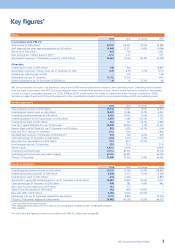

ING Direct 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ING share

PROFIT RETENTION AND DISTRIBUTION POLICY

ING Group’s profit retention and distribution policy is determined

by its internal financing requirements and its growth opportunities

on the one hand and the capital providers’ dividend expectations

on the other. ING Group’s internal funding needs are determined

partly by statutory solvency requirements and capital ratios,

compliance with which is essential to its existence. Credit ratings

are just as important to ING Group, because they directly affect

the Company’s financing costs and hence profitability. For their

part, the capital providers expect a dividend which reflects ING

Group’s financial results and is relatively predictable.

It is ING’s policy to pay dividends in relation to the long-term

underlying development of cash earnings. Dividends can only

be declared by shareholders when the Executive Board considers

such dividends appropriate, taking into consideration the financial

conditions then prevailing and the longer-term outlook.

Given the uncertain financial environment, ING will not pay a

dividend over 2009.

In case a dividend is paid, the coupon on the core Tier 1 securities is

also payable, subject to approval by DNB (the Dutch central bank).

CORE TIER 1 SECURITIES

In October 2008, ING Group made use of the previously

announced capital support facilities by the Dutch Government

by issuing EUR 10 billion of core Tier 1 securities (‘Securities’)

to the Dutch State with a coupon of 8.5%. This capital injection

significantly enhanced the capital position of ING Group. The

Securities are pari passu with common equity.

In conjunction with the EC restructuring plan ING has reached an

agreement with the Dutch State to facilitate early repayment of half

of the core Tier 1 securities issued in 2008 plus accrued interest.

ING used the opportunity to repurchase EUR 5 billion of core Tier 1

securities in December 2009, financed by a successfully completed

underwritten rights issue of EUR 7.5 billion. For more information

on the transactions with the Dutch State and the rights issue,

please refer to the section ‘ING and the financial environment’

starting on page 10.

LISTINGS

Depositary receipts for ING Group ordinary shares are listed on the

stock exchanges of Amsterdam, Brussels and New York (NYSE).

Options on ING Group ordinary shares (or the depositary receipts

therefor) are traded on the NYSE Euronext Amsterdam Derivative

Markets and the Chicago Board Options Exchange.

SHAREHOLDERS AND DEPOSITARY-RECEIPT HOLDERS

WITH STAKES OF 5% OR MORE

To the best of our knowledge, as at 31 December 2009, there were

no shareholders or holders of depositary receipts for shares who

reported to hold an interest or potential interest of 5% or more

as mentioned in the Dutch Financial Supervision Act, other than

Stichting ING Aandelen (ING Trust Office) and Stichting Continuïteit

ING (ING Continuity Foundation).

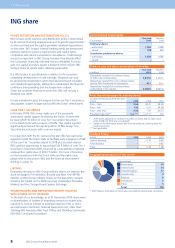

Authorised and issued capital

in EUR millions

Year-end

2009

Year-end

2008

Ordinary shares

– authorised 1,080 1,080

– issued 919 495

Cumulative preference shares

– authorised 1,080 1,080

– issued ––

Shares in issue and shares outstanding in the market

in millions

Year-end

2009

Year-end

2008

(Depositary receipts for) ordinary shares

of EUR 0.24 nominal value 3,831.6 2,063.1

(Depositary receipts for) own ordinary shares

held by ING Group and its subsidiaries 47.1 36.5

(Depositary receipts for) ordinary shares

outstanding in the market 3,784.5 2,026.6

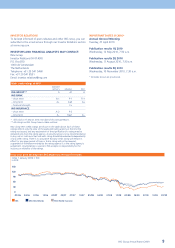

Prices depositary receipts for ordinary shares*

Euronext Amsterdam by NYSE Euronext

in EUR 2009 2008 2007

Price – high 9.64 26.21 34.69

Price – low 1.92 5.33 24.38

Price – year end 6.90 7.33 26.75

Price/earnings ratio** n.a.*** n.a.*** 6.2

* 2009 prices adjusted for increase in number of shares due to rights issue,

while 2008 and 2007 are not adjusted.

** Based on the share price at year-end and net profit per ordinary share for

the financial year.

*** Not applicable.

Dividend history

in EUR 2009 2008 2007

Interim dividend –0.74 0.66

Final dividend ––0.82

Total –0.74 1.48

* 2009 figures, estimated on information provided by several large custodians.

Geographical distribution of ING shares*

in percentages

Netherlands 34

United States 24

United Kingdom 17

Luxembourg 9

Belgium 6

Switzerland 5

Other 5

Total 100

1.1 Who we are

ING Group Annual Report 2009

8