Honeywell 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

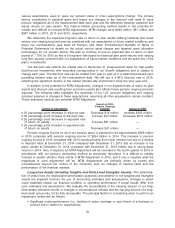

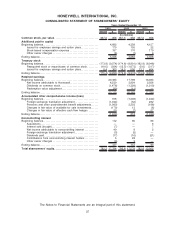

Contractual Obligations and Probable Liability Payments

Following is a summary of our significant contractual obligations and probable liability payments at

December 31, 2014:

Total(6) 2015

2016-

2017

2018-

2019 Thereafter

Payments by Period

Long-term debt, including capitalized

leases(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,985 $ 939 $ 962 $1,807 $3,277

Interest payments on long-term debt,

including capitalized leases . . . . . . . . . . . . 3,349 303 552 414 2,080

Minimum operating lease payments . . . . . . 1,281 330 470 224 257

Purchase obligations(2) . . . . . . . . . . . . . . . . . . 1,643 953 472 158 60

Estimated environmental liability

payments(3) . . . . . . . . . . . . . . . . . . . . . . . . . . 591 278 218 75 20

Asbestos related liability payments(4) . . . . 1,552 352 737 413 50

Asbestos insurance recoveries(5) . . . . . . . . (485) (31) (112) (105) (237)

$14,916 $3,124 $3,299 $2,986 $5,507

(1) Assumes all long-term debt is outstanding until scheduled maturity.

(2) Purchase obligations are entered into with various vendors in the normal course of business and

are consistent with our expected requirements.

(3) The payment amounts in the table only reflect the environmental liabilities which are probable and

reasonably estimable as of December 31, 2014.

(4) These amounts are estimates of asbestos related cash payments for NARCO and Bendix based

on our asbestos related liabilities which are probable and reasonably estimable as of December 31,

2014. See Asbestos Matters in Note 19 Commitments and Contingencies of Notes to Financial

Statements for additional information.

(5) These amounts represent our insurance recoveries that are deemed probable for asbestos related

liabilities as of December 31, 2014. See Asbestos Matters in Note 19 Commitments and

Contingencies of Notes to Financial Statements for additional information.

(6) The table excludes tax effects as well as $659 million of uncertain tax positions. See Note 5

Income Taxes of Notes to Financial Statements for additional information.

Environmental Matters

Accruals for environmental matters deemed probable and reasonably estimable were $268 million,

$272 million and $234 million in 2014, 2013 and 2012, respectively. In addition, in both 2014 and 2013

we incurred operating costs for ongoing businesses of approximately $88 million relating to compliance

with environmental regulations.

Spending related to known environmental matters was $321 million, $304 million and $320 million

in 2014, 2013 and 2012, respectively, and is estimated to be approximately $275 million in 2015. We

expect to fund expenditures for these environmental matters from operating cash flow. The timing of

cash expenditures depends on a numbers of factors, including the timing of litigation and settlements

of remediation liability, personal injury and property damage claims, regulatory approval of cleanup

projects, execution timeframe of projects, remedial techniques to be utilized and agreement with other

parties.

See Note 19 Commitments and Contingencies of Notes to Financial Statements for further

discussion of our environmental matters.

Financial Instruments

The following table illustrates the potential change in fair value for interest rate sensitive

instruments based on a hypothetical immediate one percentage point increase in interest rates across

all maturities and the potential change in fair value for foreign exchange rate sensitive instruments

27