ING Direct 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 ING Direct annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ING Group Annual Report 2008

1.2 Report of the Executive Board

18

Capital management (continued)

Available for sale assets are marked to market through

Shareholders’ equity whilst liabilities are booked on an

amortised cost basis. If ING Group were to mark its financial

liabilities (senior term debt, dated subordinated debt and hybrids)

to market, approximately EUR 12 billion would be added to

Shareholders’ equity at the end of 2008. Adjusted equity

improved by EUR 1 billion in spite of the decline in Shareholders’

equity because of an increase in hybrid Tier-1 capital, the capital

injection from the Dutch State and the adding back of the

revaluation reserve.

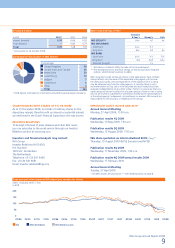

KEY CAPITAL AND LEVERAGE RATIOS

Group leverage, defined as equity investments into Bank and

Insurance from Group minus adjusted Group equity, increased

from EUR 5 billion to EUR 7 billion or, in other words, from 9.5% to

13.5%. Group paid out EUR 3 billion in dividends to shareholders

and EUR 2 billion on the remainder of the share buy-back. Group

injected EUR 2.95 billion into Bank and EUR 2.65 billion into

Insurance during the year. As indicated, Group also received

a capital injection from the Dutch State of EUR 10 billion.

Group raised EUR 1.5 billion and USD 2 billion of hybrid Tier-1

capital during 2008. The EUR issue was on-lent to Insurance and

Bank on a 50/50 basis. The USD issue was on-lent to Insurance and

Bank on a 75/25 basis. Also during the year a net USD 600 million

of hybrids were moved from Bank to Insurance.

Tier-1 capital at Bank increased from EUR 30 billion to EUR 32

billion, although the definition of Tier-1 capital changed, moving

from Basel I to Basel II. Basel II Tier-1 capital is approximately

EUR 1 billion less than Basel I Tier-1 due to different deduction

rules. Net profit in Bank was approximately EUR 0.5 billion. RWAs

grew by 17% from EUR 293 billion at the start of the year to

EUR 343 billion at the end of the year. Basel I RWAs grew by

18% from EUR 403 billion to EUR 477 billion at the end of the year.

The nominal balance sheet of Bank increased from EUR 994 billion

to EUR 1,030 billion, only 4%. The difference between nominal

balance sheet growth and the growth of RWAs can be explained

by the relative reduction of money market activities. Nominal

lending by Bank grew from EUR 526 billion to EUR 598 billion, an

increase of 14%.

The debt/equity ratio of Insurance decreased from 14% to 9%

in spite of significant capital injections into operating subsidiaries

throughout the year, especially in the fourth quarter. The amount

was a net EUR 4 billion, compensated, however, by capital

injections from Group and the on-lending of hybrid Tier-1 capital.

At the end of the year Insurance had a hybrid ratio slightly above

the 25% target.

AVAILABLE FINANCIAL RESOURCES

AND ECONOMIC CAPITAL

Increasingly ING looks at Available Financial Resources (AFR) and

Economic Capital (EC) employed when managing capital. These

concepts come from our internal risk management models.

EC is a measure for the totality of risks run in the company over

a one-year time horizon and with a AA confidence interval of

99.95%. AFR equals market value of assets minus market value

of liabilities, excluding hybrids issued by ING Group which are

counted as capital. At ING Bank the proxy for AFR is Tier-1 capital

with certain adjustments, in the absence of a full market value

balance sheet for ING Bank. AFR should exceed EC for both ING

Bank and ING Insurance. EC for ING Group is defined as EC ING

Bank plus EC ING Insurance minus the diversification benefit. The

diversification is partially due to opposite interest rate positions in

ING Bank and Insurance and is prudently estimated at 15%. AFR

ING Group equals AFR ING Bank plus AFR ING Insurance minus

core debt ING Group. The target is that ING Group AFR should be

at least 120% of ING Group EC. It is policy that any buffer should

be able to be deployed with maximum flexibility and therefore be

kept centrally. Free surplus is defined as the difference between

AFR and EC.

AFR Bank increased from EUR 32 billion to EUR 35 billion during

the year. The capital injections from Group to Bank more than

compensated the loss for the year. EC Bank increased from

EUR 18 billion to EUR 22 billion, given the increase in RWAs and

also a methodology change. Interest rate risk resulting from the

investment of capital is now included in the calculation. The free

surplus at Bank declined from EUR 14 billion to EUR 13 billion.

AFR Insurance declined in light of the adverse market

circumstances (higher credit spreads, lower interest rates and lower

equity markets) and the incurred loss of over EUR 1 billion from

EUR 23 billion to EUR 14 billion during the year. EC Insurance,

however, decreased as well from EUR 23 billion to EUR 14 billion,

given the sale of ING Life Taiwan and other actions implemented

to reduce risk in spite of lower interest rates. This means that there

was a small free surplus at Insurance at the end of the year. AFR

and EC are adjusted to reflect illiquidity in the insurance portfolios

as reporting AFR and EC with MVLs discounted at swap rates

results in an asymmetry between the assets and liabilities in terms

of reflection of illiquidity premiums. This has been approximated

by applying a AAA covered bond spread to the valuation of the

insurance liability cash flows, adjusted for the US and Japan with

the difference between the local AAA corporate spreads and the

European corporate spreads. At year-end 2007 the swap rate

was used.

AFR ING Group decreased from EUR 50 billion to EUR 42 billion

during 2008, while EC ING Group decreased from EUR 36 billion

to EUR 31 billion. Thus the free surplus declined from EUR 14

billion to EUR 11 billion. This means that the capital buffer

decreased from 138% at the end of 2007 to 137% at the end of

2008. Going forward we expect the AFR and EC numbers, given

that they are market value based, to continue to be quite volatile.

THE INVESTMENT OF CAPITAL AND THE METHOD

OF CHARGING FOR IT

Banks have developed methods of partitioning the balance sheet’s

assets and liabilities in books where assets are matched against

liabilities. This allows for more granular risk management of the

balance sheet. The surplus assets that offset equity are separated

and it is good practice for these assets to be (at least notionally)

invested risk free. This stems from the idea that risks are best run

(with the most return) in the business and that the surplus assets

representing equity are there to support the business risks and

should not themselves be at risk. Insurance companies have

developed this discipline of matching assets against liabilities and

equity to a much lesser extent, in part due to the fact that the

time horizons of insurers are longer than those of banks.