Huntington National Bank 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPOR-

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTU-

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SER-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPOR-

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SER-

TUNITY PROVEN DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPOR-

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SER-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPOR-

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCI-

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUN

VICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST

TUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPLINE OPPORTUNITY PROVEN BEST SERVICE DISCIPL

Focused Leadership. Clear Results.

2004 ANNUAL REPORT

HUNTINGTON 2004 ANNUAL REPORT

Table of contents

-

Page 1

...E N I T Y P R O V E N B E S T S E RV I C E D I S C I P L I N E O P P O RT U N I T Y P R O V E N B E S T S E RV I C E D I S C I P L I N E O P P O RT U N I T Y P R O V E N B E S T S E RV I C E D I S C I HUNTINGTON 2 0 0 4 A N N U A L R E P O RT 2004 ANNUAL REPORT Focused Leadership. Clear Results. -

Page 2

... company headquartered in Columbus, Ohio. Its principal markets are Ohio, Michigan, West Virginia, Indiana, and Kentucky. Founded in 1866, Huntington serves its customers as the "local bank with national resources." More than 8,400 associates provide consumer and commercial banking, mortgage banking... -

Page 3

... annual report, along with a few faces of those who contribute to Huntington accomplishing more every day. To Our Shareholders and Friends: The winning momentum I noted in my letter to you last year continued throughout 2004. This momentum provided positive results for shareholders and customers... -

Page 4

... in average home equity loans and lines 12% growth in average small business loans 11% growth in average total middle market commercial real estate loans 21% year-end exposure to automobile loans and leases, down from 28% 9% growth in average core deposits excluding retail CDs 0.35% net charge-off... -

Page 5

...doing business with Huntington. We opened seven new banking ofï¬ces with seven more planned for 2005. We continued to make investments in the systems and technology supporting our Direct Bank customer service and sales call center. Last year our staff handled 20.3 million phone, e-mail, or Internet... -

Page 6

... and a half years ago, we began the transformation of Huntington into the "local bank with national resources." This model places decision-making in our local markets, close to customers. Regional presidents have accountability and responsibility for commercial and retail businesses within their... -

Page 7

... be service excellence. We want every customer to experience "Simply the Best" service in their Huntington relationships. Making that happen will take time, but we are making progress and Huntington associates are committed to get there. Closing Comments This past year saw a number of changes to... -

Page 8

... Net income per common share - diluted Cash dividends declared per common share Book value per share(1) PERFORMANCE RATIOS Return on average assets Return on average shareholders' equity Net interest margin(2) Efï¬ciency ratio(3) Tangible equity/assets ratio(1) CREDIT QUALITY MEASURES Net charge... -

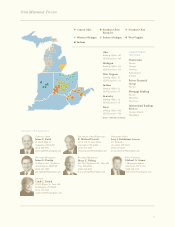

Page 9

...OFFICES Dealer Sales Florida Georgia Tennessee Pennsylvania Arizona Michigan Banking Ofï¬ces: 112 ATM Locations: 159 West Virginia Banking Ofï¬ces: 27 ATM Locations: 111 Indiana Banking Ofï¬ces: 21 ATM Locations: 59 Private Financial Group Florida Mortgage Banking Florida Maryland New Jersey... -

Page 10

... mortgages and home equity loans and lines increased to 35% from 22%. Further, and building on strengthened credit underwriting, review, and management of our commercial loans initiated two years ago, non-performing assets at the end of last year represented only 0.46% of total loans and leases... -

Page 11

Discipline E r n i e M a n u e l and Jack Freeman Middleburg Heights, Ohio Cleveland, Ohio 9 -

Page 12

... from the end of 2003. The small business checking account base now exceeds 50,000 relationships, a 9% improvement. Going Forward Associate sales and service training, the opening of new banking ofï¬ces, and the expansion of Internet and telephone banking capabilities are all targeted at growing... -

Page 13

Opportunity Ter ry M o na h a n and D e b o r a h Ste i n Cincinnati, Ohio Columbus, Ohio 11 -

Page 14

... Senior Vice President, Dealer Sales Regional Manager, 18 years experience in the ï¬nancial services industry Darlene Goldbach, Senior Vice President, Business Banking Market Manager, 15 years experience in the ï¬nancial services industry Russell Swan, Senior Vice President, Commercial Real Estate... -

Page 15

Proven R i ch Por re l l o, Da r l e n e G o l d bach and Ru s s e l l S wa n Columbus, Ohio Cleveland, Ohio Indianapolis, Indiana 13 -

Page 16

... customer experience a feeling of "Simply the Best" service from every Huntington associate. Angela Steffens, Vice President, Banking Ofï¬ce General Manager, 4 years experience in the ï¬nancial services industry Norman Wilson, Senior Vice President, Director Institutional Asset Manager, 29 years... -

