Hamilton Beach 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

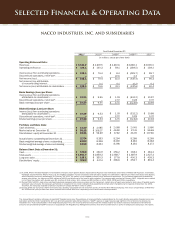

NMHG, HBB and NACoal all had

strong returns on capital employed(3)

(“ROTCE”) on a net debt basis of 26.4

percent, 27.7 percent and 17.1 percent,

respectively, with only Kitchen Collection

falling below an acceptable level at 3.1

percent. Consolidated NACCO’s ROTCE,

excluding the Applica litigation settlement,

was 22.2 percent.

In addition to the substantial increase

in net income, each of NACCO’s subsidiaries

generated strong positive cash flow before

financing activities totaling $122.5 million

in 2011, much higher than the $57.3

million generated in 2010. Also during

2011, NACoal put in place a favorable

credit agreement and paid substantial

dividends of $72.9 million to NACCO, while

HBB voluntarily prepaid $60 million on its

term loan. NACCO will continue to focus

on maximizing cash flow before financing

activities and expects continued strong

cash flow generation from all businesses

in 2012.

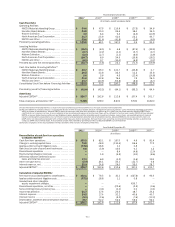

NACCO’s stock price, like the overall

stock market, has been very volatile in the

past year – reaching as high as $132.69

in February 2011 and as low as $56.53 in

October 2011, with an average of $91.56

for the year. Given the Company’s strong

position in the industries it competes in,

NACCO hopes for enhanced valuation as

it continues to successfully execute its

strategies to enable its subsidiaries to

reach their financial targets. NACCO’s

Board of Directors in November 2011

approved the repurchase of up to $50

million of the Company’s outstanding

Class A common stock. The authorization

for the repurchase program expires on

December 31, 2012. The share repurchase

program does not require the Company

to acquire any specific number of shares.

As of December 31, 2011, NACCO had

purchased 24,406 shares at an average

price of $84.53 per share.

Market conditions for NACCO’s

subsidiaries are moderating or uncertain

at this time and each subsidiary is

proceeding cautiously and monitoring

conditions closely. The global lift truck

market is expected to moderate in 2012,

resulting in volumes at NMHG comparable

to 2011. While continued improvement

in consumer confidence is expected,

selling to the mass-market consumer is

expected to remain challenging at HBB

and Kitchen Collection. In addition, rising

commodity costs are expected to create

margin pressures at HBB and NMHG

since recovering these cost increases

through price increases in the prevailing

market conditions will be challenging.

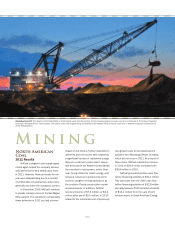

Coal deliveries are expected to be higher

in 2012, provided NACoal’s customers

continue to achieve currently planned

power plant operating levels, but the lime-

rock market in southern Florida is expected

to continue to be depressed by weak local

housing and construction markets. In light

of these anticipated market conditions,

the Company expects earnings at NMHG

to be down compared with 2011 but up

modestly at the other subsidiaries, resulting

in an overall decrease in consolidated

earnings, excluding the Applica settlement.

Subsidiary Financial Objectives

Each of NACCO’s subsidiary companies

has specific long-term financial objectives

(see below for specific goals). In 2011,

NACoal met its ROTCE objective. NMHG

made significant progress toward its

operating profit margin target as global

markets improved, volumes increased and

costs were contained. Despite a significant

improvement in economic performance,

NMHG is still well below its operating profit

margin target. Achieving NMHG’s target

operating profit margin will require higher

factory capacity utilization brought about by

increases in market share and achieving

target margins on certain products, partic-

ularly smaller internal combustion engine

products. It is difficult to provide a timetable

for achieving NMHG’s financial target.

However, market improvements, NMHG’s

programs and substantial operating

leverage have established a strong platform

for achieving NMHG’s operating profit

margin target in the future. HBB had sound

operating profit but fell well below its long-

term operating profit margin target. Kitchen

Collection also fell well below its target. At

both HBB and Kitchen Collection, operating

profits and related operating profit margins

declined compared with 2010. Looking

forward, HBB and the Kitchen Collection®

store format are expected to continue

to produce sound results but will need

additional sales volumes to achieve their

targets. The Le Gourmet Chef®stores

are not expected to achieve their target

objective until sales volumes increase

and additional underperforming stores

have been closed. As each of NACCO’s

subsidiaries proceeds with specific

programs designed to reach its financial

objectives and market conditions continue

to improve, the Company expects that its

subsidiaries’ operating fundamentals will

position each to achieve or maintain its

long-term financial goals.

Four

(3) See page eighteen for the calculation of return on capital employed.

Subsidiary Financial Objectives

• NMHG: Achieve an operating profit margin of 9 percent at the peak of the market cycle,

and an average operating profit margin of 7 percent mid-cycle.

• HBB: Achieve a minimum operating profit margin of 10 percent.

• Kitchen Collection: Achieve a minimum operating profit margin of 5 percent.

•NACoal: Earn a minimum return on capital employed of 13 percent, attain positive Economic

Value Income from all existing consolidated mining operations and any new projects,

maintain or increase the profitability of all existing unconsolidated mining operations and

achieve substantial income growth by developing new mining ventures.

• All businesses: Generate substantial cash flow before financing activities.