Honeywell 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

—(Continued)

(Dollars in millions, except per share amounts)

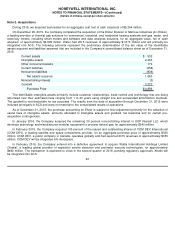

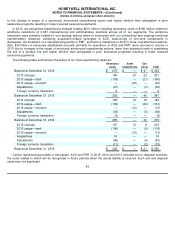

Note 3. Repositioning and Other Charges

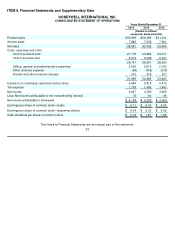

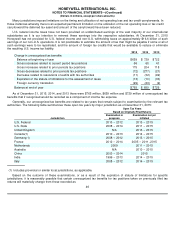

A summary of repositioning and other charges follows:

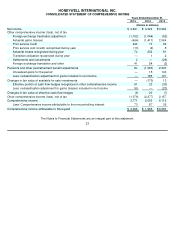

The following table summarizes the pretax distribution of total net repositioning and other charges by income statement

classification:

The following table summarizes the pretax impact of total net repositioning and other charges by segment:

In 2015, we recognized repositioning charges totaling $216 million including severance costs of $197 million related to

workforce reductions of 6,405 manufacturing and administrative positions across all of our segments. The workforce

reductions were primarily related to cost savings actions taken in connection with our productivity and ongoing functional

transformation initiatives. Also, $53 million of previously established accruals, primarily for severance, mainly in Aerospace

and ACS, were returned to income in 2015 due principally to higher attrition than anticipated in prior severance programs

resulting in lower required severance payments, and changes in scope of previously announced repositioning actions.

In 2014, we recognized repositioning charges totaling $184 million including severance costs of $156 million related to

workforce reductions of 2,975 manufacturing and administrative positions across all of our segments. The workforce

reductions were primarily related to cost savings actions taken in connection with our productivity and ongoing functional

transformation initiatives, factory transitions in ACS and Aerospace to more cost-effective locations, and site consolidations

and organizational realignments of businesses in ACS and PMT. Also, $38 million of previously established accruals,

primarily for severance, mainly in Aerospace and ACS, were returned to income in 2014 due principally

41

Years Ended December

31,

2015

2014

2013

Severance

$

197

$

156

$

186

Asset impairments

13

12

23

Exit costs

6

16

22

Reserve adjustments

(53

)

(38

)

(30

)

Total net repositioning charge

163

146

201

Asbestos related litigation charges, net of insurance

189

182

181

Probable and reasonably estimable environmental liabilities

194

268

272

Other

—

2

9

Total net repositioning and other charges

$

546

$

598

$

663

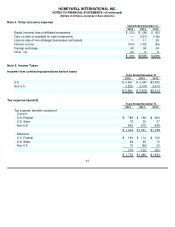

Years Ended December

31,

2015

2014

2013

Cost of products and services sold

$

483

$

525

$

566

Selling, general and administrative expenses

63

73

97

$

546

$

598

$

663

Years Ended December

31,

2015

2014

2013

Aerospace

$

211

$

193

$

235

Automation and Control Solutions

77

80

68

Performance Materials and Technologies

40

33

56

Corporate

218

292

304

$

546

$

598

$

663