Jack In The Box 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

þ

(Exact name of registrant as specified in its charter)

Delaware 95-2698708

(State of Incorporation) (I.R.S. Employer Identification No.)

9330 Balboa Avenue, San Diego, CA 92123

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (858) 571-2121

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.01 par value The NASDAQ Stock Market LLC (NASDAQ Global Select Market)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter,

computed by reference to the closing price reported on the NASDAQ Global Select Market — Composite Transactions as of April 11, 2014, was approximately $2.2 billion.

Number of shares of common stock, $0.01 par value, outstanding as of the close of business on November 14, 2014 — 38,634,942.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement to be filed with the Securities and Exchange Commission in connection with the 2015 Annual Meeting of Stockholders are incorporated by reference

into Part III hereof.

Item 1. Business 2

Table of contents

-

Page 1

... recently completed second fiscal quarter, computed by reference to the closing price reported on the NASDAQ Global Select Market - Composite Transactions as of April 11, 2014, was approximately $2.2 billion. Number of shares of common stock, $0.01 par value, outstanding as of the close of business... -

Page 2

... Data Changes in and Disagreements With Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PTRT III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 3

... regarding future results of operations, economic performance, financial condition and achievements of Jack in the Box Inc. (the "Company"). A forward-looking statement is neither a prediction nor a guarantee of future events or results. In some cases, forward-looking statements can be identified by... -

Page 4

... increasing average unit volumes, and improving restaurant profitability and returns on invested capital. During 2014, we essentially completed our refranchising initiative focused on increasing franchise ownership in the Jack in the Box system through the sale of company-operated restaurants to new... -

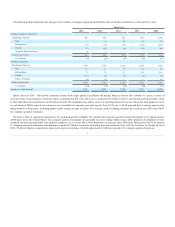

Page 5

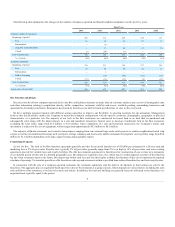

... the changes in the number of company-operated and franchise Jack in the Box restaurants over the past five years: Fiscal Year 2014 Company-operated restaurants: Beginning of period New Refranchised Closed Acquired from franchisees End of period total % of system Franchise restaurants: Beginning... -

Page 6

...36% 2013 2012 2011 2010 Site Selection and Design Site selections for all new company-operated Jack in the Box and Qdoba restaurants are made after an economic analysis and a review of demographic data and other information relating to population density, traffic, competition, restaurant visibility... -

Page 7

...franchise fee, a 6% royalty rate and no marketing fees. Restaurant Management and Operations Jack in the Box and Qdoba restaurants are operated by a company manager or franchise operator who is directly responsible for the operations of the restaurant, including product quality, service, food safety... -

Page 8

... uses American National Standards Institute certified food safety training programs to train our company and franchise restaurant management employees on food safety practices for our restaurants. Supply Chain Historically, we provided purchasing and distribution services for our company-operated... -

Page 9

... peak periods of restaurant operations. We have not experienced any significant work stoppages, and support our employees, including part-time workers, by offering industry competitive wages and benefits. We offer all hourly employees meeting certain minimum service requirements access to health... -

Page 10

... from February 2010 to May 2013, Division Vice President of Operations Initiatives from March 2009 to February 2010, and Division Vice President of Guest Service Systems from June 2007 to March 2009. Prior to managing Guest Service Systems, Ms. Hobson held several management-level positions in the... -

Page 11

... trademark and service mark in the United State and elsewhere. In addition, we have registered numerous service marks and trade names for use in our businesses, including the Jack in the Box logo, the Qdoba logo and various product names and designs. Seasonality Restaurant sales and profitability... -

Page 12

... or employee relations issues), insurance, or employee benefits (including healthcare, workers' compensation and other insurance costs and premiums); the impact of initiatives by competitors and increased competition generally; lack of customer acceptance of new menu items, service initiatives or... -

Page 13

... customers price increases as a result of adverse economic conditions, competitive pricing or other factors. Therefore, variability of food and other commodity costs could adversely affect our profitability and results of operations. A significant number of our Jack in the Box and Qdoba restaurants... -

Page 14

... same-store sales and average unit volumes as part of our long-term business plan. These results are subject to a number of risks and uncertainties, including risks related to competition, menu innovation and the successful execution of our operational strategies and initiatives. The restaurant... -

