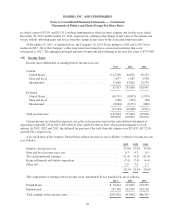

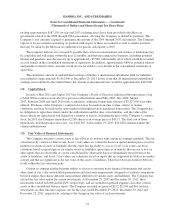

Hasbro 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)

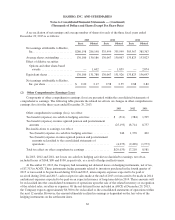

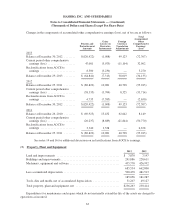

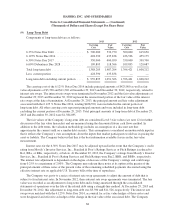

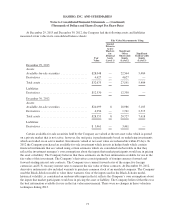

(9) Long-Term Debt

Components of long-term debt are as follows:

2013 2012

Carrying

Cost

Fair

Value

Carrying

Cost

Fair

Value

6.35% Notes Due 2040 ................... $ 500,000 532,750 500,000 615,650

6.125% Notes Due 2014 .................. 428,390 435,838 436,526 455,175

6.30% Notes Due 2017 ................... 350,000 400,050 350,000 399,700

6.60% Debentures Due 2028 ............... 109,895 118,566 109,895 129,687

Total long-term debt ..................... 1,388,285 1,487,204 1,396,421 1,600,212

Less: current portion ..................... 428,390 435,838 — —

Long-term debt excluding current portion .... $ 959,895 1,051,366 1,396,421 1,600,212

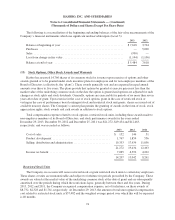

The carrying cost of the 6.125% Notes Due 2014 include principal amounts of $425,000 as well as fair

value adjustments of $3,390 and $11,526 at December 29, 2013 and December 30, 2012, respectively, related to

interest rate swaps. The interest rate swaps were terminated in November 2012 and the fair value adjustments at

December 29, 2013 and December 30, 2012 represent the unamortized portion of the fair value of the interest

rate swaps at the date of termination. At December 29, 2013, the principal amount and fair value adjustment

associated with the 6.125 % Notes Due 2014, totaling $428,390, were included in the current portion of

long-term debt. All other carrying costs represent principal amounts and were included in long-term debt

excluding the current portion at December 29, 2013. Total principal amounts of long-term debt at December 29,

2013 and December 30, 2012 were $1,384,895.

The fair values of the Company’s long-term debt are considered Level 3 fair values (see note 12 for further

discussion of the fair value hierarchy) and are measured using the discounted future cash flows method. In

addition to the debt terms, the valuation methodology includes an assumption of a discount rate that

approximates the current yield on a similar debt security. This assumption is considered an unobservable input in

that it reflects the Company’s own assumptions about the inputs that market participants would use in pricing the

asset or liability. The Company believes that this is the best information available for use in the fair value

measurement.

Interest rates for the 6.30% Notes Due 2017 may be adjusted upward in the event that the Company’s credit

rating from Moody’s Investor Services, Inc., Standard & Poor’s Ratings Services or Fitch Ratings is reduced to

Ba1, BB+, or BB+, respectively, or below. At December 29, 2013, the Company’s ratings from Moody’s Investor

Services, Inc., Standard & Poor’s Rating Services and Fitch Ratings were Baa2, BBB, and BBB+, respectively.

The interest rate adjustment is dependent on the degree of decrease of the Company’s ratings and could range

from 0.25% to a maximum of 2.00%. The Company may redeem these notes at its option at the greater of the

principal amount of these notes or the present value of the remaining scheduled payments discounted using the

effective interest rate on applicable U.S. Treasury bills at the time of repurchase.

The Company was party to a series of interest rate swap agreements to adjust the amount of debt that is

subject to fixed interest rates. In November 2012, these interest rate swap agreements were terminated. The fair

value was recorded as an adjustment to long-term debt and is being amortized through the consolidated

statements of operations over the life of the related debt using a straight-line method. At December 29, 2013 and

December 30, 2012, this adjustment to long-term debt was $3,390 and $11,526, respectively. The interest rate

swaps were matched with the 6.125% Notes Due 2014, accounted for as fair value hedges of those notes and

were designated and effective as hedges of the change in the fair value of the associated debt. The Company

68