Page 17

Best Service An ge l a Ste ffe n s, N o r man Wi l so n and G we n d o ly n N o r m a n Shelby Township, Michigan Columbus, Ohio Troy, Michigan 15 -

Page 18

... cashing a check, a mortgage sales representative helping a customer purchase his or her first home, or a business banker working with small business owners to finance their building. Frank Capella Executive Vice President, Commercial Banking 23 years experience in the ï¬nancial services industry... -

Page 19

... loans, installment loans, small business loans, and deposit products, as well as cash management, investment, and insurance services. COMMERCIAL BANKING PROFILE Customer base primarily comprised of middle market companies with annual sales of $10-$500 million and larger corporations headquartered... -

Page 20

... commercial bankers have embraced a standard sales process that includes system-wide relationship and business banking models and formal sales training for commercial associates. We continually redesign workï¬,ows for customer service and administrative support to improve productivity and make... -

Page 21

... consumer loans and leases, as well as dealer ï¬,oor plan and other commercial ï¬nancing and banking services. REVIEW Dealer Sales has been a core business for Huntington since the early 1950s. It is an integral and signiï¬cant part of our overall ï¬nancial services strategy. To build customer... -

Page 22

... Vice President, Private Financial Group 23 years experience in the ï¬nancial services industry Our ability to grow assets is a direct result of innovative products that meet customer needs...Our private bankers deliver all PFG banking, investment, and insurance products with a focus on personal... -

Page 23

..., Regional Banking Age: 58 Michael J. McMennamin Vice Chairman Age: 59 Daniel B. Benhase Senior Executive Vice President, Private Financial Group Age: 45 Richard A. Cheap General Counsel and Secretary Age: 53 Wilton W. Dolloff Executive Vice President, Operations and Technology Services Age... -

Page 24

... Dividend 10% Stock Dividend 10% Stock Dividend 10% Stock Dividend - - - - 7-31-95 7-31-96 7-31-97 7-31-98 7-30-99 7-31-00 - - - - Restated for stock dividends and stock splits as applicable. 10-YEAR TOTAL RETURN TO SHAREHOLDERS December 30, 1994 to December 31, 2004 (Assumes initial investment... -

Page 25

... Condition and Results of Operations Report of Management Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows 100 Notes to Consolidated... -

Page 26

... Assets Allowances for Credit Losses Net Charge-offs Investment Portfolio Market Risk Interest Rate Risk Lease Residual Risk Price Risk Liquidity Risk Parent Company Liquidity Off-Balance Sheet Arrangements Capital LINES OF BUSINESS DISCUSSION Regional Banking Dealer Sales Private Financial Group... -

Page 27

... Related Statistics Net Loan and Lease Charge-offs Credit Rating Agency Ratings Deposit Composition Contractual Obligations Maturity Schedule of Selected Loans Investment Securities Capital Adequacy Lines of Business - GAAP Earnings vs. Operating Earnings Reconciliation Regional Banking Dealer Sales... -

Page 28

... credit losses Net interest income after provision for credit losses Operating lease income Service charges on deposit accounts Securities gains Gain on sales of automobile loans Gain on sale of branch ofï¬ces Gain on sale of Florida operations Merchant Services gain Other non-interest income Total... -

Page 29

... company organized under Maryland law in 1966 and headquartered in Columbus, Ohio. Through its subsidiaries, Huntington is engaged in providing full-service commercial and consumer banking services, mortgage banking services, automobile ï¬nancing, equipment leasing, investment management, trust... -

Page 30

...its Annual Report on Form 10-K, while not all-inclusive, discusses a number of business risks that, in addition to the other information in this report, readers should carefully consider. Securities and Exchange Commission Formal Investigation and Formal Regulatory Supervisory Agreements SEC FORMAL... -

Page 31

... credit losses), which would have negatively impacted 2004 net income by approximately $15.3 million or $0.07 per share. A discussion about the process used to estimate the ACL is presented in the Credit Risk section of Management's Discussion and Analysis in this report. - MORTGAGE LOAN SERVICING... -

Page 32

... for credit losses Net interest income after provision for credit losses Operating lease income Service charges on deposit accounts Trust services Brokerage and insurance income Bank owned life insurance income Other service charges and fees Mortgage banking Securities gains Gain on sales of... -

Page 33

... from these gains was used to repurchase 9% of common shares outstanding and to invest in a number of activities including improvements in customer service technology and the purchases of a small money management ï¬rm and a niche equipment leasing company. The Florida insurance operation was also... -

Page 34

... investment securities. - The historically low interest rate environment of the last three years, despite a general increase in short-term rates during 2004, resulted in strong demand and growth in residential real estate, home equity, and CRE loans throughout this period. Mortgage banking revenue... -

Page 35

... Company uses gains or losses on investment securities, and beginning in 2004 gains or losses and net interest income on trading account assets, to offset MSR temporary valuation changes. Valuation of trading and investment securities generally react to interest rate changes in an opposite direction... -