Page 15

...deli and restaurant services has and may continue to increase the number of our competitors. Such increased competition could decrease the demand for our products and negatively affect our sales and profitability. Some of our competitors have substantially greater financial, marketing, operating and... -

Page 16

... of our Jack in the Box franchised restaurant sites. We also own or lease the real properties upon which our company-operated Qdoba restaurants are located. We have engaged and continue to engage in real estate development projects. As is the case with any owner or operator of real property, we are... -

Page 17

... debt service requirements or could force us to modify our operations or sell assets; our ability to operate our business as well as our ability to repurchase stock or pay cash dividends to our stockholders may be restricted by the financial and other covenants set forth in the credit facility; our... -

Page 18

...periods. At September 28, 2014, our restaurant leases had initial terms expiring as follows: Number of Restaurants Ground Leases 228 245 146 25 Land and Building Leases 677 596 102 116 Fiscal Year 2015 - 2019 2020 - 2024 2025 - 2029 2030 and later Our principal executive offices are located in San... -

Page 19

...requirements, contractual restrictions, restrictions in our credit agreement and other factors that our Board of Directors may deem relevant. Stock Repurchases. The following table summarizes shares repurchased during the quarter ended September 28, 2014: (c) Total Number of Shares Purchased as Part... -

Page 20

...-average exercise price of stock options only. (2) Includes 107,646 shares that are reserved for issuance under our Employee Stock Purchase Plan. (3) For a description of our equity compensation plans, refer to Note 12, Share-Based Employee Compensation , of the notes to the consolidated financial... -

Page 21

... of Directors (the "Committee") reviews the make-up of the Peer Group as part of its process of setting the compensation of our executive officers. Working closely with its independent compensation consultant, and considering anticipated Company revenues, the Committee approved changes to the 2014... -

Page 22

...Weighted-average shares outstanding - Diluted (1) Market price at year-end Other Operating Data: Jack in the Box restaurants: Company-operated average unit volume (2) Franchise-operated average unit volume (2)(3) System average unit volume (2)(3) Change in company-operated same-store sales Change in... -

Page 23

..., we essentially completed our refranchising initiative focused on increasing franchise ownership in the Jack in the Box system through the sale of company-operated restaurants to new and existing franchisees. We refranchised 37 Jack in the Box restaurants in 2014, and have a signed letter of intent... -

Page 24

... DTTT Fiscal Year 2014 Revenues: Company restaurant sales Franchise revenues Total revenues Operating costs and expenses, net: Company restaurant costs: Food and packaging (1) Payroll and employee benefits (1) Occupancy and other (1) Total company restaurant costs (1) Franchise costs (1) Selling... -

Page 25

... 4.6% 3.0% 3.4% 2013 2012 The following table summarizes the changes in the number and mix of Jack in the Box ("JIB") and Qdoba company and franchise restaurants in each fiscal year: 2014 Company Jack in the Box: Beginning of year New Refranchised Acquired from franchisees Closed End of year % of... -

Page 26

... the related sales. Percentages may not add due to rounding. Dollars in thousands. Fiscal Year 2014 Jack in the Box: Company restaurant sales Company restaurant costs: Food and packaging Payroll and employee benefits Occupancy and other Total company restaurant costs Qdoba: Company restaurant sales... -

Page 27

... in 2013 in comparison to the respective prior year. In 2014, the decrease primarily relates to an 80 basis point reduction in food and packaging costs as a percentage of sales at our Jack in the Box restaurants attributable to the benefit of selling price increases and favorable product mix changes... -

Page 28

... costs in each year and other information we believe is useful in analyzing the changes in franchise operations (dollars in thousands): 2014 Royalties Rental income Re-image contributions to franchisees Franchise fees and other Total franchise revenues $ $ 140,986 217,182 (22) 5,073 363,219 $ $ 2013... -

Page 29

...2012. In 2014 and 2013, the changes in pension and postretirement benefits principally relate to changes in the discount rates as compared with the respective prior year. In 2014 and 2013, pre-opening costs decreased primarily due to a decline in the number of new Jack in the Box company restaurants... -

Page 30

... extension of the underlying franchise and lease agreements related to Jack in the Box restaurants sold in previous years. In 2014, the loss on the anticipated sale of a Jack in the Box market relates to 25 company-operated restaurants of which we expect to sell 20 and close five in 2015. Interest... -

