ING Direct 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OUR MISSION

ING’s mission is to setthe standard in helping our

customers manage theirfinancial future. We aim

to deliver financial products and services inthe way

our customers want them delivered: with exemplary

service, convenience and at competitive prices.

OUR PROFILE

ING is a global financial institution of Dutch origin,

currently offering banking, investments, life insurance

andretirement services to meet the needs of a broad

customer base. Going forward, we will concentrate

onour position as a strong European bank with attractive

home market positions in Northern Europe and growth

options in Central and Eastern Europe and Asia, while

creating an optimal base for independent futures forour

insurance operations (including investment management).

OUR STRATEGY

To serve the interests of our stakeholders, increase

management focus and create value for our shareholders,

ING is moving towards separation of itsbanking and

insurance operations. We believe the widespread

demand for greater simplicity, reliability and transparency

makes this the best course of action. The separation is

also part of the restructuring plan submitted to the

European Commission in order to get approval for the

Dutch state aid received during the financial crisis. Inthe

future, ING Bank intends to be a strong European bank,

with leading domestic banking positions in attractive,

stable home markets, as well as a leading commercial

bank in the Benelux and Central and Eastern Europe. We

also intend to continue to selectively evolve our various

ING Direct units intomore mature full-service banking

models. These initiatives in Europe, coupled with our

positions outside of Europe, should give the Bank

attractive growth potential in the longterm. ING will

build on its global presence and international network

and capitalise on its leadership position in gathering

savings, multi-channel distribution, simple propositions

and marketing. On the insurance side, the focuswill be

on continuing to improve performance in order to

optimise returns and value for the business as we prepare

for separation. Wewill focus onearning our customers’

trust through transparent products, value for money and

superior service. This reflects our universal customer ideal:

saving and investing for the future should be easier.

OUR CUSTOMERS

ING serves a broad customer base, comprising

individuals, families, small businesses, large

corporations, institutions and governments.

OUR STAKEHOLDERS

ING conducts business on the basis of clearly-defined

business principles. In all our activities, we carefully

weigh the interests of our various stakeholders:

customers, employees, business relations and suppliers,

society at large and shareholders.

OUR CORPORATE RESPONSIBILITY

ING wants to build its future on sustainable profit

based on sound business ethics and respect for its

stakeholders and to be a good corporate citizen. It is

only by acting with professionalism and integrity that

we will maintain our stakeholders’ trust and preserve

our reputation. Our Business Principles prescribe the

corporate values we pursue and the responsibilities we

have towards society and the environment: we act with

integrity, we are open and clear, we respect each other

and we are socially and environmentally responsible.

Repayment of core Tier 1 securities

It is one of ING’s priorities to repay the remaining

EUR3billion of capital support to the Dutch State

assoon as possible. However, in light of the current

challenging and changing financial and regulatory

environment we take a cautious approach and

maintain strong capital ratios as we build towards

Basel III and satisfy other regulatory requirements.

Building stronger businesses

One of ING Bank’s priorities is to generate capital

andreach a core Tier 1 ratio of at least 10% by 2013.

From2013, the Bank aims for moderate balance sheet

growth in line with GDP growth and a strong focus

on deposits generation. ING Insurance/IM will continue

to focus on its customers and distributors by providing

exemplary products and service, as it restructures

in preparation for a stand-alone future.

CREATING STRONGER STAND-ALONE BUSINESSES

Strategic priorities

Our strategic priorities are to strengthen the company’s

financial position, to restructure, to streamline the

business portfolio, to repay the Dutch state aid and

to build stronger banking and insurance/investment

management businesses, all based on sound business

ethics and good corporate citizenship.

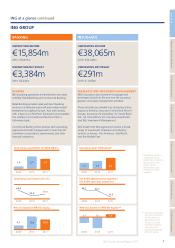

Strong financial position

Solid earnings and a strong capital and funding position

enable ING to support its customers also in uncertain

times. On the banking side the core Tier 1 ratio, a key

measure of financial strength, was at 9.6% at the

end of 2011. ING Insurance/Investment Management’s

(IM) operating resultsmostly showed improvement

throughout 2011.

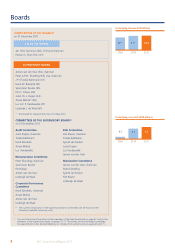

Restructuring and streamlining on track

The restructuring of the Group is on track, with

our banking and insurance/investment management

businesses operating as stand-alone companies from

January 2011. Further progress on separation projects

and divestments was made throughout 2011.

6ING Group Annual Report 2011

ING at a glance