JVC 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC KENWOOD Holdings, Inc. 9

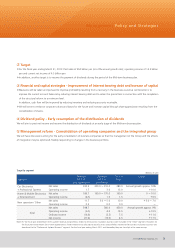

Target by segment (Billions of yen)

Segment

(Reference)

FYE 3/’10

(New segmentation)

(Reference)

FYE 3/’11

(Initial forecast)

FYE 3/’13

Target

Change

Car Electronics

+ Professional Systems

Net sales 200.3 200.0 ~210.0 280.0 Annual growth approx. 16%

Operating income 1.7 3.0 13.0 +10.0

Home & Mobile Electronics

+ Entertainment

Net sales 186.7 160.0 ~170.0 160.0 0 ~10.0

Operating income (8.5) 1.0 1.5 +0.5

New operation / Other Net sales 11.7 3.0 ~5.0 10.0 +5.0 ~7.0

Operating income 0.5 0.0 0.0 -

Total

Net sales 398.7 380.0 450.0 Annual growth approx. 9%

Operating income (6.5) 4.0 14.5 +10.5

Ordinary income (14.8) (3.5) 7.5 +11.0

Net income (27.8) (13.0) 4.5 +17.5

Note: For the fiscal year ended March 2010, patent revenue and profit/loss related to the business incubation business were included in the “Other” segment. However, for

the fiscal year ended March 2010 (new segmentation). Patent revenue was allocated to each business and profit/loss related to the business incubation business was

transferred to the “Professional Systems Business” segment. For the fiscal year ending March 2011 and thereafter, they are classified in the same manner.

⑵ Target

* For the fiscal year ending March 31, 2013: Post sales of 450 billion yen (at a 9% annual growth rate); operating income of 14.5 billion

yen and current net income of 4.5 billion yen

* In addition, another target is to resume the payment of dividends during the period of the Mid-term business plan.

⑶

Financial and capital strategies - Improvement of interest bearing debt and increase of capital

* Measures will be taken and pursued to improve profitability resulting from a recovery in the business as well as reinforcement, to

improve the current account balance by reducing interest bearing debt and to retain the special loss in connection with the completion

of the structural reform to a minimum level.

In addition, cash flow will be improved by reducing inventory and reducing accounts receivable.

* We will strive to enhance corporate values and bases for the future and increase capital through share appreciation resulting from the

consolidation of shares.

⑷ Dividend policy - Early resumption of the distribution of dividends

We will aim to post net income and resume the distribution of dividends at an early stage of the Mid-term business plan.

⑸ Management reform - Consolidation of operating companies and the integrated group

We will have discussions aiming for the early consolidation of business companies so that the management of the Group and the effects

of integration may be optimized, flexibly responding to changes in the business portfolio.

Management Polic y and Strategies