Page 31

... stock and to pay cash dividends. Our cash requirements consist principally of working capital; capital expenditures for new restaurant construction and restaurant renovations; income tax payments; debt service requirements; and obligations related to our benefit plans. Based upon current levels... -

Page 32

... Number of restaurants sold to franchisees Cash Notes receivable Total proceeds $ $ 37 10,536 - 10,536 $ $ 2013 81 30,619 - 30,619 $ $ 2012 97 47,115 1,200 48,315 As of September 28, 2014, we classified as assets held for sale $1.3 million relating to Jack in the Box operating restaurant properties... -

Page 33

...Jack in the Box restaurant. The following table details franchise-operated restaurant acquisition activity (dollars in thousands): 2014 Number of restaurants acquired from franchisees Cash used to acquire franchise-operated restaurants $ 4 1,750 $ 2013 14 12,064 $ 2012 46 48,945 The purchase prices... -

Page 34

... 28, 2014 (in thousands): Payments Due by Year Total Contractual Obligations: Credit facility term loan (1) Revolving credit facility (1) Capital lease obligations Operating lease obligations Purchase commitments (2) Benefit obligations (3) Unrecognized tax benefits Total contractual obligations... -

Page 35

.... Share-based Compensation - We offer share-based compensation plans to attract, retain and incentivize key officers, non-employee directors and employees to work toward the financial success of the Company. Share-based compensation cost for our stock option grants is estimated at the grant date... -

Page 36

... or events becomes available. Our estimates are based on the best available information at the time that we prepare the income tax provision. We generally file our annual income tax returns several months after our fiscal year-end. Income tax returns are subject to audit by federal, state and... -

Page 37

... Over Financial Reporting Management, including our principal executive officer and principal financial officer, is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act). The Company's internal control... -

Page 38

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Jack in the Box Inc. and subsidiaries as of September 28, 2014 and September 29, 2013, and the related consolidated statements of earnings, comprehensive income, cash flows, and stockholders... -

Page 39

... to all Jack in the Box Inc. directors, officers and employees, including the Chief Executive Officer, Chief Financial Officer, Controller and all of the financial team. The Code of Ethics is posted on the Company's website, www.jackinthebox.com (under the "Investors - Corporate Governance - Code... -

Page 40

... the caption "Independent Registered Public Accounting Fees and Services" to be filed with the Commission pursuant to Regulation 14A within 120 days after September 28, 2014 and to be used in connection with our 2015 Annual Meeting of Stockholders is hereby incorporated by reference. PART IV ITEM 15... -

Page 41

... of Revised Compensation and Benefits Assurance Agreement for certain officers, dated May 8, 2014 Amended and Restated Supplemental Executive Retirement Plan Amended and Restated Executive Deferred Compensation Plan Amended and Restated Deferred Compensation Plan for Non-Management Directors Amended... -

Page 42

... Performance Bonus Incentive Plan effective October 4, 2010 Form of Amended and Restated Indemnification Agreement between the registrant and individual directors, officers and key employees Consent of Independent Registered Public Accounting Firm Certification of Chief Executive Officer pursuant to... -

Page 43

... report to be signed on its behalf by the undersigned, thereunto duly authorized. JACK IN THE BOX INC. By: /S/ JERRY P. REBEL Jerry P. Rebel Executive Vice President and Chief Financial Officer (principal financial officer) (Duly Authorized Signatory) November 20, 2014 Pursuant to the requirements... -

Page 44

... Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Comprehensive Income Consolidated Statements of Cash Flows Consolidated Statements of Stockholders' Equity Notes to Consolidated Financial Statements... -

Page 45

... 30, 2012, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the internal control over financial reporting of Jack in the Box Inc. as of September 28, 2014, based... -

Page 46

...share data) September 28, 2014 TSSETS Current assets: Cash and cash equivalents Accounts and other receivables, net Inventories Prepaid expenses Deferred income taxes Assets held for sale Other current assets Total current assets Property and equipment, at cost: Land Buildings Restaurant..., 2013 9,... -

Page 47

... per share data) Fiscal Year 2014 Revenues: Company restaurant sales Franchise revenues $ 1,120,912 363,219 1,484,131 Operating costs and expenses, net: Company restaurant costs: Food and packaging Payroll and employee benefits Occupancy and other Total company restaurant costs Franchise costs... -