Page 36

...A single commercial credit recovery of $11.1 million in 2004 on a loan previously charged-off in 2002 favorably impacted the 2004 loan loss provision expense, as well as C&I, total commercial, and total net charge-offs for the year. (See Tables 3 and 16.) 9. GAIN ON THE SALE OF WEST VIRGINIA BANKING... -

Page 37

...Earnings per share, after tax Change from prior year - $ Change from prior year - % Favorable (unfavorable) impact: SEC related expenses and accruals Investment securities gains Gain on sale of automobile loans Single commercial credit recovery Property lease impairment Mortgage servicing right (MSR... -

Page 38

... lease and deposit average rates include impact of applicable derivatives and non-deferrable fees. (3) Home equity includes personal lines of credit and other consumer loans secured by ï¬rst or junior mortgages on residential property originated and underwritten through the Company's retail banking... -

Page 39

... balances has been made to conform to this presentation, resulting in an increase to previously reported home equity loans and a decrease to previously reported residential mortgage loans. (5) Effective December 31, 2004, unsecured personal credit lines were reclassiï¬ed from ''home equity loans... -

Page 40

... and direct ï¬nancing leases Securities Other earning assets Total interest income in earning assets Deposits Short-term borrowings Federal Home Loan Bank advances Subordinated notes and other long-term debt, including capital securities Total interest expense in interest-bearing liabilities Net... -

Page 41

...ï¬c objective to reduce exposure to large individual credits, as well as a strategy to focus commercial lending to customers with existing or potential relationships within the Company's primary markets. Conversely, since the end of 2002, small business loans increased to 9% from 8%, reï¬,ecting... -

Page 42

... real estate: Construction Commercial Total middle market real estate Small business commercial and industrial and commercial real estate Total commercial Consumer: Automobile loans Automobile leases Home equity Residential mortgage Other loans Total consumer Total loans and direct ï¬nancing leases... -

Page 43

... in brokered time deposits and negotiable CDs, which, in comparison with rates on retail CDs, remained a relatively lower cost of funds. Management uses the non-core funding ratio (total liabilities less core deposits and accrued expenses and other liabilities divided by total assets) to measure... -

Page 44

... charges on deposit accounts Trust services Brokerage and insurance income Bank owned life insurance income Other service charges and fees Mortgage banking Securities gains Other Sub-total before operating lease income Operating lease income Sub-total including operating lease income Gain on sales... -

Page 45

... trust income and proprietary mutual fund fees. - $3.3 million increase in service charges on deposit accounts reï¬,ecting higher NSF and overdraft fees, partially offset by lower personal and commercial account maintenance charges. 2003 versus 2002 Performance Non-interest income for 2003 declined... -

Page 46

... lease expense Sub-total including operating lease expense Restructuring reserve (releases) charges Loss on early extinguishment of debt Total non-interest expense N.M., not a meaningful value. 2004 versus 2003 Performance Non-interest expense declined $107.9 million, or 9%, from 2003. Comparisons... -

Page 47

... Year Ended December 31, (in thousands of dollars) 2004 2003 2002 2001 2000 Balance Sheet: Average operating lease assets outstanding Income Statement: Net rental income Fees Recoveries - early terminations Total operating lease income Depreciation and residual losses at termination Losses... -

Page 48

...and totaled $6.4 million in 2004, down from $9.4 million a year earlier. The ratio of operating lease asset credit losses to average operating lease assets, net of recoveries, was 1.52% in 2004, down from 1.96% in 2003. 2003 versus 2002 Performance Average operating lease assets in 2003 declined 35... -

Page 49

... agreed upon terms. Market risk represents the risk of loss due to changes in the market value of assets and liabilities due to changes in interest rates, exchange rates, residual values and equity prices. Liquidity risk arises from the possibility that funds may not be available to satisfy current... -

Page 50

... the Company's primary markets. As a result, shared national credit exposure declined signiï¬cantly over this period. The sales of automobile loans are another example of the proactive management of concentration risk. (See Significant Factor 4.) The checks and balances in the credit process and... -

Page 51

... as real estate owned. At September 30, 2004, the Company adopted a new policy of placing home equity loans and lines on non-accrual status when they exceed 180 days past due. Such loans were previously classiï¬ed as accruing loans and leases past due 90 days or more. This policy change conforms... -

Page 52

... Loan and lease losses Payments Sales Non-performing assets, end of period (1) As of September 30, 2004, the Company adopted a policy, consistent with its policy for residential mortgage loans, of placing home equity loans and lines on nonaccrual status when they become greater than 180 days past... -

Page 53

... market commercial real estate, and small business loans, the calculation involves the use of a standardized loan grading system that is applied on an individual loan level and updated on a continuous basis. The reserve factors applied to these portfolios were developed based on internal credit... -

