Honeywell 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

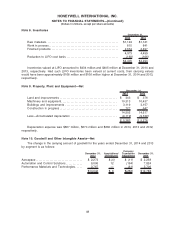

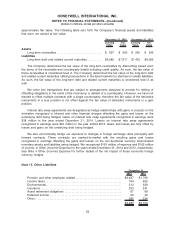

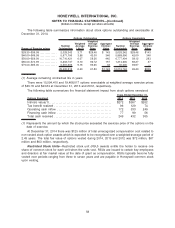

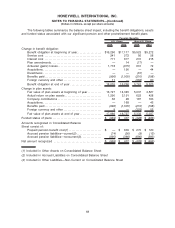

The following table summarizes information about stock options outstanding and exercisable at

December 31, 2014:

Range of Exercise prices

Number

Outstanding

Weighted

Average

Life(1)

Weighted

Average

Exercise

Price

Aggregate

Intrinsic

Value

Number

Exercisable

Weighted

Average

Exercise

Price

Aggregate

Intrinsic

Value

Options Outstanding Options Exercisable

$28.35–$39.99 . . . . . . . . . . . . . . 2,029,342 3.71 $29.46 $ 143 2,029,342 $29.46 $143

$40.00–$49.99 . . . . . . . . . . . . . . 5,971,196 3.86 42.00 346 5,968,696 42.00 346

$50.00–$59.99 . . . . . . . . . . . . . . 10,710,421 6.07 58.36 445 6,777,404 58.12 283

$60.00–$74.99 . . . . . . . . . . . . . . 5,202,747 8.10 69.72 157 1,214,300 69.27 37

$75.00–$95.00 . . . . . . . . . . . . . . 5,581,906 9.16 93.95 33 30,000 93.97 —

29,495,612 6.40 61.80 $1,124 16,019,742 49.40 $809

(1) Average remaining contractual life in years.

There were 15,594,410 and 19,468,017 options exercisable at weighted average exercise prices

of $45.76 and $43.64 at December 31, 2013 and 2012, respectively.

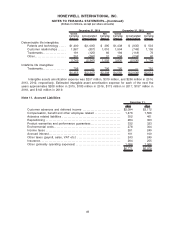

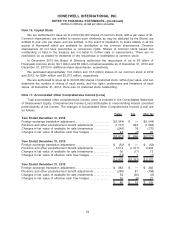

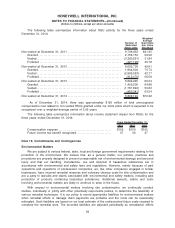

The following table summarizes the financial statement impact from stock options exercised:

Options Exercised 2014 2013 2012

Years Ended December 31,

Intrinsic value(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $272 $367 $202

Tax benefit realized . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 96 129 74

Operating cash inflow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 172 333 249

Financing cash inflow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 99 56

Total cash received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 249 432 305

(1) Represents the amount by which the stock price exceeded the exercise price of the options on the

date of exercise.

At December 31, 2014 there was $125 million of total unrecognized compensation cost related to

non-vested stock option awards which is expected to be recognized over a weighted-average period of

2.45 years. The total fair value of options vested during 2014, 2013 and 2012 was $72 million, $67

million and $63 million, respectively.

Restricted Stock Units—Restricted stock unit (RSU) awards entitle the holder to receive one

share of common stock for each unit when the units vest. RSUs are issued to certain key employees

and directors at fair market value at the date of grant as compensation. RSUs typically become fully

vested over periods ranging from three to seven years and are payable in Honeywell common stock

upon vesting.

58

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)