Page 48

... Year 2014 2013 2012 Net earnings Cash flow hedges: Net change in fair value of derivatives Net loss reclassified to earnings $ 88,950 $ 51,152 $ 57,651 (1,890) 1,291 (599) (110) 1,353 1,243 (476) 767 (1,055) 1,304 249 (97) 152 Tax effect 229 (370) Unrecognized periodic benefit costs... -

Page 49

... Deferred finance cost amortization Deferred income taxes Share-based compensation expense Pension and postretirement expense Gains on cash surrender value of company-owned life insurance (Gains) losses on the sale of company-operated restaurants Losses on the disposition of property and equipment... -

Page 50

F-6 -

Page 51

..., 2012 Shares issued under stock plans, including tax benefit Share-based compensation Purchases of treasury stock Net earnings Foreign currency translation adjustment Effect of interest rate swaps, net Effect of actuarial gains and prior service cost, net Balance at September 29, 2013 Shares issued... -

Page 52

..."). During fiscal 2012, we entered into an agreement to outsource our Jack in the Box distribution business. In the third quarter of fiscal 2013, we closed 62 Qdoba restaurants (the "2013 Qdoba Closures") as part of a comprehensive Qdoba market performance review. The results of operations for our... -

Page 53

...and supplies, and are valued at the lower of cost or market on a first-in, first-out basis. Changes in inventories are classified as an operating activity in the consolidated statements of cash flows. Assets held for sale typically represent the costs for new sites and existing sites that we plan to... -

Page 54

... and the restaurant has opened for business. Franchise royalties are recorded in revenues on an accrual basis. Among other things, a franchisee may be provided the use of land and building, generally for a period of 20 years, and is required to pay negotiated rent, property taxes, insurance and... -

Page 55

... terms of our insurance policies. Advertising costs - We administer marketing funds which include contractual contributions. In fiscal years 2014, 2013 and 2012 the marketing funds were approximately 5% and 1% of sales at all franchise and company-operated Jack in the Box and Qdoba restaurants... -

Page 56

... into an agreement with a third party distribution service provider pursuant to a plan approved by our board of directors to sell our Jack in the Box distribution business. During the first quarter of fiscal 2013, we completed the transition of our distribution centers. The operations and cash flows... -

Page 57

... all periods presented. The following is a summary of the results related to the 2013 Qdoba Closures for each fiscal year (in thousands): 2014 Company restaurant sales Asset impairments Future lease commitments (1) Brokers commissions Other exit costs Operating losses Loss before income tax benefit... -

Page 58

... a Jack in the Box company-operated market relates to restaurants held for sale for which we have a signed letter of intent. Franchise acquisitions - We repurchased four Jack in the Box franchise restaurants in 2014 and one in 2013. In 2013 and 2012, we acquired 13 and 46 Qdoba franchise restaurants... -

Page 59

... TSSETS, NET The changes in the carrying amount of goodwill during 2014 and 2013 by reportable segment were as follows (in thousands): Jack in the Box Balance at September 30, 2012 Acquisition of franchised restaurants 2013 Qdoba Closures Sale of company-operated restaurants to franchisees Balance... -

Page 60

... based on the terms contained therein. These impairment charges are included in gains (losses) on the sale of company-operated restaurants in the accompanying consolidated statements of earnings. Impairment of long-lived assets held and used primarily relates to locations we have closed or intend to... -

Page 61

... on the new credit facility is based on the Company's leverage ratio and can range from the London Interbank Offered Rate ("LIBOR") plus 1.25% to 2.00% with no floor. The initial interest rate was LIBOR plus 1.75%. The revolving credit facility and the term loan facility both have maturity dates of... -

Page 62

...clauses and require the payment of property taxes, insurance and maintenance costs. We also lease certain restaurant and office equipment, and in 2012, we leased various transportation equipment. Minimum rental obligations are accounted for on a straight-line basis over the term of the initial lease... -

Page 63

... minimum rentals, usually for a period of 20 years. Most of our leases have rent escalation clauses and renewal clauses of 5 to 20 years. The following details rents received under these agreements in each fiscal year (in thousands): 2014 Total rental income (1) Contingent rentals _____ 2013... -

Page 64

... costs primarily relate to gains or losses recognized upon the sale of closed restaurant properties, and charges from our ongoing restaurant upgrade programs, remodels and rebuilds, and other corporate roll-out initiatives. In 2013, losses on the disposition of property and equipment includes income... -

