John Deere 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 John Deere annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

operating activities equaled $2.3 billion on an enterprise basis.

The total was more than enough to fund a healthy level of capital

projects, resume share repurchases, and pay out a record amount

in dividends to shareholders.

Deere’s performance reected continued success delivering

more prot from a lean slate of productive assets. Our prot and

asset model aims for all businesses to earn their cost of capital –

and deliver SVA, or Shareholder Value Added – across the

business cycle. In 2010, SVA reached a record $1.714 billion.

All company business units had improved SVA performance for

the year. What’s more, despite signicantly higher sales and

factory production, asset levels remained well under control.

A&T Pacing Performance

Our performance was led by the Agriculture and Turf (A&T)

division, which delivered particularly impressive results. With a

sales increase of just 10 percent, A&T reported almost twice as

much operating prot and more than four times the level of SVA

achieved in 2009. Deere’s largest division efciently managed

assets, brought advanced new products to market and broadened

its customer base. A&T results were aided by positive farm

conditions and strong sales of large equipment, particularly in

the United States.

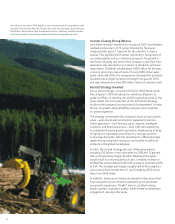

John Deere 8345R tractor has more power than earlier models and “smart tractor”

telematics. Integrated with machine controls, telematics allows remote monitoring

and increased productivity. Deere’s 8R-series tractors are equipped with

engines that meet more-rigorous emissions standards taking effect in 2011.

Sales also rose dramatically in Brazil after a steep decrease in

2009. However, conditions in Europe – our second-largest regional

market, after North America – showed a further decline.

In other parts of our business, Construction and Forestry (C&F)

saw an impressive rebound with sales increasing by 41 percent

and operating prot turning strongly positive. C&F had success

introducing advanced new products, expanding into new

geographies and picking up market share in key categories. The

division’s results were especially noteworthy in light of underlying

weakness in U.S. construction markets. Even with the year’s

sharp improvement, sales remained well below what traditionally

has been considered a trough level.

Making a further contribution to last year’s performance was

John Deere Credit, which recorded signicantly higher nancial

results while continuing to provide competitive nancing to

our equipment customers. Credit’s earnings jumped 85 percent

as a result of higher loan margins and loan quality in addition to

growth in the average portfolio of about $1 billion. Loan quality

remained quite strong as the provision for loss declined to less

than $50 for each $10,000 of portfolio value.