Page 54

... 2000 Commercial: Middle market commercial and industrial Middle market commercial real estate Small business commercial and industrial and commercial real estate Total commercial Consumer: Automobile loans and leases Home equity Residential mortgage Other loans Total consumer Total unallocated... -

Page 55

... market commercial real estate Small business commercial and industrial and commercial real estate Total commercial Consumer Automobile loans and leases Home equity(1) Residential mortgage Other consumer loans(1) Total consumer Total recoveries Net loan and lease losses Provision for credit losses... -

Page 56

...: Long-term Targets(1) Middle market C&I Middle market CRE Small business Automobile loans Automobile direct ï¬nance leases Home equity loans and lines Residential loans Total loans and leases (1) Assumes loan and lease portfolio mix comparable to December 31, 2004, and stable economic environment... -

Page 57

...Commercial Total middle market commercial real estate Small business commercial and industrial and commercial real estate Total commercial Consumer: Automobile loans Automobile leases Automobile loans and leases Home equity Residential mortgage Other loans(3) Total consumer Total net charge-offs Net... -

Page 58

... board of directors' policies. Interest rate risk management is a dynamic process that encompasses monitoring loan and deposit ï¬,ows, investment and funding activities, and assessing the impact of the changing market and business environment. Effective management of interest rate risk begins with... -

Page 59

...-dealer subsidiaries, in the foreign exchange positions that the Bank holds to accommodate its customers, in investments in private equity limited partnerships accounted for at fair value, and in the marketable equity securities available for sale held by insurance subsidiaries. To manage price... -

Page 60

...liquidity exists to meet the funding needs of the Bank and the parent company. Credit ratings as of February 8, 2005, for the parent company and the Bank were: Table 17 - Credit Rating Agency Ratings Senior Unsecured Notes Huntington Bancshares Incorporated Moody's Investor Service Standard and Poor... -

Page 61

... and negotiable CDs, Federal Home Loan Bank (FHLB) advances, and medium- and long-term debt. The Company is a member of the FHLB of Cincinnati, which provides funding to its members through advances. These advances carry maturities from one month to 20 years. At December 31, 2004, the Company had... -

Page 62

... time deposits Total deposits Total core deposits: Commercial Personal Total core deposits By business segment:(1) Regional banking Central Ohio Northern Ohio Southern Ohio / Kentucky West Michigan East Michigan West Virginia Indiana Total regional banking Dealer sales Private ï¬nancial group... -

Page 63

...without a stated maturity Certiï¬cates of deposit and other time deposits Other long-term debt Federal Home Loan Bank advances Short-term borrowings Subordinated notes Purchase commitments Operating lease obligations Federal Funds Purchased and Repurchase Agreements At December 31, (in millions of... -

Page 64

... 6-10 years Over 10 years Total Private Label CMO Asset backed securities Under 1 year 1-5 years 6-10 years Over 10 years Total asset backed securities Other Under 1 year 1-5 years 6-10 years Over 10 years Retained interest in securitizations Marketable equity securities Total other Total investment... -

Page 65

... into forward contracts relating to its mortgage banking business. At December 31, 2004 and 2003, commitments to sell residential real estate loans totaled $311.3 million and $276.9 million, respectively. These contracts mature in less than one year. The parent company and/or the Bank may also have... -

Page 66

... Incentive Plan shares. All purchases under the current authorization will be made from time-to-time in the open market or through privately negotiated transactions depending on market conditions. Effective with the dividend declared in the 2004 third quarter, the quarterly common stock dividend was... -

Page 67

.... The Treasury/Other business segment charges (credits) an internal cost of funds for assets held in (or pays for funding provided by) each line of business. The FTP rate is based on prevailing market interest rates for comparable duration assets (or liabilities). Deposits of an indeterminate... -

Page 68

...operating Change from prior year - $ Change from prior year - % 2002 Net income - GAAP Restructuring charges Loss from Florida operations Gain on sale of Florida operations Merchant services gain Net income - operating N.M., not a meaningful value. (1) See Signiï¬cant Factors Inï¬,uencing Financial... -

Page 69

... branches, over 700 ATMs, plus Internet and telephone banking channels. Each region is further divided into Retail and Commercial Banking units. Retail products and services include home equity loans and lines of credit, ï¬rst mortgage loans, direct installment loans, business loans, personal and... -

Page 70

...retail CDs. The decline in the net interest margin reï¬,ected the impact of the more rapid decline in variable-rate loans than on deposits, which were at historically low levels making it difï¬cult to lower deposit rates commensurate with the decline in market rates. The provision for credit losses... -

Page 71

... Excluding Securities Gains (FTE) SELECTED AVERAGE BALANCES Loans: Middle market C&I Middle market CRE Construction Commercial Small business loans Total Commercial Consumer Auto loans - indirect Home equity loans & lines of credit Residential mortgage Other loans Total Consumer Total Loans & Leases... -