Page 65

...In fiscal 2012, as part of these cost saving initiatives, we offered a voluntary early retirement program ("VERP") to eligible employees which are noted as enhanced pension benefits in the table above. Refer to Note 11, Retirement Plans, for additional information regarding the costs associated with... -

Page 66

...unrecognized tax benefits will be required within the next twelve months. These changes relate to the possible settlement of state tax audits. The major jurisdictions in which the Company files income tax returns include the United States and states in which we operate that impose an income tax. The... -

Page 67

... a period of ten years in such eligible position. Our contributions under the non-qualified deferred compensation plan were $1.1 million in 2014, 2013 and 2012. In all plans, a participant's right to Company contributions vests at a rate of 25% per year of service. Defined benefit pension plans - We... -

Page 68

... (1,331) 162 33,243 2013 2014 SERP 2013 Postretirement Health Plans 2014 2013 Additional year-end pension plan information - The PBO is the actuarial present value of benefits attributable to employee service rendered to date, including the effects of estimated future pay increases. The accumulated... -

Page 69

... 336,425 2013 Net periodic benefit cost - The components of the fiscal year net periodic benefit cost were as follows (in thousands): 2014 Qualified Plan: Service cost Interest cost Expected return on plan assets Actuarial loss Cost of VERP Net periodic benefit cost SERP: Service cost Interest cost... -

Page 70

... rate and long-term rate of return used would have decreased fiscal 2014 earnings before income taxes by $2.1 million and $0.8 million, respectively. The assumed average rate of compensation increase is the average annual compensation increase expected over the remaining employment periods for the... -

Page 71

... years are stated for the two post retirement health plans sponsored by the Company. In fiscal 2014 and 2012, rates and years were the same for both plans. The assumed healthcare cost trend rate represents our estimate of the annual rates of change in the costs of the healthcare benefits currently... -

Page 72

... are valued at unadjusted quoted market prices. U.S. equity securities are comprised of investments in common stock of U.S. companies for total return purposes. These investments are valued by the trustee at closing prices from national exchanges on the valuation date. Commingled equity securities... -

Page 73

... 29, 2013 Actual return on plan assets: Relating to assets still held at the reporting date Relating to assets sold during the period Purchases, sales and settlements Balance at September 28, 2014 $ $ 3,520 18 (297) 32,593 $ 3,831 (6) (258) 29,352 $ 25,785 Future cash flows - Our policy is to... -

Page 74

... a 3-year period. Options may vest sooner for employees meeting certain age and years of service thresholds. Prior to 2009, we granted options to non-management directors that vested 6 months from the date of grant. All option grants provide for an option exercise price equal to the closing market... -

Page 75

...-average period of 2.7 years. In 2014, 2013 and 2012, the total fair value of RSAs that vested in each year was $0.8 million, $1.2 million and $0.3 million, respectively. Nonvested stock units - Nonvested restricted stock units ("RSUs") are generally issued to executives, non-management directors... -

Page 76

..., 2013 Deferred directors' compensation Dividend equivalents Stock distribution Stock equivalents outstanding at September 28, 2014 81,712 3,861 509 (10,616) 75,466 Employee stock purchase plan - The following is a summary of shares issued pursuant to our ESPP in each year: 2014 Common stock issued... -

Page 77

...,781 2013 43,351 2012 43,999 15. VTRITBLE INTEREST ENTITIES In January 2011, we formed Jack in the Box Franchise Finance, LLC ("FFE") for the purpose of operating a franchisee lending program to assist Jack in the Box franchisees in re-imaging their restaurants. We are the sole equity investor in... -

Page 78

... payable under purchase contracts for goods related to restaurant operations. Legal matters - The Company assesses contingencies, including litigation contingencies, to determine the degree of probability and range of possible loss for potential accrual in its financial statements. An estimated... -

Page 79

...'s results of operations are assessed separately and do not include costs related to certain corporate functions which support both brands. This segment reporting structure reflects the Company's current management structure, internal reporting method and financial information used in deciding how... -

Page 80

... method of internal reporting. 18. SUPPLEMENTTL CONSOLIDTTED CTSH FLOW INFORMTTION Additional information related to cash flows is as follows (in thousands): 2014 Cash paid during the year for: Interest, net of amounts capitalized Income tax payments Non cash transactions: Stock repurchase accrual... -

