John Deere 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

RESULTS OF OPERATIONS FOR THE YEARS ENDED

OCTOBER 31, 2012, 2011 AND 2010

OVERVIEW

Organization

The company’s equipment operations generate revenues and

cash primarily from the sale of equipment to John Deere dealers

and distributors. The equipment operations manufacture and

distribute a full line of agricultural equipment; a variety of

commercial, consumer and landscapes equipment and products;

and a broad range of equipment for construction and forestry.

The company’s financial services primarily provide credit

services, which mainly finance sales and leases of equipment by

John Deere dealers and trade receivables purchased from the

equipment operations. In addition, financial services offer crop

risk mitigation products and extended equipment warranties.

The information in the following discussion is presented in a

format that includes information grouped as consolidated,

equipment operations and financial services. The company also

views its operations as consisting of two geographic areas, the

U.S. and Canada, and outside the U.S. and Canada. The

company’s operating segments consist of agriculture and turf,

construction and forestry, and financial services.

Trends and Economic Conditions

The company’s agriculture and turf equipment sales increased

13 percent in 2012 and are forecast to increase by about 4

percent for 2013. Industry agricultural machinery sales in the

U.S. and Canada for 2013 are forecast to remain approximately

the same, compared to healthy levels in 2012. Industry sales in

the European Union (EU)27 nations of Western and Central

Europe are forecast to be about the same to 5 percent lower in

2013, while sales in the Commonwealth of Independent States

are expected to be modestly higher. South American industry

sales are projected to increase approximately 10 percent in

2013. Industry sales in Asia are forecast to be about the same in

2013. Industry sales of turf and utility equipment in the U.S.

and Canada are expected to increase approximately 5 percent.

The company’s construction and forestry sales increased 19

percent in 2012 and are forecast to increase by about 8 percent

in 2013. Sales in world forestry markets are expected to be

approximately the same in 2013. Net income of the company’s

financial services operations attributable to Deere & Company

in 2013 is expected to be approximately $500 million.

Items of concern include the uncertainty of the effective-

ness of governmental actions in respect to monetary and fiscal

policies, the global economic recovery, the impact of sovereign

and state debt, capital market disruptions, trade agreements, the

availability of credit for the company’s customers and suppliers,

and financial regulatory reform. Drought conditions and

significant volatility in the price of many commodities could

also impact the company’s results. The availability of certain

components that could impact the company’s ability to meet

production schedules continues to be monitored. Designing and

producing products with engines that continue to meet high

performance standards and increasingly stringent emissions

regulations is one of the company’s major priorities.

The company remains well positioned to carry out its

growth plans and capitalize on positive long-term trends.

With support from employees, dealers and suppliers, the

company’s plans for helping meet the world’s growing need for

food and infrastructure are moving ahead successfully.

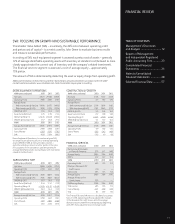

2012 COMPARED WITH 2011

CONSOLIDATED RESULTS

Worldwide net income attributable to Deere & Company in

2012 was $3,065 million, or $7.63 per share diluted ($7.72

basic), compared with $2,800 million, or $6.63 per share

diluted ($6.71 basic), in 2011. Net sales and revenues increased

13 percent to $36,157 million in 2012, compared with $32,013

million in 2011. Net sales of the equipment operations

increased 14 percent in 2012 to $33,501 million from $29,466

million last year. The sales increase included improved price

realization of 4 percent and an unfavorable foreign currency

translation effect of 3 percent. Net sales in the U.S. and Canada

increased 20 percent in 2012. Net sales outside the U.S. and

Canada increased by 5 percent in 2012, which included an

unfavorable effect of 6 percent for foreign currency translation.

Worldwide equipment operations had an operating profit

of $4,397 million in 2012, compared with $3,839 million in

2011. The higher operating profit was primarily due to the

impact of improved price realization and higher shipment

volumes, partially offset by higher production and raw material

costs, unfavorable effects of foreign currency exchange,

increased research and development expenses, higher selling,

administrative and general expenses and a goodwill impairment

charge (see Note 5). The increase in production costs related to

new products, engine emission requirements and incentive

compensation expenses.

The equipment operations’ net income was $2,616 million

in 2012, compared with $2,329 million in 2011. The same

operating factors mentioned above, as well as an increase in

the effective tax rate and interest expense affected these results.

Net income of the financial services operations attribut-

able to Deere & Company in 2012 decreased to $460 million,

compared with $471 million in 2011. The decrease was primarily

a result of increased selling, administrative and general expenses,

higher reserves for crop insurance claims and narrower financing

spreads, partially offset by growth in the credit portfolio and a

lower provision for credit losses. Additional information is

presented in the following discussion of the “Worldwide

Financial Services Operations.”

The cost of sales to net sales ratio for 2012 was 74.6 percent,

compared with 74.4 percent last year. The increase was primarily

due to higher production costs, increased raw material costs and

unfavorable effects of foreign currency exchange, partially offset

by improved price realization.

12