ING Direct 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ING Group Annual Report 2008

19

For many years, as part of its capital management policy, RAROC

methodology and transfer pricing business model, ING Bank has

used a system of capital investment rules and of capital charging

and benefits to manage the balance sheet and make business

results comparable. Capital is invested credit risk free (notionally)

and the returns on the assets in the capital book are charged away

from the business units in return for the euro risk free rate on the

Economic Capital they employ. Business units with this method

become insensitive to the local capital they actually hold but

become sensitive to the Economic Capital they employ. Capital

can no longer be used as free funding to support earnings.

This management accounting method makes all business units

comparable as it includes the adjusted return over Economic

Capital, irrespective of the amount of capital they hold and

currency conditions they operate in. This then facilitates optimal

allocation of capital as the returns on Economic Capital reported

by the business units are comparable.

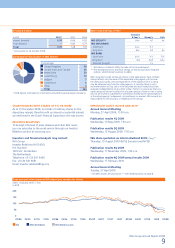

CAPITAL MARKET OPERATIONS

In 2008, the following issues were done:

For ING Groep N.V.

EUR 10,000 million core Tier-1 securities•

EUR 1,000 million 5-year senior unsecured bond•

EUR 1,500 million hybrid Tier-1 capital in retail market•

USD 2,000 million hybrid Tier-1 capital in retail market, fixed rate•

For ING Bank N.V.

EUR 1,000 million 5-year covered bond•

EUR 4,000 million 2-year senior unsecured bond•

EUR 2,000 million 10-year covered bond•

EUR 3,500 million 3-year senior unsecured bond•

EUR 1,000 million lower Tier-2•

GBP 800 million lower Tier-2•

USD 1,250 million extendible, institutional market•

LIQUIDITY FACILITIES

Although demand from international investors for securitised

assets has all but disappeared and securitisations of a bank’s own

assets have become less effective under Basel II, 2008 was a very

active year for securitisations. Under Basel I the sale of (super)

senior tranches of securitisations to investors led to a significant

reduction of RWAs on the bank balance sheet without a significant

transfer of risk taking place. This arbitrage is no longer possible

under Basel II. Also, after the summer of 2007 the market for

securitisations dried up, even for the most highly rated senior

tranches of securitisations. However, lack of liquidity in the

unsecured money markets has since then raised the demand for

eligible collateral and this has created a new use for securitisations.

The transaction can be summarised as follows: a bank sells a pool

of mortgages to a Special Purpose Vehicle (SPV). The SPV issues

secured notes in two tranches, one subordinated tranche and one

senior tranche, the latter rated AAA by the rating agencies. The

bank buys both tranches, but can now use the AAA-rated tranche

as collateral in the money market for secured borrowings. With

the securitisation, illiquid assets have thus become to a large extent

liquid. The Basel II RWAs of the bank remain unchanged. During

2008, ING Bank created a number of these securitisations through

which in total approximately EUR 70 billion of AAA-rated notes

were created. Own-originated mortgages in the Netherlands were

used as the underlying assets. Apart from the structuring and

administration costs these securitisations are P&L neutral.

ACQUISITIONS AND DIVESTMENTS

In 2008, the acquisitions and divestments of ING Group balanced

in terms of transaction value. Total divestments in the amount

of EUR 1.5 billion comprised mainly of the sale of the Mexican

non-core insurance business to AXA and the sale of our Taiwanese

life insurance business to Fubon Financial Holding (closed on

11 February 2009). Furthermore, we closed the sale of NRG

to a subsidiary of Berkshire Hathaway in June 2008 which was

announced in December 2007. In South Korea we sold our 20%

stake in the asset management joint-venture KBAM to KB Financial

Group while we acquired the remaining 14.9% in ING Life Korea

from Kookmin Bank. ING and KB Financial Group remain

committed to their strategic partnership in Korea via the 49%

stake in KB Life Insurance while ING increased its stake in KB

Financial Group to 5.05%. Add-on acquisitions amounted to a

value of about EUR 1.3 billion in 2008 and include the acquisition

of CitiStreet in the US, Interhyp in Germany and Oyak Emiklilik

in Turkey.

On 19 February 2009 we completed the sale of our stake in ING

Canada via a secondary offering for proceeds of CAD 2.2 billion

(EUR 1.35 billion).