Huntington National Bank 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

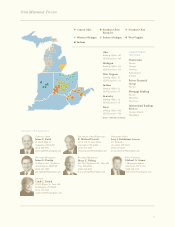

We have demonstrated our ability to grow loans and deposits.

Rich Porrello, Senior Vice President, Dealer Sales Regional Manager, 18 years experience in the financial services industry

Darlene Goldbach, Senior Vice President, Business Banking Market Manager, 15 years experience in the financial services industry

Russell Swan, Senior Vice President, Commercial Real Estate Team Leader, 29 years experience in the financial services industry

Increasing earnings is dependent on growing the franchise, of which a key component is the ability to grow loans and deposits.

Over the last two years, we have produced strong growth in residential mortgages, home equity loans and lines, middle

market commercial real estate loans, and small business loans.

Small businesses are the foundation to economic growth in our markets and are key to attracting additional business. Two

years ago we launched an initiative focused on meeting the needs of this segment. It has been a success. During 2004, small business

loans increased 12%, compared with a 9% growth rate in the previous year. In addition, small businesses often seek financial help

beyond just loans. This typically includes cash management services, which grows deposits and generates fee-based revenue.

Importantly, our deposit growth has been broad-based. Over the last three years, total deposits, a stable source for funding

loan growth, increased in every one of our key markets.

Our “local bank with national resources” positioning enables us to stay close to our customers, with loan and deposit

relationships being key elements. Increasingly, customers view Huntington as their essential financial partner. This builds loyalty,

and loyalty builds earnings.

12

Akron

Charleston

Holland-Grand

Haven

Indianapolis

Toledo

Grand Rapids

Cincinnati

Detroit

Cleveland

Columbus

Total Deposit Growth

(millions of dollars)

Small Business Loan Growth

(average in millions of dollars)

+9%

$5,658 +78%

$2,259 +40%

$2,142 +18%

$1,231 +44%

$1,114 +60%

$955 +17%

$559 +33%

$434 +12%

$419 +24%

$392 +28%

June 2004

June 2001

Why It Matters

Going Forward

$1,642

$1,787

$2,003

2002 2003 2004

+12%