Page 72

... market C&I Middle market CRE Small business loans Residential mortgage Home equity Total Non-accrual Loans Renegotiated loans Total Non-performing Loans (NPL) Other real estate, net (OREO) Total Non-performing Assets Accruing loans past due 90 days or more (eop) Allowance for Loan and Lease Losses... -

Page 73

...-line customers (eop) on-line retail household penetration (eop) Small Business Average loans (in millions) Average deposits (in millions) # employees - full-time equivalent (eop) # business DDA relationships (eop) # New relationships 90-day cross-sell (average) Commercial Banking Average loans (in... -

Page 74

... or direct ï¬nance leases, ï¬nances the dealership's ï¬,oor plan inventories, real estate, or working capital needs, and provides other banking services to the automotive dealerships and their owners. The accounting for automobile leases signiï¬cantly impacts the presentation of Dealer Sales... -

Page 75

... lease portfolio. Other non-interest expense declined 6% primarily due to lower residual value insurance costs, while personnel costs increased 9% primarily due to higher beneï¬ts costs and production-related salary costs. The return on average assets and return on average equity for Dealer Sales... -

Page 76

... credit losses Net Interest Income After Provision for Credit Losses Operating lease income Service charges on deposit accounts Brokerage and insurance income Trust services Mortgage banking Other service charges and fees Other Total Non-Interest Income Before Securities Gains Securities gains Total... -

Page 77

... commercial Consumer Auto leases Auto loans Home equity loans & lines of credit Other loans Total consumer Total Net Charge-offs Non-performing Assets (NPA) (in millions) Middle market C&I Middle market CRE Total Non-accrual Loans Renegotiated loans Total Non-performing Loans (NPL) Other real estate... -

Page 78

... - Dealer Sales(1) AND A NALYSIS H U N T I N G TO N B A N C S H A R E S I N C O R P O R AT E D Change From 2003 2004 SUPPLEMENTAL DATA # employees - full-time equivalent Automobile loans Production (in millions) % Production new vehicles Average term (in months) Automobile leases Production (in... -

Page 79

...rate offerings and a redirection of sweep account balances from money market mutual fund accounts. The net interest margin declined to 3.21% mainly due the fact that loan growth signiï¬cantly exceeded deposit growth, as well as reï¬,ecting the lower margins on personal credit lines as customer rate... -

Page 80

... to increased mortgage reï¬nancing activity combined with revenue from sales of a new wealth transfer insurance product. Trust income was essentially ï¬,at with the prior year, as increased personal and institutional trust income was offset by reduced revenue from proprietary mutual fund fees. The... -

Page 81

...26 - Private Financial Group(1) Change From 2003 2004 INCOME STATEMENT (in thousands) Net interest income Provision for credit losses Net Interest Income After Provision for Credit Losses Service charges on deposit accounts Brokerage and insurance income Trust services Mortgage banking Other service... -

Page 82

...- Private Financial Group(1) Change From 2003 2004 PERFORMANCE METRICS Return on average assets Return on average equity Net interest margin Efï¬ciency ratio CREDIT QUALITY Net Charge-offs by Loan Type Middle market C&I Middle market CRE Total commercial Consumer Home equity loans & lines of credit... -

Page 83

... and Insurance Income Fee sharing Total Brokerage and Insurance Income (net of fee sharing) Mutual fund sales volume (in thousands) Annuities sales volume (in thousands) Trust Services Income (in thousands) Personal trust revenue Huntington funds revenue Institutional trust revenue Corporate trust... -

Page 84

...expense related to assets, liabilities, and equity that are not directly assigned or allocated to one of the other three business segments. Assets included in this segment include investment securities, bank owned life insurance, and mezzanine loans originated through Huntington Capital Markets. Net... -

Page 85

... Huntington Capital Markets lending activity, was nearly ï¬,at year over year. Non-interest income was higher, reï¬,ecting gains recognized on Capital Markets Group investments. Non-interest expense for operational, administrative, and support groups not speciï¬cally allocated to the other business... -

Page 86

...INCOME STATEMENT (in thousands) Net interest income Provision for credit losses Net Interest Income After Provision for Credit Losses Service charges on deposit accounts Brokerage and insurance income Mortgage banking Bank Owned Life Insurance income Other Total Non-Interest Income Before Securities... -

Page 87

... Total Net Charge-offs Non-performing Assets (NPA) Middle market C&I Middle market CRE Total Non-accrual Loans Renegotiated loans Total Non-performing Loans (NPL) Other real estate, net (OREO) Total Non-performing Assets Accruing loans past due 90 days or more Allowance for Loan and Lease Losses... -

Page 88

... Securities Gains (FTE) SELECTED AVERAGE BALANCES Loans: Middle market C&I Middle market CRE Construction Commercial Small business loans Total Commercial Consumer Auto leases - indirect Auto loans - indirect Home equity loans & lines of credit Residential mortgage Other loans Total Consumer Total... -

