Huntington National Bank 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

make up for this lost revenue, some banks have raised fees, eliminated free checking, or taken other

customer-unfriendly actions. Our view is that such actions will only further frustrate and alienate

banking customers. Consistent with our “Fair Play” banking philosophy, in September, we introduced

24-hour Grace

TM

on personal overdraft fees. This gives consumers until the next business day to correct

an overdraft balance in their account and avoid an overdraft fee. Customers are responding very

positively, with this contributing to our higher than expected growth in consumer households. In 2009,

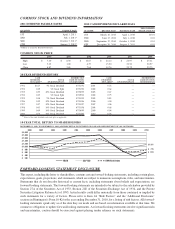

service charge on deposit accounts represented 12% of total revenue. This dropped to 10% of total

revenue in 2010, reflecting a $20.1 million decline in the second half of last year as Reg E was

implemented in August. In 2011, we face a full-year’s impact, which we estimated could be as much

as $45 million.

Durbin Amendment — When the Dodd-Frank Wall Street Reform and Consumer Protection Act

(Dodd-Frank Act) was passed last year, an amendment was added at the last moment, the Durbin

Amendment. This amendment instructed the Federal Reserve to establish the rate merchants pay banks

for electronic clearing of debit card transactions (i.e., the interchange rate). Interchange fees accounted

for about $90 million, or just over 80%, of our electronic banking income last year, our fourth largest

fee income activity. In the fourth quarter, the Federal Reserve put out a proposal for comment that

would cap the interchange rate at either $0.07 or $0.12 per transaction. While these rates are not

finalized, if they stand, we estimate that between 75%-85% of our interchange income could be lost.

The new rate is scheduled to take effect July 21, 2011. If enacted as proposed, this would represent a

significant earnings headwind with a loss of revenue of $68-$77 million annually.

Consumer Financial Protection Bureau (CFPB) — This bureau was also created by the Dodd-

Frank Act. It currently is in the process of being organized and staffed, and it is targeted to be

operational by July 2011. It will have extensive regulatory and enforcement powers over consumer

financial products and services. Exactly what rules, regulations, or requirements will ultimately be

mandated and their effect on banking and overall competitiveness is not known. But we believe they

are likely to result in further restrictions on fees and may mandate changes in product offerings.

•A stable economic environment that may begin to expand. Our markets appear to have stabilized. It

was encouraging to see some economic growth, especially toward the end of last year. Our most

profitable use of deposit growth is making loans. We saw growth in loans throughout 2010, and in fact,

we began growing loans earlier than many of our peers. Nevertheless, a lack of customer confidence to

borrow and invest in their businesses remains. As such, growth in deposits outstripped growth in loans.

Our profitability will benefit from more balance between the growth of deposits and loans.

•An increase in long-term interest rates late in 2010. The Federal Reserve has maintained a low

interest rate environment as part of its strategy to spur economic activity. During the fourth quarter,

long-term interest rates increased. This had a dramatic slowing effect on mortgage refinance activity as

the year ended. Last year’s $175.8 million in mortgage banking income was a banner year. It

represented 7% of total revenue, and it was our second largest fee income activity.

2011 Outlook

Borrower and consumer confidence remains a major factor impacting growth opportunities for 2011. We

continue to believe that the economy will remain relatively stable throughout the coming year, with the

potential for improvement in the latter half. Revenue headwinds as a result of environmental factors noted

above will represent challenges to earnings growth.

Nevertheless, we anticipate net income will grow throughout 2011.

The primary driver of net income growth is expected to come from a decline in provision for credit

losses. We anticipate the absolute levels of net charge-offs and nonperforming assets will continue to decline.

Provision for credit losses will likely decline faster than net charge-offs since much of the charge-offs are

expected to relate to loans with previously established reserves. Our credit quality metrics are improving

quickly and faster than those of many of our peers. As such, we expect the level of our provision for credit

4