Huntington National Bank 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We’re growing key customer relationships.

Terry Monahan, Vice President, Private Financial Group Portfolio Manager, 10 years experience in the financial services industry

Deborah Stein, Senior Vice President, Retail Group Executive, 21 years experience in the financial services industry

Opening a checking account is normally the first step in building a complete customer relationship. Until this past year,

we had seen little growth in consumer demand deposit households or small business demand deposit relationships, two very

important customer segments and both critical to our ability to expand the franchise.

Importantly, in 2004, the investments made over the last couple of years in associate sales and service training, as well

as technology upgrades to our front-line banking office capabilities, began to payoff.

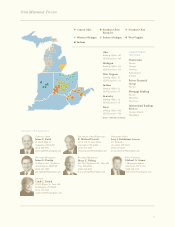

During 2004, our consumer household checking base grew. We now serve over 500,000 consumer checking account

households, a 2% improvement from the end of 2003. The small business checking account base now exceeds 50,000 relationships,

a 9% improvement.

Associate sales and service training, the opening of new banking offices, and the expansion of Internet and telephone

banking capabilities are all targeted at growing consumer and business relationships. Our success will be demonstrated by our

ability to attract new customers and deepen relationships with existing customers, both key drivers of expanding the franchise.

Small Business Relationships

10

Consumer Households

489,491

502,931

486,913

488,516

490,924

494,960

6/02 12/02 6/03 12/03 6/04 12/04

46,708

50,857

46,317

46,585

46,614

48,984

6/02 12/02 6/03 12/03 6/04 12/04

GROWING RETAIL CHECKING ACCOUNT RELATIONSHIPS(1)

Why It Matters

Going Forward

(1) Excludes sold banking offices.