Honeywell 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

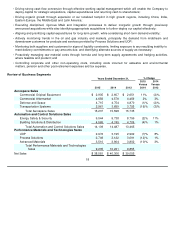

Review of Business Segments

18

•

Driving strong cash flow conversion through effective working capital management which will enable the Company to

deploy capital for strategic acquisitions, capital expenditures and returning cash to shareholders;

•

Driving organic growth through expansion of our localized footprint in high growth regions, including China, India,

Eastern Europe, the Middle East and Latin America;

•

Executing disciplined, rigorous M&A and integration processes to deliver inorganic growth through previously

announced acquisitions while also identifying appropriate acquisitions to further deploy our capital effectively;

•

Aligning and prioritizing capital expenditures for long-term growth, while considering short-term demand volatility;

•

Actively monitoring trends in the oil and gas industry end markets, principally the demand from midstream and

downstream customers for products and services provided by Process Solutions and UOP;

•

Monitoring both suppliers and customers for signs of liquidity constraints, limiting exposure to any resultjing inability to

meet delivery commitments or pay amounts due, and identifying alternate sources of supply as necessary;

•

Proactively managing raw material costs through formula and long-term supply agreements and hedging activities,

where feasible and prudent; and

•

Controlling corporate and other non-operating costs, including costs incurred for asbestos and environmental

matters, pension and other post-retirement expenses and tax expense.

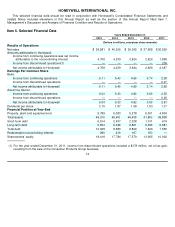

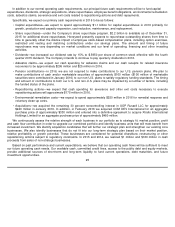

Years Ended December 31,

% Change

2015

Versus

2014

2014

Versus

2013

2015

2014

2013

Aerospace Sales

Commercial Original Equipment

$

2,905

$

2,607

$

2,651

11

%

(2

)%

Commercial Aftermarket

4,656

4,578

4,459

2

%

3

%

Defense and Space

4,715

4,754

4,870

(1

)%

(2

)%

Transportation Systems

2,961

3,659

3,755

(19

)%

(3

)%

Total Aerospace Sales

15,237

15,598

15,735

Automation and Control Solutions Sales

Energy Safety & Security

9,544

9,738

8,756

(2

)%

11

%

Building Solutions & Distribution

4,565

4,749

4,709

(4

)%

1

%

Total Automation and Control Solutions Sales

14,109

14,487

13,465

Performance Materials and Technologies Sales

UOP

2,976

3,195

2,962

(7

)%

8

%

Process Solutions

2,749

3,122

3,091

(12

)%

1

%

Advanced Materials

3,510

3,904

3,802

(10

)%

3

%

Total Performance Materials and Technologies

Sales

9,235

10,221

9,855

Net Sales

$

38,581

$

40,306

$

39,055