Page 89

... Auto loans Home equity loans & lines of credit Residential mortgage Other loans Total consumer Total Net Charge-offs Net Charge-offs - annualized percentages Middle market C&I Middle market CRE Small business loans Total commercial Consumer Auto leases Auto loans Home equity loans & lines of credit... -

Page 90

...and overdraft service charge income and, to a lesser degree, lower service charges on commercial accounts related to higher commercial deposit credits that occur as interest rates increase, as well as a decrease in check processing activity. - $1.5 million, or 10%, decline in brokerage and insurance... -

Page 91

... resulted in $26.6 million in commercial and middle market commercial real estate loan net charge-offs, or an annualized 0.50% of average total loans and leases. Total consumer net charge-offs in the fourth quarter were $15.8 million, or an annualized 0.49% of related loans. This compared with $18... -

Page 92

..., the ACL as a percent of total loans and leases was 1.29% at December 31, 2004, compared with 1.59% a year earlier. Similarly, the ACL as a percent of NPAs was 280% at December 31, 2004, compared with 384% a year earlier. The provision for loan and lease losses in the 2004 fourth quarter was $12... -

Page 93

...for credit losses Net interest income after provision for credit losses Operating lease income Service charges on deposit accounts Trust services Brokerage and insurance income Bank owned life insurance income Other service charges and fees Mortgage banking Securities gains (losses) Gain on sales of... -

Page 94

... Book value per share Common share repurchase program Number of shares repurchased Quarterly key ratios and statistics Margin analysis - as a % of average earning assets(2) Interest income(2) Interest expense Net interest margin(2) Return on average assets Return on average shareholders' equity... -

Page 95

... ofï¬cer and the chief ï¬nancial ofï¬cer. Huntington's management assessed the effectiveness of the Company's accounting and other internal control systems over ï¬nancial reporting as of December 31, 2004. In making this assessment, Management used the criteria set forth by the Committee of... -

Page 96

... timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the ï¬nancial statements. Because of the inherent limitations of internal control over ï¬nancial reporting, including the possibility of collusion or improper management... -

Page 97

...Bancshares Incorporated Columbus, Ohio We have audited the accompanying consolidated balance sheet of Huntington Bancshares Incorporated and subsidiaries (the ''Company'') as of December 31, 2004, and the related consolidated statements of income, changes in shareholders' equity, and cash ï¬,ows for... -

Page 98

... Loans held for sale Investment securities Loans and leases: Commercial Commercial and industrial Commercial real estate Consumer Automobile loans Automobile leases Home equity loans Residential mortgage loans Other consumer loans Total loans and leases Allowance for loan and lease losses Net loans... -

Page 99

... for credit losses Net Interest Income After Provision for Credit Losses Operating lease income Service charges on deposit accounts Trust services Brokerage and insurance income Bank owned life insurance income Other service charges and fees Mortgage banking Securities gains Gain on sales of... -

Page 100

... relationships Minimum pension liability Total comprehensive income Cash dividends declared ($0.67 per share) Stock options exercised Treasury shares purchased Other Balance - December 31, 2003 Comprehensive Income: Net income Unrealized net holding losses on securities available for sale arising... -

Page 101

... from sales of other real estate Consolidation of cash of securitization trust Net cash paid in purchase acquisitions Proceeds from restructuring of Huntington Merchant Services, LLC Net cash paid related to sale of Florida banking and insurance operations Net Cash Used for Investing Activities... -

Page 102

... company organized under Maryland law in 1966 and headquartered in Columbus, Ohio. Through its subsidiaries, Huntington is engaged in providing full-service commercial and consumer banking services, mortgage banking services, automobile ï¬nancing, equipment leasing, investment management, trust... -

Page 103

... and leases past due 90 days or more. This policy change conforms the home equity loans and lines classiï¬cation to that of other consumer loans secured by residential real estate. The new policy did not have a material impact on total non-performing assets, the allowances for credit losses, or net... -

Page 104

... market commercial real estate, and small business loans, the calculation involves the use of a standardized loan grading system that is applied on an individual loan level and updated on a continuous basis. The reserve factors applied to these portfolios were developed based on internal credit... -

Page 105

... lower of cost (net of purchase discounts or premiums and effects of hedge accounting) or fair value as determined on an aggregate basis. Fair value is determined using available secondary market prices for loans with similar coupons, maturities, and credit quality. Huntington recognizes the rights... -

Page 106

... income payments accrued, but not received, are written off when they reach 120 days past due and at that time the asset is evaluated for impairment. - BANK OWNED LIFE INSURANCE - Huntington's bank owned life insurance policies are carried at their cash surrender value. Periodically, management con... -

