Intel 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

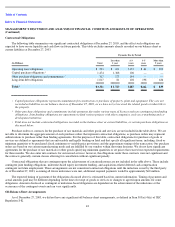

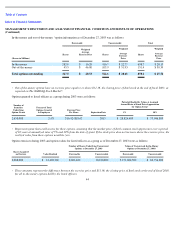

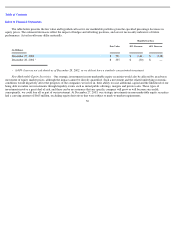

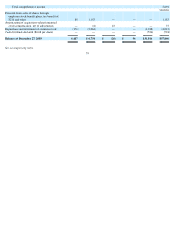

The table below presents the fair value and hypothetical loss for our marketable portfolio given the specified percentage decreases in

equity prices. The estimated decreases reflect the impact of hedges and offsetting positions, and are not necessarily indicative of future

performance. Actual results may differ materially.

Hypothetical Loss

(In Millions)

Fair Value

30% Decrease

60% Decrease

December 27, 2003

$

591

$

(161

)

$

(318

)

December 28, 2002

†

$

335

$

(30

)

$

—

Non-Marketable Equity Securities. Our strategic investments in non-marketable equity securities would also be affected by an adverse

movement of equity market prices, although the impact cannot be directly quantified. Such a movement and the related underlying economic

conditions would negatively affect the prospects of the companies we invest in, their ability to raise additional capital and the likelihood of our

being able to realize our investments through liquidity events such as initial public offerings, mergers and private sales. These types of

investments involve a great deal of risk, and there can be no assurance that any specific company will grow or will become successful;

consequently, we could lose all or part of our investment. At December 27, 2003, our strategic investments in non-marketable equity securities

had a carrying amount of $665 million, excluding equity derivatives that were subject to mark-to-market requirements.

50

†

A 60% loss was not calculated as of December 28, 2002, as we did not have a similarly concentrated investment.