Harley Davidson 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

As discussed in "Outlook", the Company plans to significantly increase its spending in 2016 to drive demand. It plans to

offset this increased spending by reducing spending in other areas, primarily support functions and through a reorganization of

its commercial operations. To support this planned reallocation of spending, the Company incurred approximately $30 million

of reorganization expenses in the fourth quarter of 2015. This included approximately $23 million of operating expense and $5

million of cost of goods sold in the Motorcycles segment. These costs consisted of employee severance benefits, retirement

benefits and other reorganization costs. The Company also incurred approximately $2 million of reorganization expenses in the

Financial Services segment.

On August 4, 2015, the Company completed its purchase of certain assets and liabilities from Fred Deeley Imports, Ltd

(Deeley Imports) including, among other things, the acquisition of the exclusive right to distribute the Company's motorcycles

and other products in Canada. As a result of the acquisition, the Company now directly distributes its products in Canada as it

does in other countries. The Company incurred approximately $20 million of selling and administrative expense related to its

Canada operations in 2015.

Financial Services Segment

Segment Results

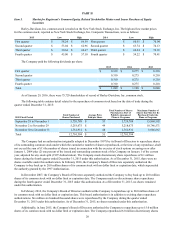

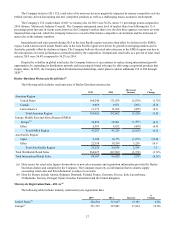

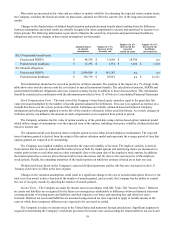

The following table includes the condensed statements of operations for the Financial Services segment (in thousands):

2015 2014 Increase

(Decrease) %

Change

Interest income $ 605,770 $ 585,187 $ 20,583 3.5%

Other income 80,888 75,640 5,248 6.9

Financial services revenue 686,658 660,827 25,831 3.9

Interest expense 161,983 164,476 (2,493)(1.5)

Provision for credit losses 101,345 80,946 20,399 25.2

Operating expenses 143,125 137,569 5,556 4.0

Financial Services expense 406,453 382,991 23,462 6.1

Operating income from Financial Services $ 280,205 $ 277,836 $ 2,369 0.9%

Interest income was favorable due to higher average receivables in the retail and wholesale portfolios, partially offset by

lower retail yields due to low rate promotions during parts of 2015 and increased competition. Other income was favorable

primarily due to increased credit card licensing and insurance revenue. Other income now includes international income which

had previously been reported in interest income. Prior period amounts, which were not material, have been adjusted for

comparability.

Interest expense benefited from a more favorable cost of funds and a lower loss on the extinguishment of a portion of the

Company's 6.80% medium-term notes than in 2014, partially offset by higher average outstanding debt.

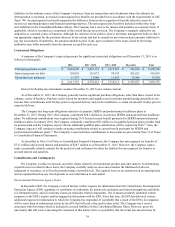

The provision for credit losses increased $20.4 million compared to 2014. The retail motorcycle provision increased $18.2

million during 2015 as a result of higher credit losses and portfolio growth. Credit losses were higher as a result of expected

increased losses in the subprime portfolio, lower recovery values on repossessed motorcycles, and deterioration in performance

in oil-dependent areas of the U.S. in late 2015.

Annual losses on the Company's retail motorcycle loans were 1.42% during 2015 compared to 1.22% in 2014. The 30-

day delinquency rate for retail motorcycle loans at December 31, 2015 increased to 3.78% from 3.61% at December 31, 2014.

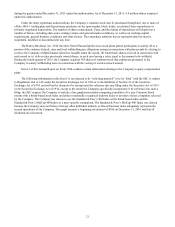

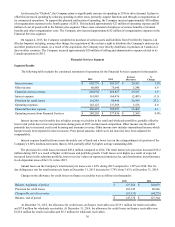

Changes in the allowance for credit losses on finance receivables were as follows (in thousands):

2015 2014

Balance, beginning of period $ 127,364 $ 110,693

Provision for credit losses 101,345 80,946

Charge-offs, net of recoveries (81,531)(64,275)

Balance, end of period $ 147,178 $ 127,364

At December 31, 2015, the allowance for credit losses on finance receivables was $139.3 million for retail receivables

and $7.9 million for wholesale receivables. At December 31, 2014, the allowance for credit losses on finance receivables was

$122.0 million for retail receivables and $5.3 million for wholesale receivables.