Page 107

... three years: Year Ended December 31, (in millions of dollars, except per share amounts) 2004 2003 2002 Assumptions Risk-free interest rate Expected dividend yield Expected volatility of Huntington's common stock Pro Forma Results Net income, as reported Less pro forma expense related to options... -

Page 108

...ling as small business issuers) will be required to apply Statement 123(R) as of the ï¬rst interim or annual reporting period that begins after June 15, 2005. Effective January 1, 2005, Huntington has adopted Statement 123R. See Note 1 for the current accounting policy on share-based payments and... -

Page 109

...914,510 $ (34,504) Other securities include privately placed collateralized mortgage obligations, Federal Home Loan Bank and Federal Reserve Bank stock, corporate debt and municipal securities, and marketable equity securities. Contractual maturities of investment securities as of December 31 were... -

Page 110

... real estate qualifying loans were pledged to secure advances from the Federal Home Loan Bank. Real estate qualifying loans are comprised of residential mortgage loans secured by ï¬rst and second liens. Huntington's loan and lease portfolio includes lease ï¬nancing receivables consisting of direct... -

Page 111

...Total non-performing loans Other real estate, net(2) Total non-performing assets Accruing Loans Past Due 90 Days or More (1) As of September 30, 2004, the Company adopted a policy, consistent with its policy for residential mortgage loans, of placing home equity loans and lines on nonaccrual status... -

Page 112

... is contractually separated from the underlying mortgage loans by sale or securitization of the loans with servicing rights retained. The initial carrying value of the asset is established based on its relative fair value at the time of sale using assumptions that are consistent with assumptions... -

Page 113

... three tranches for servicing rights on 15-year ï¬xed-rate mortgage loans (based on interest rate bands of below 5.50%; 5.50% up to 6.49%; and 6.50% and above), and one tranche encompassing balloon and adjustable rate mortgages. Huntington began using the expanded interest rate bands in the fourth... -

Page 114

...as a component of the loan's carrying value upon their sale. The allowance associated with the 2002 sale of the Florida banking and insurance operations was $22,297. (2) Includes impaired commercial and industrial loans and commercial real estate loans with outstanding balances greater than $500,000... -

Page 115

... ï¬xed monthly rental payment over a speciï¬ed lease term, typically from 36 to 66 months. These vehicles, net of accumulated depreciation, were recorded as operating lease assets in the consolidated balance sheet. Rental income is earned by Huntington on the operating lease assets and reported as... -

Page 116

... month-end balance during the year Commercial paper is issued by Huntington Bancshares Financial Corporation, a non-bank subsidiary, with principal and interest guaranteed by the parent company. 11. FEDERAL HOME LOAN BANK ADVANCES Huntington's long-term advances from the Federal Home Loan Bank... -

Page 117

...the ï¬rst quarter of 2004 were used to fund the payment of the long-term notes. The weighted-average interest rate for subordinated notes was 5.16 % at December 31, 2004, and 6.36% at the end of 2003. Amounts above are reported net of unamortized discounts and include values related to hedging with... -

Page 118

... net gains Related tax expense Net Total unrealized holding (losses) gains on securities available for sale arising during the period, net of reclassiï¬cation adjustment for net gains included in net income Unrealized holding gains and losses on derivatives used in cash ï¬,ow hedging relationships... -

Page 119

... of accounting change Net income $1.74 1.74 1.71 1.71 $1.68 1.62 1.67 1.61 $1.34 1.34 1.33 1.33 The average market price of Huntington's common stock for the period was used in determining the dilutive effect of outstanding stock options. Common stock equivalents are computed based on the number... -

Page 120

...AT E D The fair value of the options granted was estimated at the date of grant using a Black-Scholes option-pricing model. Huntington's stock option activity and related information for each of the recent three years ended December 31 is summarized below: 2004 WeightedAverage Exercise Price $19.40... -

Page 121

... under the Internal Revenue Code. In addition, Huntington has an unfunded deï¬ned beneï¬t post-retirement plan that provides certain health-care and life insurance beneï¬ts to retired employees who have attained the age of 55 and have at least 10 years of vesting service under this plan. For any... -

Page 122

... on Plan assets over a long time horizon, while meeting the Plan obligations. At September 30, 2004, Plan assets were invested 73% in equity investments and 27% in bonds, with an average duration of four years on bond investments. The estimated life of beneï¬t obligations was 12 years. Management... -

Page 123

... 31, 2004. The curtailment reï¬,ected above related to the sale of the Florida banking and insurance operations. This expense was recognized in Huntington's results of operations in 2002. It is Huntington's policy to recognize settlement gains and losses as incurred. Management expects net periodic... -

Page 124

...100% Balance $ 300 500 240,456 95,837 16,129 353,222 Cash Huntington Huntington Huntington Huntington Funds - money market Funds - equity funds Funds - ï¬xed income funds Common Stock Fair value of plan assets at September 30 The number of shares of Huntington common stock held by the Plan was... -

