ING Direct 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ING Group Annual Report 2008

13

Financial highlights

Results impacted by dislocation in financial markets

In 2008, ING’s results were adversely impacted by the

global financial crisis. The sharp market deterioration led

to significant impairments and negative revaluations

across almost all asset classes. Several steps were taken to

strengthen ING Group’s capital position, including a capital

support facility of EUR 10 billion by the Dutch State. ING

also actively reduced risk exposures. The turmoil in financial

markets caused a sharp decline in results for ING’s insurance

operations. At the same time, the banking business reported

positive net results despite the challenging circumstances.

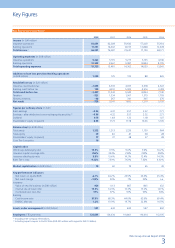

GROUP RESULTS

Total net result decreased from EUR 9,241 million in 2007 to

EUR -729 million. Underlying net result, which is defined as total

net result excluding the impact of divestments and special items,

decreased from EUR 9,172 million to EUR -171 million. Underlying

result before tax decreased from EUR 11,080 million to EUR -786

million. Extreme market volatility and sharp declines in asset prices

triggered impairments and fair value changes of EUR 5,081

million, of which EUR 2,599 million related to pressurised assets

and EUR 1,707 million to equity securities. The remainder was

attributable to impairments on other debt securities, including

financial institutions’ debt.

Globally, real estate prices fell noticeably in 2008, leading

to negative revaluations on real estate and impairments on

development projects of EUR 1,184 million. Negative revaluations

on private equity were EUR 399 million. Other impacts stemming

from the weak financial landscape were EUR -162 million, including

deferred acquisition cost unlocking and hedge losses, partly

compensated by capital gains on equity securities. The weakening

of most currencies against the euro during 2008 had a negative

impact of EUR 163 million on net underlying result. Earnings per

share decreased to EUR -0.36 from EUR 4.32.

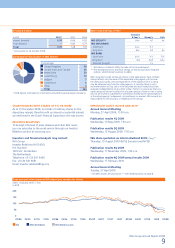

Commercial performance

Underlying result before tax of the Insurance operations decreased

to a loss of EUR 1,235 million in 2008 from a profit of EUR 6,113

million in 2007. The sharp decline in results was mainly due to the

financial market deterioration in the second half of 2008. However,

the reported decline in 2008 is somewhat distorted by the fact

that EUR 2,087 million in capital gains were booked in 2007.

Underlying result before tax of the Banking operations declined by

91.0% to EUR 449 million. Retail Banking and Wholesale Banking

remained profitable, while ING Direct turned to a loss of EUR 1,125

million due to impairments on pressurised assets.

Measured over the full-year 2008, net production of client

balances was EUR 93 billion, excluding currency impacts. Including

the impact of currency effects, total client balances remained

stable at EUR 1,455 billion compared with the previous year.

Client savings and deposits accounted for EUR 21 billion of the

net production (excluding currency effects), EUR 12 billion of which

was attributable to retail customers. At Insurance, positive net

production of client balances was generated by all business lines

as inflows in life insurance and retirement services more than

offset outflows in third-party assets under management.

Overall, lending growth was robust in 2008, despite a fourth

quarter decline in all markets except for the Netherlands. Of the

client balance net production, bank lending contributed EUR 59

billion in 2008, excluding currency effects.

Bringing expenses in line with operating environment

Underlying operating expenses (i.e. excluding the impact of

divestments and special items) from Insurance operations

decreased 0.6%. Underlying operating expenses from Banking

operations increased 5.0% to EUR 10,002 million mainly at Retail

Banking (due to the inclusion of ING Bank Turkey, formerly Oyak

Bank) and ING Direct.

Contribution business lines to underlying result,

excluding market volatility and risk costs

in percentages

Insurance Europe 15

Insurance Americas 17

Insurance Asia/Pacific 6

Wholesale Banking 26

Retail Banking 24

ING Direct 12

Total 100

ING results 2008*

Year-end 2008

in EUR million Bank Insurance Group

Underlying result, excluding

market volatility and risk costs 5,263 2,057 7,319

Impairments and FV changes on

pressurised assets –2,039 –560 –2,599

Impairments on equity securities –331 –1,376 –1,707

Impairments on other debt securities –255 –520 –775

Impairments and losses –2,625 –2,455 –5,081

Revaluations on real estate/

impairments on development projects –732 –452 –1,184

Revaluations on private equity –399 –399

Revaluations –732 –851 –1,583

Equity capital gains/equity hedge 30 1,181 1, 211

Equity related DAC unlocking –567 –567

FX hedge/Other –206 –600 –806

Other market impacts –176 14 –162

Risk costs Bank –1,280 –1,280

Underlying result before tax 449 –1,235 –786

Tax and third-party interests 273 343 615

Underlying net result 722 –893 –171

Divestments and special items –267 –291 –558

Total net result 454 –1,183 –729

* Numbers may not add up due to rounding.