ING Direct 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

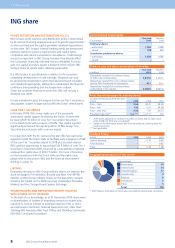

ING ENTERING INTO TRANSACTIONS WITH

THE DUTCH STATE

The rapidly worsening conditions following the summer of 2008

fuelled an internationally recognised belief that capital requirements

for financial institutions had to be raised. In order to create a strong

buffer to navigate the challenging environment, ING therefore

decided to strengthen its capital position in October 2008 by

issuing EUR 10 billion of core Tier 1 securities to the Dutch State.

Under the terms of the agreement we obtained the right to buy

back all or some of the securities at any time at 150% of the issue

price. In addition, we obtained the right to convert all or some of

the securities into (depositary receipts for) ordinary shares on a

one-for-one basis, from three years after the issuance onwards.

It was also agreed that should ING choose to do so, the Dutch

State would be able to opt for repayment of the securities at

EUR 10 each in cash. The coupon on the core Tier 1 securities will

only be payable if a dividend – either interim or final – was paid on

common shares over the financial year preceding the coupon date.

This transaction enabled ING to strengthen its capital position

significantly.

In the fourth quarter of 2008 market conditions deteriorated even

further, making it the worst quarter for equity and credit markets in

over half a century. Market prices for residential mortgage-backed

securities (RMBS, including Alt-A classified RMBS), collateralised

debt obligations (CDOs) and collateralised loan obligations (CLOs)

fell sharply as liquidity dried up. This eventually affected ING’s

results and equity more than expected, in particular due to ING’s

portfolio of Alt-A RMBS. We therefore entered into an agreement

with the Dutch State on an Illiquid Assets Back-up Facility (IABF)

covering 80% of our Alt-A RMBS.

Under the terms of the IABF, a full risk transfer to the Dutch State

was realised on 80% of our approximately EUR 30 billion par value

portfolio of Alt-A RMBS at ING Direct USA and ING Insurance

Americas. As a consequence, the Dutch State now participates in

80% of any results of the portfolio. The risk transfer took place at

a discount of 10% of par value. In exchange, the Dutch State was

to pay a funding fee and principal payments on two Government

receivables to ING. The first receivable initially had a funding fee

of 3.5%, the second receivable initially had a funding fee of Libor

+50 basis points (please note that these fees were revised following

discussions with the European Commission, which will be discussed

below). ING remained the legal owner of 100% of the securities

with an exposure of 20% to the portfolio’s results. The transaction

significantly strengthened ING’s capital and balance sheet as it

resulted in a reduction of equity volatility. Moreover, it had a

positive impact on shareholders’ equity amounting to EUR 5 billion

through a reduction of the negative revaluation reserve.

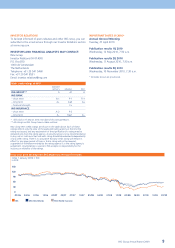

BACK TO BASICS

FIRST PHASES

In April 2009 we introduced our Back to Basics programme:

a strategic change programme to stabilise the Company, restore

credibility and regain trust, with the ultimate objective of

sharpening focus and creating a more coherent set of activities.

First, the implementation of the programme involved a series of

measures to strengthen the Company’s financial position through

cost containment, reductions of risk and capital exposures, and

deleveraging the balance sheet by reducing asset exposures and

preserving equity.

Over the course of 2009 we completed this first phase of our Back

to Basics programme, exceeding each of the targets set. Operating

expenses were reduced by EUR 1.5 billion, exceeding both the

original target of EUR 1 billion as well as the increased target

of EUR 1.3 billion on a comparable basis, of which approximately

EUR 1.2 billion represent sustainable savings and EUR 0.3 million

were one-off items. The expense figures have been adjusted for

acquisitions and divestments, as well as impairments on real estate

development projects and the charge for the Dutch deposit

guarantee scheme related to DSB Bank. Headcount reductions

totalled 11,331, including divestments, surpassing the expected

reduction of 7,000 FTEs. Derisking measures progressed well and

continued in the fourth quarter. ING Direct sold EUR 0.8 billion of

its US prime RMBS portfolio, realising a loss of EUR 83 million, but

releasing EUR 7 billion of risk-weighted assets. Deleveraging of the

bank’s balance sheet also exceeded the original target, reaching

EUR 194 billion, or 18.0%, compared with the end of September

2008 when the balance sheet reductions began.

Secondly, we announced a strategic review of our portfolio with

the objective of identifying measures to simplify the Group,

increase our strategic focus and create a more coherent set of

activities. In order to simplify the organisation, we decided to

operationally separate the management of our businesses, into

one Bank aiming for an integrated balance sheet and one Insurer/

Investment Manager under the umbrella of the Group. In addition,

the portfolio review made clear that a group of smaller businesses

within ING Group consumed a disproportionate amount of capital,

given the fact that they did not have a clear outlook for market

leadership. To address this over-extension, we made a number

of portfolio choices based on market leadership, capital intensity,

return on capital, funding needs, earnings contribution and the

overall coherence of the Group.

We decided to reduce our geographic and business scope by

concentrating on positions in markets with the strongest franchises.

As a consequence, we announced and completed a number of

significant divestments over the course of 2009. These included our

Annuities business in Argentina, ING Canada, our life insurance and

wealth management venture in Australia and New Zealand, Private

Banking Switzerland, Private Banking Asia, ING Reinsurance US,

three of our US independent retail broker-dealer units, and our

Annuity and Mortgage businesses in Chile. The proceeds of these

divestments amounted to EUR 3.8 billion and freed up EUR 2.7

billion of capital.

In July, we announced that the formerly separate organisations

of Nationale-Nederlanden, RVS and ING Verzekeren Retail

(formerly Postbank Verzekeren) in the Netherlands were to be

combined into one customer-oriented organisation under the

Nationale-Nederlanden brand. The new insurance organisation

will have dedicated business units for retail customers, small and

medium-sized enterprises, and corporate clients.

Meanwhile, we managed to turn around our commercial

performance. While implementing the first phases of the Back to

Basics programme and redefining the strategic direction of the

ING Group Annual Report 2009 11