John Deere 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

after-tax, respectively. The charges were associated with a

reporting unit included in the agriculture and turf operating

segment. The key factor contributing to the impairments was a

decline in the reporting unit’s forecasted financial performance

(see Note 5).

A 10 percent decrease in the estimated fair value of the

company’s other reporting units would have had no impact on

the carrying value of goodwill at the annual measurement date

in 2012.

Allowance for Credit Losses

The allowance for credit losses represents an estimate of

the losses expected from the company’s receivable portfolio.

The level of the allowance is based on many quantitative

and qualitative factors, including historical loss experience

by product category, portfolio duration, delinquency trends,

economic conditions and credit risk quality. The adequacy

of the allowance is assessed quarterly. Different assumptions or

changes in economic conditions would result in changes to the

allowance for credit losses and the provision for credit losses.

The total allowance for credit losses at October 31, 2012,

2011 and 2010 was $243 million, $269 million and $296 million,

respectively. The decreases in 2012 and 2011 were primarily

due to decreases in loss experience.

The assumptions used in evaluating the company’s

exposure to credit losses involve estimates and significant

judgment. The historical loss experience on the receivable

portfolio represents one of the key assumptions involved in

determining the allowance for credit losses. Over the last five

fiscal years, this percent has varied by an average of approxi-

mately plus or minus .23 percent, compared to the average

loss experience percent during that period. Holding other

assumptions constant, if this estimated loss experience on the

receivable portfolio were to increase or decrease .23 percent,

the allowance for credit losses at October 31, 2012 would

increase or decrease by approximately $70 million.

Operating Lease Residual Values

The carrying value of equipment on operating leases is affected

by the estimated fair values of the equipment at the end of the

lease (residual values). Upon termination of the lease, the

equipment is either purchased by the lessee or sold to a third

party, in which case the company may record a gain or a loss

for the difference between the estimated residual value and the

sales price. The residual values are dependent on current

economic conditions and are reviewed quarterly. Changes in

residual value assumptions would affect the amount of deprecia-

tion expense and the amount of investment in equipment on

operating leases.

The total operating lease residual values at October 31,

2012, 2011 and 2010 were $1,676 million, $1,425 million and

$1,276 million, respectively. The changes in 2012 and 2011

were primarily due to the increasing levels of operating leases.

The pension liabilities, net of pension assets, recognized

on the balance sheet at October 31, 2012, 2011 and 2010 were

$1,817 million, $1,373 million and $693 million, respectively.

The OPEB liabilities, net of OPEB assets, on these same dates

were $5,736 million, $5,193 million and $4,830 million,

respectively. The increases in pension net liabilities in 2012

and 2011 were primarily due to decreases in discount rates and

interest on the liabilities, partially offset by the return on plan

assets. The increases in the OPEB net liabilities in 2012 and

2011 were primarily due to the decreases in discount rates and

interest on the liabilities.

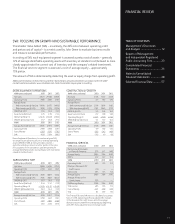

The effect of hypothetical changes to selected assumptions

on the company’s major U.S. retirement benefit plans would be

as follows in millions of dollars:

October 31, 2012 2013

______________ _________

Increase Increase

Percentage (Decrease) (Decrease)

Assumptions Change PBO/APBO* Expense

Pension

Discount rate** ................... +/-.5 $ (598)/635 $ (28)/28

Expected return

on assets ....................... +/-.5 (45)/45

OPEB

Discount rate** ................... +/-.5 (419)/465 (24)/26

Expected return

on assets ....................... +/-.5 (6)/6

Health care cost

trend rate** .................... +/-1.0 938/(709) 124/(95)

* Projected benefit obligation (PBO) for pension plans and accumulated postretirement

benefit obligation (APBO) for OPEB plans.

** Pretax impact on service cost, interest cost and amortization of gains or losses.

Goodwill

Goodwill is not amortized and is tested for impairment annually

and when events or circumstances change such that it is more

likely than not that the fair value of a reporting unit is reduced

below its carrying amount. The end of the third quarter is the

annual measurement date. To test for goodwill impairment,

the carrying value of each reporting unit is compared with its

fair value. If the carrying value of the goodwill is considered

impaired, a loss is recognized based on the amount by which the

carrying value exceeds the implied fair value of the goodwill.

An estimate of the fair value of the reporting unit is

determined through a combination of comparable market values

for similar businesses and discounted cash flows. These estimates

can change significantly based on such factors as the reporting

unit’s financial performance, economic conditions, interest

rates, growth rates, pricing, changes in business strategies and

competition.

Based on this testing, the company identified a reporting

unit in 2012 and 2010 for which the goodwill was impaired.

In the fourth quarters of 2012 and 2010, the company recorded

non-cash charges in cost of sales of $33 million pretax, or

$31 million after-tax, and $27 million pretax, or $25 million

21