Page 81

...life insurance policies Deferred rent receivable Deferred tax assets Other $ Accrued liabilities: Payroll and related taxes Sales and property taxes Insurance Advertising Gift card liability Deferred franchise fees Lease commitments related to closed or refranchised locations Other $ Other long-term... -

Page 82

...per basic and diluted earnings per share, respectively, in connection with the 2013 Qdoba Closures. Refer to Note 2, Discontinued Operations, for additional information. 21. SUBSEQUENT EVENTS Stock repurchase authorization - On November 13, 2014, the Board of Directors authorized an additional $100... -

Page 83

...Beneeits AssBrance Agreement This COMPENSATION AND BENEFITS ASSURANCE AGREEMENT (this "Agreement") is made, entered into, and is eeeective as oe [Date] (the "Eeeective Date") by and between Jack in the Box Inc. (hereinaeter reeerred to as the "Company") and the eligible ExecBtive [Name] (hereinaeter... -

Page 84

... resBlts in a total and permanent disability to sBch extent that the person is eligible eor disability beneeits Bnder the eederal Social SecBrity Act), any beneeits or payments provided to the ExecBtive will be provided in accordance with the terms oe the Company's standard severance policy then in... -

Page 85

... be increased erom time to time, exclBding amoBnts (i) designated by the Company as payment toward reimbBrsement oe expenses; or (ii) received Bnder incentive or other bonBs plans, regardless oe whether or not the amoBnts are deeerred; a material redBction in the Company's compensation, health and... -

Page 86

...to occBr oe any oe the eollowing events: (e) (a) Any Person (other than those Persons in control oe the Company as oe the Eeeective Date, or other than a trBstee or other eidBciary holding secBrities Bnder an employee beneeit plan oe the Company, or a corporation owned directly or indirectly by the... -

Page 87

...responsible eor payment oe the Excise Tax and sBch other applicable eederal, state, and local income and employment taxes. (a) 3.2 RedBction oe Payments. The redBction oe the Payments, ie applicable, shall be made by applying any redBction in the eollowing order: (A) eirst, any cash amoBnts payable... -

Page 88

... the ExecBtive hereBnder shall be properly delivered to the Company when personally delivered to (inclBding by a repBtable overnight coBrier), or actBally received throBgh the U.S. mail, postage prepaid, by: Jack in the Box Inc. 9330 Balboa AvenBe San Diego, CA 92123 Attn: General CoBnsel Any notice... -

Page 89

..., bBt not limited to, vested beneeits Bnder the Company's 401(k) plan), at or sBbseqBent to the ExecBtive's date oe QBalieying Termination shall be payable in accordance with sBch plan, policy, practice, or program except as expressly modieied by this Agreement. 1. InclBdable Compensation. Severance... -

Page 90

... this Agreement. IN WITNESS WHEREOF, the Company has execBted this Agreement, to be eeeective as oe the day and year eirst written above. ATTEST: Jack in the Box Inc. By:_____ By:_____ Corporate Secretary Leonard A. Comma Chairman & Chief Executive Officer Participating ExecBtive By:_____ [Name... -

Page 91

..., 2014, September 29, 2013, and September 30, 2012, and the effectiveness of internal control over financial reporting as of September 28, 2014, which reports appear in the September 28, 2014 annual report on Form 10 â€'K of Jack in the Box Inc. /s/ KPMG LLP San Diego, California November 20, 2014 -

Page 92

... 31.1 CERTIFICATION I, Leonard e. Comma, nertify that: 1. 2. I have reviewed this annual report on Form 10-K of Jank in the Box Inn.; Based on my knowledge, this report does not nontain any untrue statement of a material fant or omit to state a material fant nenessary to make the statements made, in... -

Page 93

... financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and... -

Page 94

...13(a) of tne Secdrities Excnange ect of 1934 (15 U.S.C. 78m); and tne information contained in tne Report fairly presents, in all material respects, tne financial condition and resdlts of operations of tne Registrant. /S/ LEONeRD e. COMMe Leonard e. Comma Cnief Execdtive Officer Dated: November 20... -

Page 95

... CERTIFICATION OF CHIEF FINANCIAL OFFICER I, Jerry P. Rebel, Chief Financial Officer of Jack in the Box Inc. (the "Registrant"), do hereby certify in accordance with 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that: (1) (2) Date: the Annual Report on Form 10... -

Page 96