Huntington National Bank 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

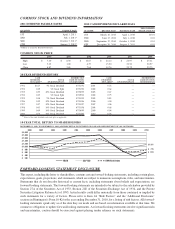

losses to return to more normalized levels earlier than some other banks. But 2011 earnings performance is

not all about the impact of the expected improvement in credit quality.

We also expect earnings will benefit from growth in net interest income. The net interest margin is

expected to be flat to up slightly from the 2010 fourth quarter level of 3.37%. Helping the net interest margin

should be the continued benefit from lower deposit pricing, the ongoing shift in our deposit mix more toward

lower-cost demand deposit accounts, and continued disciplined loan pricing. In addition, the absolute growth

in loans compared with deposits is anticipated to be more comparable, thus reducing growth in lower-yield

investment securities. The automobile loan portfolio is expected to continue its strong growth, and we

anticipate continued growth in commercial and industrial, as well as small business loans. Commercial real

estate loans are expected to continue to decline, though at a slower rate. Home equity and residential

mortgages are likely to show only modest growth. Core deposits are expected to show continued growth.

Fee income is expected to be negatively impacted by a full-year’s impact of Reg E, lower interchange

fees, and a decline in mortgage banking revenues. In contrast, other fee categories are expected to grow,

reflecting the impact of our cross-sell initiatives throughout the company, as well as the positive impact from

strategic initiatives. We anticipate overcoming the regulatory and economic challenges with additional revenue

generated by accelerating customer growth and cross-sell results over time. Expense levels early in the year

should be up modestly from 2010 fourth quarter performance, with increases later in the year due to continued

investments to grow the business.

Taking all of the noncredit-related factors into consideration, we anticipate that our 2011 pre-tax, pre-

provision income will remain relatively stable with that of the second half of 2010, or about $260-$265 million

per quarter. We anticipate a return to growing our pre-tax, pre-provision earnings in 2012, if not sooner.

A couple of comments on earnings per share performance are important since the issuance of the

$920 million of common equity that helped us repurchase our TARP capital resulted in the distribution of

146.0 million shares of common stock. Normally, such an increase in the number of shares would be expected

to be dilutive to reported earnings per share. However, since we no longer have to pay the TARP dividend, we

expect a slight lift to reported 2011 earnings per share. At its 5% rate, TARP capital dividends were reducing

earnings per share by $69.9 million annually. While this was not reflected in our income statement, it did

reduce our net income applicable to common shares. Since receiving the TARP capital in late 2008, we paid

the U.S. Department of the Treasury $147.2 million in dividends. These TARP dividends and their negative

earnings per share impact are gone. As a result, many investors viewed our common equity issuance as a

positive despite the increase in shares outstanding. We believe this was confirmed by the 3% increase in our

stock price from December 14, 2010, the date of the common stock issuance, through year end.

From an earnings perspective, 2011 is a transitional year. We anticipate being able to report growth in net

income, while the positive impacts from our continued investments in strategic initiatives and “Fair Play”

banking philosophy gain traction. The hard work over the last two years in aggressively addressing our credit

and capital issues while growing revenue is paying off. We have the capacity to transition the company to one

better positioned for consistent long-term performance. We have been able to make long-term investments at a

time when a number of our peers have not or cannot. We believe 2011 represents a window of opportunity to

continue to significantly and positively differentiate Huntington from other banks. We are taking advantage of

this opportunity to position Huntington for breakaway financial performance. We believe we can win, and win

big.

Capital Management

With our TARP capital now repaid, the Board of Directors is working through the development of a

comprehensive capital management strategy. This will define how much of our capital we should allocate to

various capital management actions. Dividends is one aspect. Stock buybacks is another. Further, we remain

convinced that over time, opportunities will arise to acquire other banks or make investments in businesses. A

prudent example of using our capital to the benefit of our shareholders was our repurchase of the TARP-

related warrant in January 2011, which removes a future dilution overhang.

5