Honeywell 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

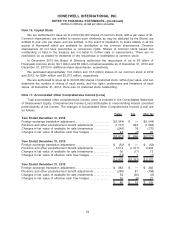

Note 16. Capital Stock

We are authorized to issue up to 2,000,000,000 shares of common stock, with a par value of $1.

Common shareowners are entitled to receive such dividends as may be declared by the Board, are

entitled to one vote per share, and are entitled, in the event of liquidation, to share ratably in all the

assets of Honeywell which are available for distribution to the common shareowners. Common

shareowners do not have preemptive or conversion rights. Shares of common stock issued and

outstanding or held in the treasury are not liable to further calls or assessments. There are no

restrictions on us relative to dividends or the repurchase or redemption of common stock.

In December 2013 the Board of Directors authorized the repurchase of up to $5 billion of

Honeywell common stock, $4.1 billion and $5 billion remained available as of December 31, 2014 and

December 31, 2013 for additional share repurchases, respectively.

We purchased approximately 10.0 million and 13.5 million shares of our common stock in 2014

and 2013, for $924 million and $1,073 million, respectively.

We are authorized to issue up to 40,000,000 shares of preferred stock, without par value, and can

determine the number of shares of each series, and the rights, preferences and limitations of each

series. At December 31, 2014, there was no preferred stock outstanding.

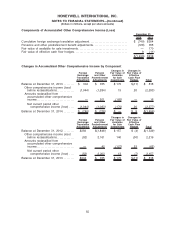

Note 17. Accumulated Other Comprehensive Income (Loss)

Total accumulated other comprehensive income (loss) is included in the Consolidated Statement

of Shareowners’ Equity. Comprehensive Income (Loss) attributable to noncontrolling interest consisted

predominantly of net income. The changes in Accumulated Other Comprehensive Income (Loss) are

as follows:

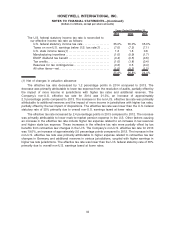

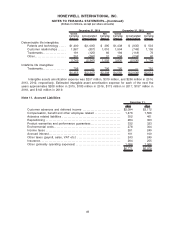

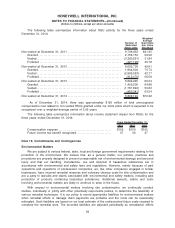

Pretax Tax After Tax

Year Ended December 31, 2014

Foreign exchange translation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . $(1,044) $ — $(1,044)

Pensions and other postretirement benefit adjustments . . . . . . . . . . . . (1,707) 624 (1,083)

Changes in fair value of available for sale investments . . . . . . . . . . . . (246) 76 (170)

Changes in fair value of effective cash flow hedges . . . . . . . . . . . . . . . 24 (4) 20

$(2,973) $ 696 $(2,277)

Year Ended December 31, 2013

Foreign exchange translation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . $ (52) $ — $ (52)

Pensions and other postretirement benefit adjustments . . . . . . . . . . . . 3,514 (1,311) 2,203

Changes in fair value of available for sale investments . . . . . . . . . . . . 30 (17) 13

Changes in fair value of effective cash flow hedges . . . . . . . . . . . . . . . (14) 7 (7)

$ 3,478 $(1,321) $ 2,157

Year Ended December 31, 2012

Foreign exchange translation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . $ 282 $ — $ 282

Pensions and other postretirement benefit adjustments . . . . . . . . . . . . (285) 87 (198)

Changes in fair value of available for sale investments . . . . . . . . . . . . 54 (60) (6)

Changes in fair value of effective cash flow hedges . . . . . . . . . . . . . . . 35 (8) 27

$ 86 $ 19 $ 105

54

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)