Harley Davidson 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

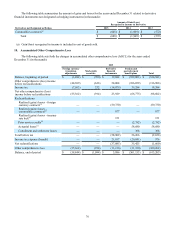

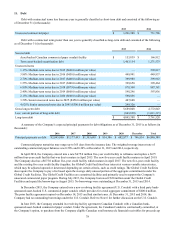

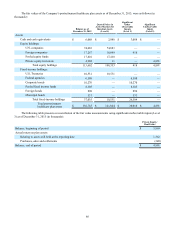

The following table summarizes the amount of gains and losses for the years ended December 31 related to derivative

financial instruments not designated as hedging instruments (in thousands):

Amount of Gain/(Loss)

Recognized in Income on Derivative

Derivatives not Designated as Hedges 2015 2014 2013

Commodities contracts(a) $(648) $ (1,969) $ (572)

Total $ (648) $ (1,969) $ (572)

(a) Gain/(loss) recognized in income is included in cost of goods sold.

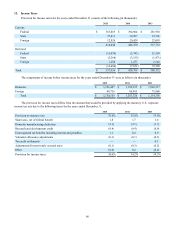

10. Accumulated Other Comprehensive Loss

The following table sets forth the changes in accumulated other comprehensive loss (AOCL) for the years ended

December 31 (in thousands):

2015

Foreign currency

translation

adjustments Marketable

securities

Derivative

financial

instruments

Pension and

postretirement

benefit plans Total

Balance, beginning of period $ (3,482) $ (700) $ 19,042 $ (529,803) $ (514,943)

Other comprehensive (loss) income

before reclassifications (48,309) (626) 38,008 (106,059)(116,986)

Income tax (7,053) 232 (14,079) 39,284 18,384

Net other comprehensive (loss)

income before reclassifications (55,362) (394) 23,929 (66,775)(98,602)

Reclassifications:

Realized (gains) losses - foreign

currency contracts(a) — — (59,730) — (59,730)

Realized (gains) losses -

commodities contracts(a) — — 677 — 677

Realized (gains) losses - treasury

rate lock(b) 151 151

Prior service credits(c) ———(2,782)(2,782)

Actuarial losses(c) — — — 58,680 58,680

Curtailment and settlement losses — — — 368 368

Total before tax — — (58,902) 56,266 (2,636)

Income tax expense (benefit) — — 21,817 (20,841) 976

Net reclassifications — — (37,085) 35,425 (1,660)

Other comprehensive loss (55,362) (394)(13,156)(31,350)(100,262)

Balance, end of period $ (58,844) $ (1,094) $ 5,886 $ (561,153) $ (615,205)