Hamilton Beach 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Hamilton Beach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

mix to lower-margin markets and higher

marketing and employee-related costs.

The decrease in net income is expected to

occur primarily in the first half of the year,

with modest improvements expected in the

second half of 2012 compared with the

second half of 2011. Results are expected

to be down in all major markets except

Brazil. Significant improvements in Brazil

are expected to be offset by a decline in

the North America results. Cash flow before

financing activities for the full year 2012 is

expected to be higher than 2011 despite a

significant increase in capital expenditures

in 2012 compared with 2011.

Longer-Term Perspective

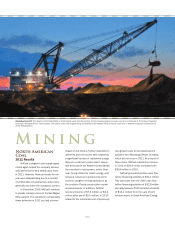

NMHG remains committed to its vision

of being a leading globally integrated

designer, manufacturer and marketer of a

complete range of high-quality, application-

tailored lift trucks, offering the lowest cost

of ownership, outstanding parts and service

support and the best overall value. NMHG

made significant progress in 2011 and

expects to continue that progress in 2012.

The company believes it is well-positioned

to maintain its global competitiveness.

However, as markets begin to moderate,

NMHG will be particularly focused on

achieving its financial targets and furthering

its global reach. As such, NMHG is focused

on five strategic goals which are designed

to enhance market share: (1) offering the

lowest cost of ownership, (2) understanding

customer needs at the product and after-

market levels, (3) further penetrating the

warehouse market, (4) achieving leadership

in independent distribution through broad

account coverage of the market and

strong dealers throughout the world, and

(5) expanding in Asia by offering lift trucks

that meet the needs of that market and

strengthening partner relationships.

The company’s product pipeline is

on track to produce a continuous stream

of new product innovations and product

introductions over the next several years

to meet customer needs and provide the

lowest cost of ownership. The products

in the pipeline are expected to enhance

NMHG’s competitiveness and market

share. In 2011, NMHG launched two new

electric-rider lift trucks and expects to

launch the final two models in this electric-

rider lift truck program in the first half of

2012. In addition, NMHG successfully

launched a new medium-duty internal

combustion engine lift truck in Europe in

the third quarter of 2011, complementing

a product launched in the Americas in

July 2010. In 2011, the company also

introduced, into selected Latin American

markets, a new range of UTILEV®brand

forklift trucks, which are basic forklift

trucks that meet the needs of low-intensity

users. This new internal combustion

engine series of utility lift trucks is expected

to be introduced into other global markets

in 2012. With the addition of the UTILEV®

forklift truck range, NMHG is now able

to provide coverage to all segments of

the market – utility, medium-duty and

heavy-duty.

NMHG currently has truck engine

systems that meet the emission require-

ments for the regions of the world in which

it does business. However, new, stricter

diesel emission regulations are currently

affecting all lift truck manufacturers, and

some of these new regulations go into

effect in 2012 in certain global markets.

NMHG has been working to ensure these

new requirements are satisfied in a cost-

effective manner, but the company expects

these new regulations will increase the cost

of the trucks, which in turn is likely to lead

to substantial price increases for certain

trucks beginning with 2012 deliveries. As

a result of the stricter regulations, NMHG

expects to launch a range of lift trucks in

2012, beginning with the Big Truck product

line, which will include engine systems that

meet the new emission requirements.

As part of NMHG’s efforts to further

penetrate the warehouse equipment

market, the company plans to focus on

direct sales to major accounts as well as

product enhancements in the Americas. In

addition, NMHG expects to launch a new

Reach Truck for the European warehouse

market in early 2013.

In the years ahead, the company

expects to continue to work aggressively to

meet evolving market requirements in all

product segments of the market and has

already begun making progress in achieving

its goals. In 2011, Hyster Company was

ranked No. 1 in brand satisfaction and

Hyster®lift trucks were ranked No. 1 in

the U.S. for lowest total cost of ownership

in two independent surveys conducted by

Peerless Media Research Group.

Overall, NMHG believes its products,

supply chain, manufacturing, quality, pricing,

distribution and sales and marketing

capabilities will position the company well

in the global lift truck market. NMHG’s

objective is to leverage this position to

increase market share and improve product

margins to target levels. NMHG anticipates

share gains over the next five years, which

are expected to move the company’s

financial performance in the next few years

toward its target level of an average mini-

mum operating profit margin of 7 percent

at the mid-point of the market cycle.

Eight