John Deere 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

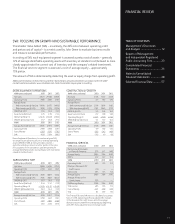

Worldwide Financial Services Operations

The operating profit of the financial services segment was

$725 million in 2011, compared with $499 million in 2010.

The increase in operating profit was primarily due to growth

in the credit portfolio and a lower provision for credit losses,

partially offset by narrower financing spreads. Results in 2010

were also affected by the write-down of wind energy assets that

were held for sale (see Note 4). Total revenues of the financial

services operations, including intercompany revenues, increased

3 percent in 2011, primarily reflecting the larger portfolio.

The average balance of receivables and leases financed was 13

percent higher in 2011, compared with 2010. Interest expense

decreased 7 percent in 2011 as a result of lower average

borrowing rates, partially offset by higher average borrowings.

The financial services operations’ ratio of earnings to fixed

charges was 2.22 to 1 in 2011, compared with 1.77 to 1 in 2010.

Equipment Operations in U.S. and Canada

The equipment operations in the U.S. and Canada had an

operating profit of $2,898 million in 2011, compared with

$2,302 million in 2010. The increase was due to higher

shipment volumes and improved price realization, partially

offset by increased raw material costs, higher manufacturing

overhead costs related to new products, increased selling,

administrative and general expenses and higher research and

development expenses. Net sales increased 17 percent primarily

due to higher shipment volumes and improved price realization.

The physical volume of sales increased 12 percent, compared

with 2010.

Equipment Operations outside U.S. and Canada

The equipment operations outside the U.S. and Canada had

an operating profit of $941 million in 2011, compared with

$607 million in 2010. The increase was primarily due to the

effects of higher shipment volumes and improved price

realization, partially offset by higher raw material costs, higher

manufacturing overhead costs related to new products, increased

selling, administrative and general expenses and higher research

and development costs. Net sales were 38 percent higher

primarily reflecting increased volumes and the effect of foreign

currency translation. The physical volume of sales increased 30

percent, compared with 2010.

CAPITAL RESOURCES AND LIQUIDITY

The discussion of capital resources and liquidity has been

organized to review separately, where appropriate, the company’s

consolidated totals, equipment operations and financial services

operations.

CONSOLIDATED

Positive cash flows from consolidated operating activities in

2012 were $1,168 million. This resulted primarily from net

income adjusted for non-cash provisions and an increase in

accounts payable and accrued expenses, which were partially

offset by an increase in trade receivables, inventories and

insurance receivables. Cash outflows from investing activities

were $4,004 million in 2012, primarily due to the cost of

receivables (excluding receivables related to sales) and equip-

ment on operating leases exceeding the collections of

receivables and the proceeds from sales of equipment on

operating leases by $2,076 million, purchases of property and

equipment of $1,319 million and purchases exceeding maturi-

ties and sales of marketable securities by $682 million. Cash

inflows from financing activities were $3,880 million in 2012

primarily due to an increase in borrowings of $6,141 million,

partially offset by repurchases of common stock of $1,588

million and dividends paid of $698 million. Cash and cash

equivalents increased $1,005 million during 2012.

Over the last three years, operating activities have

provided an aggregate of $5,776 million in cash. In addition,

increases in borrowings were $8,050 million, proceeds from

sales of businesses were $976 million, proceeds from issuance

of common stock (resulting from the exercise of stock options)

were $360 million. The aggregate amount of these cash flows

was used mainly to acquire receivables (excluding receivables

related to sales) and equipment on operating leases that

exceeded collections of receivables and the proceeds from sales

of equipment on operating leases by $5,199 million, repurchase

common stock of $3,614 million, purchase property and

equipment of $3,138 million, pay dividends of $1,775 million

and purchase marketable securities that exceeded proceeds from

maturities and sales by $1,261 million. Cash and cash equiva-

lents remained approximately the same as three years ago.

Given the continued uncertainty in the global economy,

there has been a reduction in liquidity in some global markets

that continues to affect the funding activities of the company.

However, the company has access to most global markets at a

reasonable cost and expects to have sufficient sources of global

funding and liquidity to meet its funding needs. The company’s

exposures to receivables from customers in European countries

experiencing economic strains are not significant. Sources of

liquidity for the company include cash and cash equivalents,

marketable securities, funds from operations, the issuance of

commercial paper and term debt, the securitization of retail

notes (both public and private markets) and committed and

uncommitted bank lines of credit. The company’s commercial

paper outstanding at October 31, 2012 and 2011 was $1,207

million and $1,279 million, respectively, while the total cash

and cash equivalents and marketable securities position was

$6,123 million and $4,435 million, respectively. The amount

of the total cash and cash equivalents and marketable securities

held by foreign subsidiaries, in which earnings are considered

indefinitely reinvested, was $628 million and $720 million at

October 31, 2012 and 2011, respectively.

17