Hasbro 2013 Annual Report Download - page 53

Download and view the complete annual report

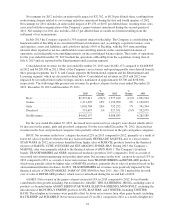

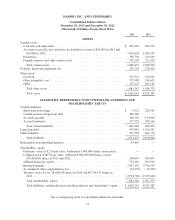

Please find page 53 of the 2013 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.resulting from the translation of foreign currency. Absent the impact of foreign exchange, increased accounts

receivable, net primarily reflects the growth in fourth quarter net revenues in the International segment in 2013.

Days sales outstanding increased to 77 days at December 29, 2013 from 72 days at December 30, 2012, primarily

due to the impact of higher balances in certain international markets which have longer payment terms. Accounts

receivable, net decreased to $1,029,959 at December 30, 2012 from $1,034,580 at December 25, 2011. The

accounts receivable balance at December 30, 2012 included an increase of approximately $10,600 resulting from

the translation of foreign currency. Absent the impact of foreign exchange, accounts receivable, net decreased

reflecting lower fourth quarter sales. Days sales outstanding increased to 72 days at December 30, 2012 from 70

days at December 25, 2011, primarily due to higher revenue volume in Latin America, a region which has longer

payment terms.

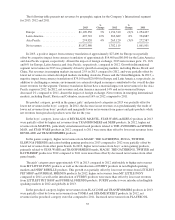

Inventories increased to $348,794 at December 29, 2013 from $316,049 at December 30, 2012. The

inventory balance at December 29, 2013 includes a decrease of approximately $4,400 resulting from foreign

currency translation. Inventory in the International segment increased approximately 16%, primarily due to

higher balances in emerging markets, including Russia and Brazil, in support of the growth the Company has

experienced in these markets. Inventory in the U.S. and Canada segment increased 2% in 2013 compared to

2012. Inventories decreased to $316,049 at December 30, 2012 compared to $333,993 at December 25, 2011.

Inventories declined 23% in the U.S. and Canada segment, partially offset by increases in certain international

markets including Russia, China and Korea.

Prepaid expenses and other current assets increased to $355,594 at December 29, 2013 from $312,493 at

December 30, 2012. Higher prepaid royalties, primarily related to the Company’s amended agreements with

Disney related to its MARVEL and STAR WARS licenses, contributed to increased balances in 2013 compared

to 2012. Prepaid expenses and other current assets also includes approximately $3,200 related to a forward-

starting interest rate swap contract which hedges future interest payments on the expected refinancing of the

Company’s 6.125% Notes Due 2014. These increases were partially offset by lower non-income based tax

receivables, primarily value added taxes in Europe, compared to 2012 as a result of collections in 2013. Prepaid

expenses and other current assets increased to $312,493 at December 30, 2012 from $243,431 at December 25,

2011. The balance at December 30, 2012 included an increase of approximately $5,500 as a result of translation

of foreign currency. Absent the impact of foreign currency translation, increases in prepaid royalties, primarily

related to prepaid royalties previously recorded as long-term which have become current related to the MARVEL

license, as well as deferred income taxes were partially offset by lower non-income-based tax receivables

compared to 2011 as a result of collections in 2012.

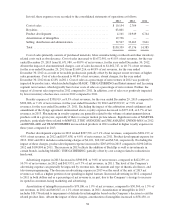

Accounts payable and accrued expenses increased to $926,558 at December 29, 2013 from $736,070 at

December 30, 2012. The balance includes a decrease of approximately $6,300 resulting from the translation of

foreign currency. Higher accrued royalties, interest and dividends as well as higher accounts payable contributed

to the increase in accounts payable and accrued expenses in 2013 compared to 2012. These increases include

accrued royalties of $42,950 and accrued interest of $15,090 related to the settlement of an adverse arbitration

award. Higher accrued dividends reflect a decision by the Company’s Board in 2012 to accelerate the payment of

the dividend declared in December 2012 from February 2013 to December 2012. As such, there were no accrued

dividends at December 30, 2012. Accounts payable and accrued expenses decreased to $736,070 at

December 30, 2012 from $761,914 at December 25, 2011. The 2012 balance includes an increase of

approximately $8,300 as a result of the translation of foreign currency balances. The decrease was partially the

result of the changes in accrued dividends discussed above as well as a decrease in accrued royalties resulting

from lower sales of entertainment-based products as well as lower accrued non-income-based taxes. These lower

balances were partially offset by severance costs accrued in the fourth quarter of 2012 as well as higher accrued

payroll and management incentives.

Other liabilities of $351,304 at December 29, 2013 compared to $461,152 at December 30, 2012 and

$370,043 at December 25, 2011. The decrease in 2013 compared to 2012 is primarily due to lower liabilities

related to pension and uncertain tax positions. The decline in liabilities related to uncertain tax positions is

primarily due to the settlement of tax examinations during 2013, partially offset by additions for current year

activity. The decline in pension liabilities is primarily due to increased discount rates, and, to a lesser extent,

41