Page 125

...: Cash and short-term assets Trading account securities Mortgages held for sale Investment securities Net loans and direct ï¬nancing leases Customers' acceptance liability Derivatives Financial Liabilities: Deposits Short-term borrowings Bank acceptances outstanding Federal Home Loan Bank advances... -

Page 126

... its mortgage loans held for sale. Market risk, which is the possibility that economic value of net assets or net interest income will be adversely affected by changes in interest rates or other economic factors, is managed through the use of derivatives. Derivatives are also sold to meet customers... -

Page 127

... of overall interest rate risk management activities to assess the impact on the net interest margin. Fair Value Hedges Cash Flow Hedges (in thousands of dollars) Total Instruments associated with: Investment securities Loans Deposits Federal Home Loan Bank advances Subordinated notes Other long... -

Page 128

... in 2002. The total notional value of derivative ï¬nancial instruments used by Huntington on behalf of customers (for which the related interest rate risk is offset by third parties) was $4.5 billion at the end of 2004 and $5.0 billion at the end of the prior year. Huntington's credit risk from... -

Page 129

... than 90 days. The merchandise or cargo being traded normally secures these instruments. COMMITMENTS TO SELL LOANS Huntington entered into forward contracts, relating to its mortgage banking business. At December 31, 2004 and 2003, Huntington had commitments to sell residential real estate loans of... -

Page 130

... written plans and progress reports by management. These written agreements remain in effect until terminated by the banking regulators. Management has been working with its banking regulators over the past several months and has been taking actions and devoting signiï¬cant resources to address all... -

Page 131

... 25. PARENT COMPANY FINANCIAL STATEMENTS The parent company condensed ï¬nancial statements, which include transactions with subsidiaries, are as follows. Balance Sheets (in thousands of dollars) December 31, 2004 2003 ASSETS Cash and cash equivalents Due from The Huntington National Bank Due from... -

Page 132

... AT E D Year Ended December 31, 2004 2003 2002 Income Dividends from The Huntington National Bank Non-bank subsidiaries Interest from The Huntington National Bank Non-bank subsidiaries Management fees from subsidiaries Other Total Income Expense Personnel costs Interest on debt Other Total Expense... -

Page 133

... effect of change in accounting principle Equity in undistributed net income of subsidiaries Depreciation and amortization Gain on sales of securities available for sale Change in other assets and other liabilities Restructuring charges Net Cash Provided by Operating Activities Investing Activities... -

Page 134

... branches, over 700 ATMs, plus Internet and telephone banking channels. Each region is further divided into Retail and Commercial Banking units. Retail products and services include home equity loans and lines of credit, ï¬rst mortgage loans, direct installment loans, business loans, personal and... -

Page 135

...'s ï¬,oor plan inventories, real estate, or working capital needs, and provides other banking services to the automotive dealerships and their owners. Private Financial Group: This segment provides products and services designed to meet the needs of the Company's higher net worth customers. Revenue... -

Page 136

... income Provision for credit losses Non-Interest income Non-Interest expense Income taxes Operating earnings Restructuring charges, net of tax Florida operations sold, net of tax Gain on sale of Florida operations, net of tax Merchant Services restructuring gain, net of tax Net income $ 605,378... -

Page 137

... for credit losses Non-interest income Non-interest expense Income before income taxes Income taxes Income before cumulative effect of change in accounting principle Cumulative effect of change in accounting principle, net of tax Net income Income per common share before cumulative effect of change... -

Page 138

..., net Net cash provided by operating activities Investing Activities Net loan and lease originations, excluding sales Proceeds from the sale of branch ofï¬ces Purchases of premises and equipment Net cash used for investing activities Financing Activities Increase in total deposits Net cash provided... -

Page 139

...domestic time deposits greater than $100,000. Derivative - A contractual agreement between two parties to exchange cash or other assets in response to changes in an external factor, such as an interest rate or a foreign exchange rate. Dividend Payout Ratio - Dividends per common share divided by net... -

Page 140

... at statutory rates, typically 35%. This adjustment puts all earning assets, most notably tax-exempt municipal securities, on a common basis that facilitates comparison of net interest margin to competitors. Operating Earnings - Used in lines of business reporting and represents reported (GAAP... -

Page 141

... January 2006. CREDIT RATINGS(1) Huntington Bancshares Incorporated: Senior Unsecured Notes Subordinated Notes Short Term Outlook DIRECT DEPOSIT OF DIVIDENDS Automatic direct deposit of quarterly dividends is offered to our shareholders, at no charge, and provides secure and timely access to their... -

Page 142

... B E S T S E RV I C E D I S C I P L I N E O P P O RT U N Huntington Center, 41 S. High Street, Columbus, Ohio 43287 (614) 480-8300 huntington.com ® and Huntington® are federally registered service marks of Huntington Bancshares Incorporated. ©2005 Huntington Bancshares Incorporated. 03005AR