the impact of new products.

Construction and Forestry.

The company’s worldwide sales

of construction and forestry equipment are forecast to increase

by about 8 percent for fiscal year 2013 due in part to modest

improvement in U.S. economic conditions. Sales in world

forestry markets are projected to be about the same for the

year as further weakness in European markets offsets stronger

demand in the U.S.

Financial Services.

Fiscal year 2013 net income attributable

to Deere & Company for the financial services operations is

expected to be approximately $500 million. The forecast

improvement is primarily due to expected growth in the credit

portfolio and lower crop insurance claims. These factors are

projected to be partially offset by an increase in the provision

for credit losses, which is anticipated to return to a more

typical level.

SAFE HARBOR STATEMENT

Safe Harbor Statement under the Private Securities Litigation Reform

Act of 1995: Statements under “Overview,” “Market

Conditions and Outlook,” and other forward-looking state-

ments herein that relate to future events, expectations, trends

and operating periods involve certain factors that are subject to

change, and important risks and uncertainties that could cause

actual results to differ materially. Some of these risks and

uncertainties could affect particular lines of business, while

others could affect all of the company’s businesses.

The company’s agricultural equipment business is subject

to a number of uncertainties including the many interrelated

factors that affect farmers’ confidence. These factors include

worldwide economic conditions, demand for agricultural

products, world grain stocks, weather conditions (including its

effects on timely planting and harvesting), soil conditions

(including low subsoil moisture from recent drought conditions),

harvest yields, prices for commodities and livestock, crop and

livestock production expenses, availability of transport for crops,

the growth of non-food uses for some crops (including ethanol

and biodiesel production), real estate values, available acreage

for farming, the land ownership policies of various govern-

ments, changes in government farm programs and policies

(including those in Argentina, Brazil, China, the European

Union, India, Russia and the U.S.), international reaction

to such programs, changes in and effects of crop insurance

programs, global trade agreements, animal diseases and their

effects on poultry, beef and pork consumption and prices,

crop pests and diseases, and the level of farm product exports

(including concerns about genetically modified organisms).

Factors affecting the outlook for the company’s turf

and utility equipment include general economic conditions,

consumer confidence, weather conditions, customer profitabil-

ity, consumer borrowing patterns, consumer purchasing

preferences, housing starts, infrastructure investment, spending

by municipalities and golf courses, and consumable input costs.

14