Intel 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

INTEL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

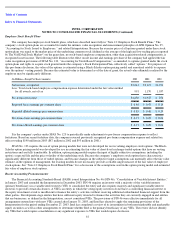

During 2001, the company granted merit-based options that would typically have been granted in 2002, in order to enhance the potential

long-term retention value of these stock options. This grant is referred to in the table above as “2002 merit grant.”

The 2002 merit grant vests in

2007, on about the same date that the options would vest if they had been granted in 2002. Merit grants made in 2002, included in “other

grants” in the table above, were reduced by the shares granted in this early grant program during 2001.

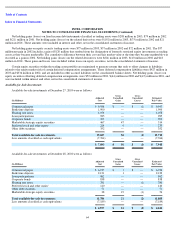

The range of option exercise prices for options outstanding at December 27, 2003 was $0.01 to $87.90. This range reflects the impact of

options assumed with acquired companies in addition to the fluctuating price of Intel common stock.

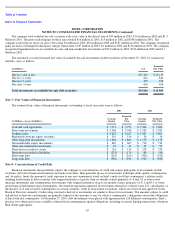

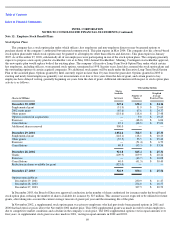

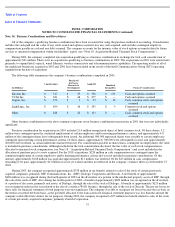

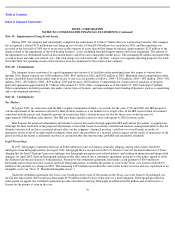

The following table summarizes information about options outstanding at December 27, 2003:

These options will expire if not exercised at specific dates through October 2013. Option exercise prices for options exercised during the

three-year period ended December 27, 2003 ranged from $0.01 to $36.47.

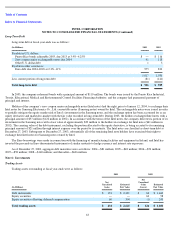

Stock Participation Plan

In addition to the employee stock option plans, the company has a Stock Participation Plan, under which eligible employees may

purchase shares of Intel’s common stock at 85% of the average of the high and low stock price reported on The NASDAQ Stock Market* at

specific, predetermined dates. Approximately 75% of the company’s employees were participating in the Stock Participation Plan as of

December 27, 2003. Of the 944 million shares authorized to be issued under the plan, 85.9 million shares remained available for issuance at

December 27, 2003. Employees purchased 23.8 million shares in 2003 (17.0 million in 2002 and 13.0 million in 2001) for $328 million ($338

million in 2002 and $351 million in 2001).

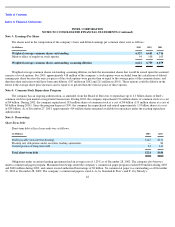

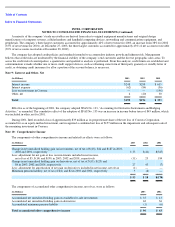

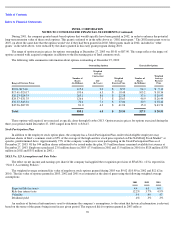

SFAS No. 123 Assumptions and Fair Value

The effect on net income and earnings per share if the company had applied the recognition provision of SFAS No. 123 is reported in

“Note 2: Accounting Policies.”

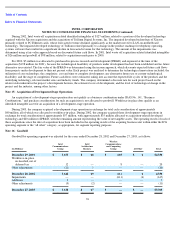

The weighted average estimated fair value of employee stock options granted during 2003 was $9.02 ($10.89 in 2002 and $12.62 in

2001). The fair value of options granted in 2003, 2002 and 2001 was estimated at the date of grant using the following weighted average

assumptions:

An analysis of historical information is used to determine the company’

s assumptions, to the extent that historical information is relevant,

based on the terms of the grants being issued in any given period. The expected life for options granted in 2003 reflects

70

Outstanding Options

Exercisable Options

Range of Exercise Prices

Number of

Shares

(In Millions)

Weighted

Average

Contractual

Life

(In Years)

Weighted

Average

Exercise Price

Number of

Shares

(In Millions)

Weighted

Average

Exercise

Price

$0.01

–

$

17.40

115.4

3.0

$

8.57

94.3

$

7.13

$17.41

–

$

20.17

193.6

6.3

$

18.48

103.2

$

18.34

$20.23

–

$

24.35

263.1

8.0

$

22.38

37.6

$

20.97

$24.37

–

$

31.35

126.6

7.1

$

28.63

46.9

$

26.44

$31.37

–

$

45.16

70.4

7.1

$

37.06

30.5

$

38.46

$45.96

–

$

87.90

81.0

6.3

$

61.96

15.0

$

63.74

Total

850.1

6.5

$

25.54

327.5

$

20.53

2003

2002

2001

Expected life (in years)

4.4

6.0

6.0

Risk

-

free interest rate

12.2

%

3.7

%

4.9

%

Volatility

.5

4

.4

9

.4

7

Dividend yield

.4

%

.3

%

.3

%