Honeywell 2014 Annual Report Download - page 47

Download and view the complete annual report

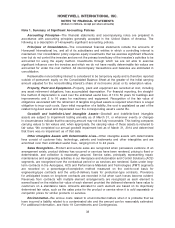

Please find page 47 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1. Summary of Significant Accounting Policies

Accounting Principles—The financial statements and accompanying notes are prepared in

accordance with accounting principles generally accepted in the United States of America. The

following is a description of Honeywell’s significant accounting policies.

Principles of Consolidation—The consolidated financial statements include the accounts of

Honeywell International Inc. and all of its subsidiaries and entities in which a controlling interest is

maintained. Our consolidation policy requires equity investments that we exercise significant influence

over but do not control the investee and are not the primary beneficiary of the investee’s activities to be

accounted for using the equity method. Investments through which we are not able to exercise

significant influence over the investee and which we do not have readily determinable fair values are

accounted for under the cost method. All intercompany transactions and balances are eliminated in

consolidation.

Redeemable noncontrolling interest is considered to be temporary equity and is therefore reported

outside of permanent equity on the Consolidated Balance Sheet at the greater of the initial carrying

amount adjusted for the noncontrolling interest’s share of net income (loss) or its redemption value.

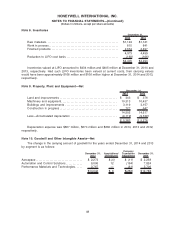

Property, Plant and Equipment—Property, plant and equipment are recorded at cost, including

any asset retirement obligations, less accumulated depreciation. For financial reporting, the straight-

line method of depreciation is used over the estimated useful lives of 10 to 50 years for buildings and

improvements and 2 to 16 years for machinery and equipment. Recognition of the fair value of

obligations associated with the retirement of tangible long-lived assets is required when there is a legal

obligation to incur such costs. Upon initial recognition of a liability, the cost is capitalized as part of the

related long-lived asset and depreciated over the corresponding asset’s useful life.

Goodwill and Indefinite-Lived Intangible Assets—Goodwill and indefinite-lived intangible

assets are subject to impairment testing annually as of March 31, or whenever events or changes

in circumstances indicate that the carrying amount may not be fully recoverable. This testing compares

carrying values to fair values and, when appropriate, the carrying value of these assets is reduced to

fair value. We completed our annual goodwill impairment test as of March 31, 2014 and determined

that there was no impairment as of that date.

Other Intangible Assets with Determinable Lives—Other intangible assets with determinable

lives consist of customer lists, technology, patents and trademarks and other intangibles and are

amortized over their estimated useful lives, ranging from 2 to 24 years.

Sales Recognition—Product and service sales are recognized when persuasive evidence of an

arrangement exists, product delivery has occurred or services have been rendered, pricing is fixed or

determinable, and collection is reasonably assured. Service sales, principally representing repair,

maintenance and engineering activities in our Aerospace and Automation and Control Solutions (ACS)

segments, are recognized over the contractual period or as services are rendered. Sales under long-

term contracts in the Aerospace, ACS and Performance Materials and Technologies (PMT) segments

are recorded on a percentage-of-completion method measured on the cost-to-cost basis for

engineering-type contracts and the units-of-delivery basis for production-type contracts. Provisions

for anticipated losses on long-term contracts are recorded in full when such losses become evident.

Revenues from contracts with multiple element arrangements are recognized as each element is

earned based on the relative fair value of each element provided the delivered elements have value to

customers on a standalone basis. Amounts allocated to each element are based on its objectively

determined fair value, such as the sales price for the product or service when it is sold separately or

competitor prices for similar products or services.

Environmental—We accrue costs related to environmental matters when it is probable that we

have incurred a liability related to a contaminated site and the amount can be reasonably estimated.

For additional information, see Note 19 Commitments and Contingencies.

38

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

(Dollars in millions, except per share amounts)