Intel 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

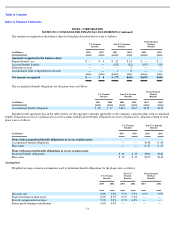

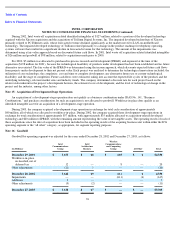

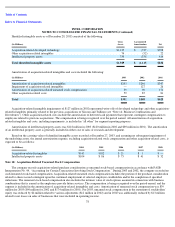

Note 14: Business Combinations and Divestitures

All of the company’s qualifying business combinations have been accounted for using the purchase method of accounting. Consideration

includes the cash paid and the value of any stock issued and options assumed, less any cash acquired, and excludes contingent employee

compensation payable in cash and any debt assumed. The company accounts for the intrinsic value of stock options assumed related to future

services as unearned compensation within stockholders’ equity (see “Note 18: Acquisition-Related Unearned Stock Compensation”).

During 2003, the company completed one acquisition qualifying as a business combination in exchange for total cash consideration of

approximately $21 million. There were no acquisitions qualifying as business combinations in 2002. The acquisitions in 2001 were entered into

primarily to expand Intel’s optical, wired Ethernet, wireless connectivity and telecommunications capabilities. The operating results of all of

the significant businesses acquired in 2003 and 2001 have been included in the results of the Intel Communications Group (ICG) operating

segment from the date of acquisition.

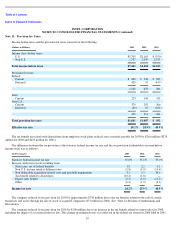

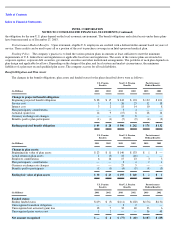

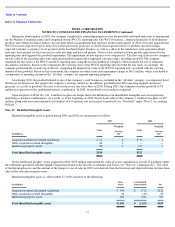

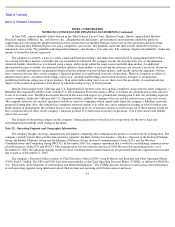

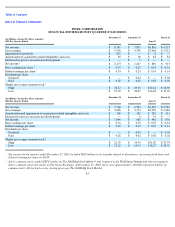

The following table summarizes the company’s business combinations completed in 2001:

Other business combinations in the above summary represent seven business combination transactions in 2001 that were not individually

significant.

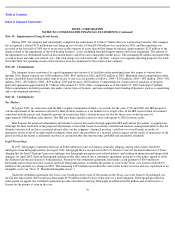

Purchase consideration for acquisitions in 2001 included 21.0 million unregistered shares of Intel common stock. Of these shares, 5.2

million were contingent upon the continued employment of certain employees and/or meeting performance criteria, and approximately 4.8

million of the contingent shares have subsequently been issued. An additional 900,000 registered shares were issuable to certain employees

contingent upon meeting certain performance criteria. Of these shares, approximately 700,000 were subsequently issued, and approximately

200,000 were forfeited, as certain milestones had not been met. For consideration payable in shares that is contingent on employment, the value

is included in purchase consideration. Although included in the total consideration disclosed, the fair value of such stock compensation is

allocated to unearned stock compensation (see Note 18: “Acquisition-Related Unearned Stock Compensation”) and is not included in the

allocation of purchase price to assets acquired. For the 2001 acquisitions, $224 million in cash compensation was contingent upon the

continued employment of certain employees and/or meeting performance criteria and was not included in purchase consideration. Of this

amount, approximately $168 million was paid and approximately $11 million was forfeited. Of the $45 million in cash compensation

remaining to be paid, approximately $13 million was not yet earned and thus not reflected in the company’s balance sheet as of December 27,

2003.

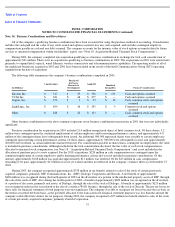

During 2003, the company recognized approximately $758 million in tax benefits related to sales of the stock of certain previously

acquired companies, primarily DSP Communications, Inc. (DSP), Dialogic Corporation and Xircom. A net benefit of approximately

$420 million was recognized during the fourth quarter of 2003 on the divestiture of a portion of the intellectual property assets of DSP, through

the sale of the stock of DSP. Also during the fourth quarter of 2003, a benefit of approximately $200 million was recognized on the divestiture

of a portion of the assets, primarily real estate, of Dialogic, through the sale of the stock of Dialogic. A benefit of approximately $125 million

was recognized earlier in the year related to the sale of a wireless WAN business, through the sale of the stock of Xircom. The pre-

tax losses on

these sales for financial statement or book purposes were not significant. The company was able to recognize tax losses because the tax basis in

the entities exceeded the book basis, as the goodwill allocated to the transactions for financial statement purposes was less than the amount the

company could effectively deduct for tax purposes. During 2002, the company recognized a $75 million tax benefit related to sales of the stock

of certain previously acquired companies, primarily Ziatech Corporation.

75

(In Millions)

Consideration

Purchased

In-Process

Research &

Development

Goodwill

Identified

Intangibles

Form of Consideration

Xircom, Inc.

$

517

$

53

$

336

$

154

Cash and options assumed

VxTel Inc.

$

381

$

68

$

277

$

—

Cash and options assumed

Cognet, Inc.

$

156

$

9

$

93

$

20

Cash, common stock and options

assumed

LightLogic, Inc.

$

409

$

46

$

295

$

9

Common stock and options

assumed

Other

$

228

$

22

$

153

$

—

Cash, common stock and options

assumed