ING Direct 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ING Group Annual Report 2008

8

1.1 Who we are

Information for shareholders (continued)

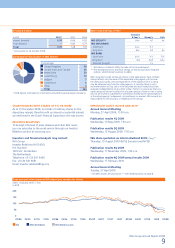

PROFIT RETENTION AND DISTRIBUTION POLICY

ING Group’s profit retention and distribution policy is determined

by its internal financing requirements and its growth opportunities

on the one hand and the capital providers’ dividend expectations

on the other. ING Group’s internal funding needs are determined

partly by statutory solvency requirements and capital ratios,

compliance with which is essential to its existence. Credit ratings

are just as important to ING Group, because they directly affect

the company’s financing costs and hence profitability. For their

part, the capital providers expect a dividend which reflects ING

Group’s financial results and is relatively predictable. Following the

capital injection from the Dutch State, ING maintains full discretion

to determine its dividend on ordinary shares.

ING Group has announced that it will not pay a final dividend in

May 2009 over the year 2008. Given the intensity of the crisis, it

is difficult to foresee whether ING Group will be in a position to

pay a dividend in 2009. The interim dividend for 2009 will not

automatically be half of the total dividend of 2008.

ING Group will continue to pay dividends in relation to underlying

cash earnings, and will take a balanced approach to dividends in

a careful and conservative manner in the next few years.

Core Tier-1 securities

In October 2008, ING Group took advantage of previously

announced capital support facilities by the Dutch Government by

issuing EUR 10 billion of core Tier-1 (‘Securities’) to the Dutch State

with a coupon of 8.5%. This capital injection significantly

enhanced the capital position of ING Group. The Securities are pari

passu with common equity (there is no claim, even in liquidation).

When a dividend is paid, however small, the coupon on the

Securities is also payable, albeit only with the permission of DNB

(the Dutch central bank). More information on the Securities and

the relation between dividend on common shares and the coupon

on the Securities is available in the Capital management section,

starting on page 16.

Share buy-back programme

On 16 May 2007, ING announced a share buy-back programme

to purchase ordinary shares (or depositary receipts for such shares),

with a total value of EUR 5 billion over a period of 12 months,

beginning in June 2007. On 23 May 2008, ING Group announced

that it had completed the share buy-back programme. Under the

programme, ING has repurchased 183,158,017 ordinary shares

(or the depositary receipts therefor) in the market for a total

consideration of EUR 4,903,355,838.50, bringing the average

purchase price for the total programme to EUR 26.77. The

repurchased shares were cancelled in accordance with approval

obtained at the 2008 annual General Meeting.

Preference A shares

On 5 March 2008, ING announced the tender offer for the

6,012,839 issued and outstanding preference A shares (or the

depositary receipts therefor) of ING Groep N.V., with a nominal

value of EUR 1.20 each. The purchase price for each share offered

in accordance with the Tender Offer was EUR 3.60, or EUR 21.6

million in total. The purpose of the buy-back of the preference

A shares was to simplify the corporate ownership and capital

structure of ING on a one-share-one-vote basis and to optimise its

capital structure. The tender period ended on 26 June 2008 and

all preference A shares (or the depositary receipts therefor) were

cancelled in accordance with the resolution of ING’s General

Meeting held on 22 April 2008.

LISTINGS

In November 2008, ING Group announced its intention to

concentrate the trading of its shares (or the depositary receipts

therefor) on the stock exchanges in Amsterdam, Brussels and

New York (NYSE). Accordingly, ING has sought voluntary delisting

of shares from the stock exchanges in Frankfurt, Paris and

Switzerland. All relevant authorities and exchanges have approved

the applications to delist and trading was halted as of 20 January

2009 in Paris, as of 26 February 2009 in Frankfurt and as of

3 March 2009 in Switzerland. Options on ordinary shares

ING Group (or the depositary receipts therefor) are traded at

the NYSE Euronext Amsterdam Derivative Markets and the

Chicago Board Options Exchange.

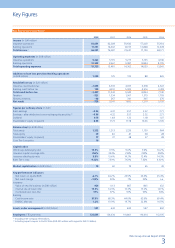

Authorised and issued capital

in millions

Year-end

2008

Year-end

2007

Ordinary shares

– authorised 1,080 720

– issued 495 534

Preference shares

– authorised 360

– issued 19

Cumulative preference shares

– authorised 1,080 1,080

– issued ––

Shares in issue and shares outstanding in the market

in millions

Year-end

2008

Year-end

2007

(Depositary receipts for) ordinary shares

of EUR 0.24 nominal value 2,063.1 2,226.4

(Depositary receipts for) own ordinary shares

held by ING Group and its subsidiaries 36.5 126.8

(Depositary receipts for) ordinary shares

outstanding in the market 2,026.6 2,099.6

(Depositary receipts for) preference shares

of EUR 1.20 nominal value 16

(Depositary receipts for) own preference shares

held by ING Group and its subsidiaries 10

(Depositary receipts for) preference shares

outstanding in the market 6

Prices depositary receipts for ordinary shares

Euronext Amsterdam by NYSE Euronext

in EUR 2008 2007 2006

Price – high 26.21 34.69 35.95

Price – low 5.33 24.38 27. 82

Price – year end 7.33 26.75 33.59

Price/earnings ratio* n.a.** 6.2 9.4

* Based on the share price at year-end and underlying net profit per ordinary

share for the financial year.

** Not applicable.