Harley Davidson 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

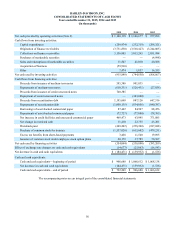

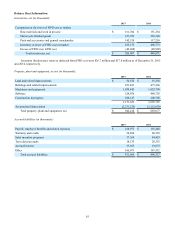

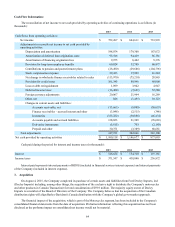

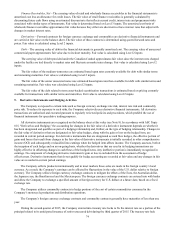

Cash Flow Information:

The reconciliation of net income to net cash provided by operating activities of continuing operations is as follows (in

thousands):

2015 2014 2013

Cash flows from operating activities:

Net income $ 752,207 $ 844,611 $ 733,993

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization 198,074 179,300 167,072

Amortization of deferred loan origination costs 93,546 94,429 86,181

Amortization of financing origination fees 9,975 8,442 9,376

Provision for long-term employee benefits 60,824 33,709 66,877

Contributions to pension and postretirement plans (28,490)(29,686)(204,796)

Stock compensation expense 29,433 37,929 41,244

Net change in wholesale finance receivables related to sales (113,970)(75,210) 28,865

Provision for credit losses 101,345 80,946 60,008

Loss on debt extinguishment 1,099 3,942 4,947

Deferred income taxes (16,484)(7,621) 52,580

Foreign currency adjustments 20,067 21,964 16,269

Other, net 846 (1,491) 10,123

Changes in current assets and liabilities:

Accounts receivable, net (13,665)(9,809)(36,653)

Finance receivables – accrued interest and other (3,046)(2,515)(346)

Inventories (155,222)(50,886)(46,474)

Accounts payable and accrued liabilities 138,823 21,309 (78,665)

Derivative instruments (5,615) 703 (2,189)

Prepaid and other 30,371 (3,389) 68,681

Total adjustments 347,911 302,066 243,100

Net cash provided by operating activities $ 1,100,118 $ 1,146,677 $ 977,093

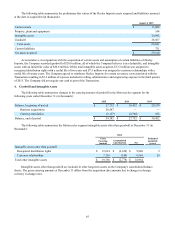

Cash paid during the period for interest and income taxes (in thousands):

2015 2014 2013

Interest $ 148,654 $ 154,310 $ 197,161

Income taxes $ 371,547 $ 438,840 $ 236,972

Interest paid represents interest payments of HDFS (included in financial services interest expense) and interest payments

of the Company (included in interest expense).

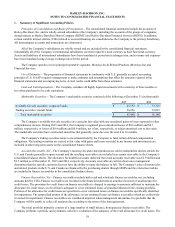

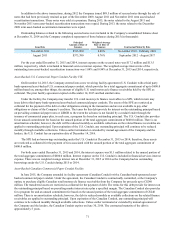

3. Acquisition

On August 4, 2015, the Company completed its purchase of certain assets and liabilities from Fred Deeley Imports, Ltd

(Deeley Imports) including, among other things, the acquisition of the exclusive right to distribute the Company's motorcycles

and other products in Canada (Transaction) for total consideration of $59.9 million. The majority equity owner of Deeley

Imports is a member of the Board of Directors of the Company. The Company believes that the acquisition of the Canadian

distribution rights will align Harley-Davidson's Canada distribution with the Company's global go-to-market approach.

The financial impact of the acquisition, which is part of the Motorcycles segment, has been included in the Company's

consolidated financial statements from the date of acquisition. Proforma information reflecting this acquisition has not been

disclosed as the proforma impact on consolidated net income would not be material.