Harris Teeter 1998 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1998 Harris Teeter annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ruddick Corporation

and Subsidiaries

8

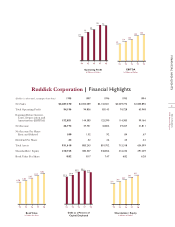

Operating Profit by Subsidiary

In Millions of Dollars

■Harris Teeter ■American & Efird

Operating profit margins expanded

at Harris Teeter while A&E’s margins

in fiscal 1998 reflected the impact of

losses in and the withdrawal from

its Korean operations.

94 95 96 97 98

37.0

42.1

48.5

52.1

26.9

34.6 34.7

49.2

42.1

Capital Expenditures by Subsidiary

In Millions of Dollars

■Harris Teeter ■American & Efird

94 95 96 97 98

46.4

81.4 83.2 86.2

75.1

20.4 16.4

35.6

28.9

20.2

Some investors believe that separat-

ing its two subsidiaries could enhance

Ruddick’s value. What is your view of

this opportunity?

Management and our Board of Directors

regularly evaluate this option and all others

that might increase shareholder value. In

the past, we have felt strongly that there are

overriding benefits associated with our cur-

rent two-company structure, but we certainly

recognize that future changes in circum-

stances could cause the option of separating

our subsidiaries to become more attractive.

Both companies have unique market

positions and strong competitive advan-

tages. Each provides a separate revenue

stream and helps cushion the impact of

economic changes in either industry on the

Corporation as a whole. Diversity of prod-

uct line and geography also helps to reduce

business risk. We also believe we have been

able to negotiate lower cost financing than

either subsidiary could obtain alone, and,

because the headquarters staff manages

insurance, financing, SEC reporting, the

401(k) plan and other employee benefits,

subsidiary management is left free to focus

strictly on operations. Over the years, A&E

has contributed a significant share of

Ruddick’s operating profit and supplied

excess cash flow to support the aggressive

growth of Harris Teeter. We believe that

the initiatives in place at both companies

should result in earnings growth that would

enhance shareholder value in the future.

We hope that Ruddick’s heightened visibility

through more investor communication and

sell-side analyst coverage will improve our

market multiple over time as well.

A&E generates low-cost funding for

expansion-oriented Harris Teeter.

EBITDA by Subsidiary

In Millions of Dollars

■Harris Teeter ■American & Efird

94 95 96 97 98

65.9 73.8

86.0 88.2

100.7

37.2

45.9 47.1

64.1 58.4

Q

A