Huntington National Bank 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The financial results for each of these business segments are included in Note 25 of Notes to

Consolidated Financial Statements and are discussed in the Business Segment Discussion of our MD&A.

Competition

Although there has been consolidation in the financial services industry, our markets remain competitive.

We compete with other banks and financial services companies such as savings and loans, credit unions, and

finance and trust companies, as well as mortgage banking companies, automobile and equipment financing

companies, insurance companies, mutual funds, investment advisors, and brokerage firms, both within and

outside of our primary market areas. Internet companies are also providing nontraditional, but increasingly

strong, competition for our borrowers, depositors, and other customers. In addition, our AFCRE segment faces

competition from the financing divisions of automobile manufacturers.

We compete for loans primarily on the basis of a combination of value and service by building customer

relationships as a result of addressing our customers’ entire suite of banking needs, demonstrating expertise,

and providing convenience to our customers. We also consider the competitive pricing pressures in each of our

markets.

We compete for deposits similarly on a basis of a combination of value and service and by providing

convenience through a banking network of over 600 branches and over 1,300 ATMs within our markets and

our award-winning website at www.huntington.com. We have also instituted new and more customer friendly

practices under our Fair Play banking philosophy, such as our 24-Hour Grace

tm

account feature introduced in

2010, which gives customers an additional business day to cover overdrafts to their consumer account without

being charged overdraft fees.

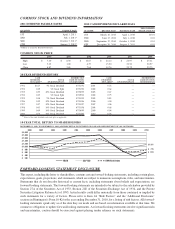

The table below shows our competitive ranking and market share based on deposits of FDIC-insured

institutions as of June 30, 2010, in the top 12 metropolitan statistical areas (MSA) in which we compete:

MSA Rank Deposits Market Share

(in millions)

Columbus, OH ..................................... 1 $9,124 22%

Cleveland, OH...................................... 5 3,941 8

Detroit, MI ........................................ 8 3,607 4

Toledo, OH ........................................ 1 2,306 23

Pittsburgh, PA ...................................... 7 2,270 3

Cincinnati, OH ..................................... 5 1,999 4

Indianapolis, IN..................................... 4 1,902 6

Youngstown, OH . . . ................................. 1 1,877 20

Canton, OH ........................................ 1 1,485 27

Grand Rapids, MI . . ................................. 3 1,280 10

Akron, OH ........................................ 5 886 8

Charleston, WV..................................... 3 604 11

Source: FDIC.gov, based on June 30, 2010 survey.

Many of our nonfinancial institution competitors have fewer regulatory constraints, broader geographic

service areas, greater capital, and, in some cases, lower cost structures. In addition, competition for quality

customers has intensified as a result of changes in regulation, advances in technology and product delivery

systems, consolidation among financial service providers, bank failures, and the conversion of certain former

investment banks to bank holding companies.

3